Schedule Cgt - Capital Gains Tax Recalculation Form

ADVERTISEMENT

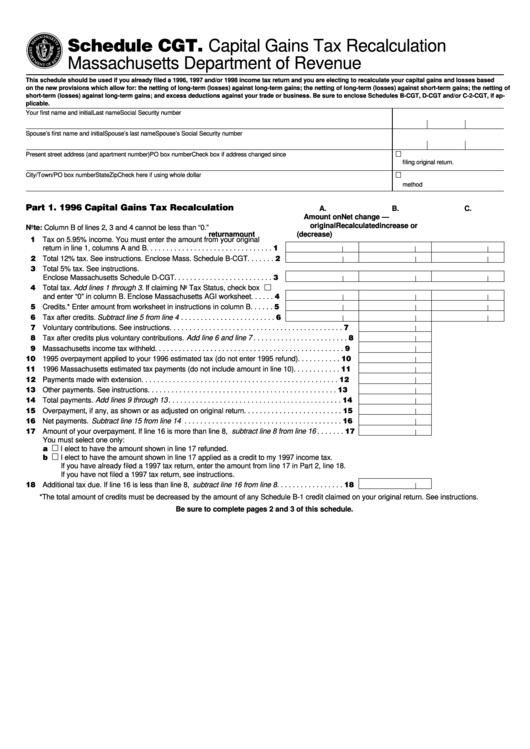

Schedule CGT. Capital Gains Tax Recalculation

Massachusetts Department of Revenue

This schedule should be used if you already filed a 1996, 1997 and/or 1998 income tax return and you are electing to recalculate your capital gains and losses based

on the new provisions which allow for: the netting of long-term (losses) against long-term gains; the netting of long-term (losses) against short-term gains; the netting of

short-term (losses) against long-term gains; and excess deductions against your trade or business. Be sure to enclose Schedules B-CGT, D-CGT and/or C-2-CGT, if ap-

plicable.

Your first name and initial

Last name

Social Security number

Spouse’s first name and initial

Spouse’s last name

Spouse’s Social Security number

Present street address (and apartment number)

PO box number

Check box if address changed since

filing original return.

City/Town/PO box number

State

Zip

Check here if using whole dollar

method

Part 1. 1996 Capital Gains Tax Recalculation

A.

B.

C.

Amount on

Net change —

original

Recalculated

increase or

Note: Column B of lines 2, 3 and 4 cannot be less than “0.”

return

amount

(decrease)

11 Tax on 5.95% income. You must enter the amount from your original

return in line 1, columns A and B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Total 12% tax. See instructions. Enclose Mass. Schedule B-CGT. . . . . . . 2

13 Total 5% tax. See instructions.

Enclose Massachusetts Schedule D-CGT . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Total tax. Add lines 1 through 3. If claiming No Tax Status, check box

and enter “0” in column B. Enclose Massachusetts AGI worksheet. . . . . . 4

15 Credits.* Enter amount from worksheet in instructions in column B. . . . . . 5

16 Tax after credits. Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Voluntary contributions. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Tax after credits plus voluntary contributions. Add line 6 and line 7 . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Massachusetts income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 1995 overpayment applied to your 1996 estimated tax (do not enter 1995 refund). . . . . . . . . . . 10

11 1996 Massachusetts estimated tax payments (do not include amount in line 10) . . . . . . . . . . . . 11

12 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Other payments. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Total payments. Add lines 9 through 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Overpayment, if any, as shown or as adjusted on original return. . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Net payments. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Amount of your overpayment. If line 16 is more than line 8, subtract line 8 from line 16 . . . . . . . 17

You must select one only:

a

I elect to have the amount shown in line 17 refunded.

b

I elect to have the amount shown in line 17 applied as a credit to my 1997 income tax.

If you have already filed a 1997 tax return, enter the amount from line 17 in Part 2, line 18.

If you have not filed a 1997 tax return, see instructions.

18 Additional tax due. If line 16 is less than line 8, subtract line 16 from line 8 . . . . . . . . . . . . . . . . . 18

*The total amount of credits must be decreased by the amount of any Schedule B-1 credit claimed on your original return. See instructions.

Be sure to complete pages 2 and 3 of this schedule.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3