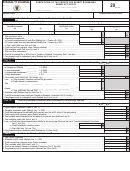

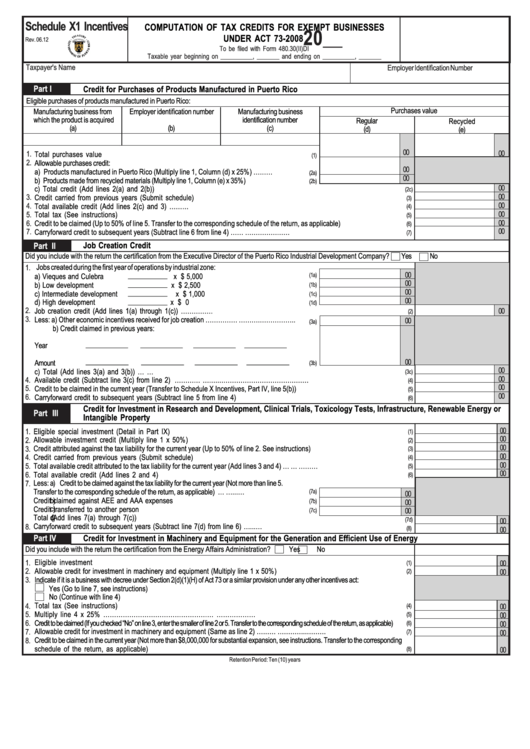

Schedule X1 Incentives - Computation Of Tax Credits For Exempt Businesses Under Act 73-2008

ADVERTISEMENT

Schedule X1 Incentives

COMPUTATION OF TAX CREDITS FOR EXEMPT BUSINESSES

20__

UNDER ACT 73-2008

Rev. 06.12

To be filed with Form 480.30(II)DI

Taxable year beginning on __________, _______ and ending on __________, _______

Taxpayer's Name

Employer Identification Number

Part I

Credit for Purchases of Products Manufactured in Puerto Rico

Eligible purchases of products manufactured in Puerto Rico:

Purchases value

Manufacturing business from

Employer identification number

Manufacturing business

which the product is acquired

identification number

Regular

Recycled

(a)

(b)

(c)

(d)

(e)

00

00

1.

Total purchases value ........................................................................................................

(1)

2.

Allowable purchases credit:

00

a) Products manufactured in Puerto Rico (Multiply line 1, Column (d) x 25%) ………..................

(2a)

00

b) Products made from recycled materials (Multiply line 1, Column (e) x 35%) ..................................

(2b)

00

c) Total credit (Add lines 2(a) and 2(b)) .................................................................................................................................

(2c)

00

3.

Credit carried from previous years (Submit schedule) ............................................................................................................

(3)

00

4.

Total available credit (Add lines 2(c) and 3) ………................................................................................................................

(4)

00

5.

Total tax (See instructions) ................................................................................................................................................

(5)

00

6.

Credit to be claimed (Up to 50% of line 5. Transfer to the corresponding schedule of the return, as applicable) ...............................

(6)

00

7.

Carryforward credit to subsequent years (Subtract line 6 from line 4) ……............................................................…………………

(7)

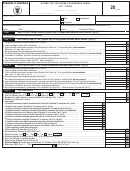

Job Creation Credit

Part II

Did you include with the return the certification from the Executive Director of the Puerto Rico Industrial Development Company?

Yes

No

Jobs created during the first year of operations by industrial zone:

1.

00

____________

(1a)

a) Vieques and Culebra

x $ 5,000 .................................................

00

____________

b) Low development

x $ 2,500 .................................................

(1b)

00

____________

c) Intermediate development

x $ 1,000 .................................................

(1c)

00

____________

d) High development

x $ 0 ......................................................

(1d)

2.

Job creation credit (Add lines 1(a) through 1(c)) ……………....................................................................................................

00

(2)

3.

Less: a) Other economic incentives received for job creation ……………......……….……………..

00

(3a)

b) Credit claimed in previous years:

____________

____________ ____________ ____________

Year

____________

____________

____________ ____________ ..........

00

Amount

(3b)

00

c) Total (Add lines 3(a) and 3(b)) ….............................................................................................................................…

(3c)

00

4.

Available credit (Subtract line 3(c) from line 2) …………..................................................……..……………………………………

(4)

00

5.

Credit to be claimed in the current year (Transfer to Schedule X Incentives, Part IV, line 5(b)) ........................................................

(5)

00

6.

Carryforward credit to subsequent years (Subtract line 5 from line 4) .......................................................................................

(6)

Credit for Investment in Research and Development, Clinical Trials, Toxicology Tests, Infrastructure, Renewable Energy or

Part

IIII

Intangible Property

00

1.

Eligible special investment (Detail in Part IX) ........................................................................................................................

(1)

00

Allowable investment credit (Multiply line 1 x 50%) ..............................................................................................................

2.

(2)

00

3.

Credit attributed against the tax liability for the current year (Up to 50% of line 2. See instructions) ................................................

(3)

00

Credit carried from previous years (Submit schedule) ............................................................................................................

4.

(4)

00

5.

Total available credit attributed to the tax liability for the current year (Add lines 3 and 4) …...........................................…....………

(5)

00

Total available credit (Add lines 2 and 4) ..............................................................................................................................

6.

(6)

7.

Less: Credit to be claimed against the tax liability for the current year (Not more than line 5.

a)

Transfer to the corresponding schedule of the return, as applicable) .....….................…...…

(7a)

00

b)

Credit claimed against AEE and AAA expenses .........................................................

(7b)

00

c)

Credit transferred to another person ...........................................................................

(7c)

00

d)

Total (Add lines 7(a) through 7(c)) ...............................................................................................................................

(7d)

00

Carryforward credit to subsequent years (Subtract line 7(d) from line 6) …...…...........................................................................

8.

(8)

00

Part IV

Credit for Investment in Machinery and Equipment for the Generation and Efficient Use of Energy

Did you include with the return the certification from the Energy Affairs Administration?

Yes

No

Eligible investment ...........................................................................................................................................................

1.

00

(1)

2.

Allowable credit for investment in machinery and equipment (Multiply line 1 x 50%) ...................................................................

(2)

00

Indicate if it is a business with decree under Section 2(d)(1)(H) of Act 73 or a similar provision under any other incentives act:

3.

Yes (Go to line 7, see instructions)

No (Continue with line 4)

4.

Total tax (See instructions) .................................................................................................................................................

(4)

00

Multiply line 4 x 25% ……………………………………………...........................................................……………….................

5.

00

(5)

6.

Credit to be claimed (If you checked “No” on line 3, enter the smaller of line 2 or 5. Transfer to the corresponding schedule of the return, as applicable) ....

(6)

00

Allowable credit for investment in machinery and equipment (Same as line 2) ……….........................................…………..………

7.

00

(7)

8.

Credit to be claimed in the current year (Not more than $8,000,000 for substantial expansion, see instructions. Transfer to the corresponding

schedule of the return, as applicable) ..................................................................................................................................

00

(8)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2