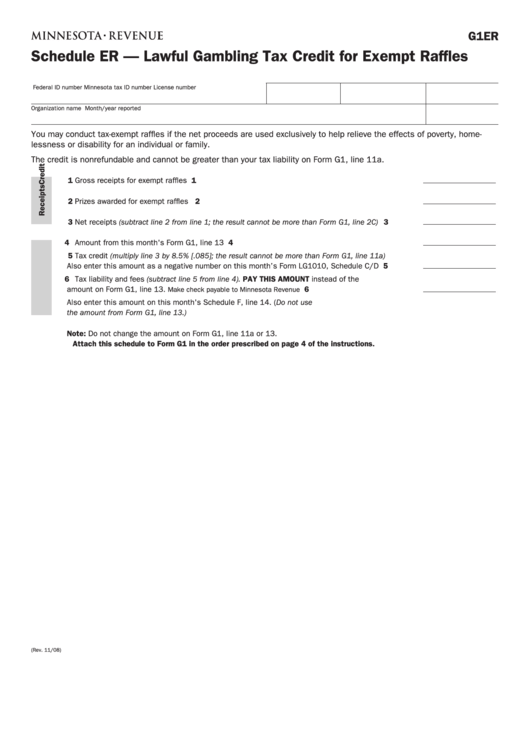

G1ER

Schedule ER — Lawful Gambling Tax Credit for Exempt Raffles

Federal ID number

Minnesota tax ID number

License number

Organization name

Month/year reported

You may conduct tax-exempt raffles if the net proceeds are used exclusively to help relieve the effects of poverty, home-

lessness or disability for an individual or family .

The credit is nonrefundable and cannot be greater than your tax liability on Form G1, line 11a .

1 Gross receipts for exempt raffles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Prizes awarded for exempt raffles . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Net receipts (subtract line 2 from line 1; the result cannot be more than Form G1, line 2C) . . . . . . 3

4 Amount from this month's Form G1, line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Tax credit (multiply line 3 by 8.5% [.085]; the result cannot be more than Form G1, line 11a)

Also enter this amount as a negative number on this month’s Form LG1010, Schedule C/D . . . . 5

6 Tax liability and fees (subtract line 5 from line 4). Pay ThiS amounT instead of the

amount on Form G1, line 13 .

. . . . . . . . . . . . . . . . . . . . . 6

Make check payable to Minnesota Revenue

Also enter this amount on this month's Schedule F, line 14 . (Do not use

the amount from Form G1, line 13.)

note: Do not change the amount on Form G1, line 11a or 13 .

attach this schedule to Form G1 in the order prescribed on page 4 of the instructions.

(Rev . 11/08)

1

1