Form Dr-601i - Florida Intangible Personal Property Tax Return Form For Individual And Joint Filers - 2002 Page 3

ADVERTISEMENT

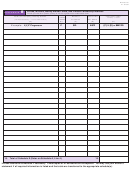

DR-601IS

Include These Schedules With Your Tax Return

R. 01/02

Social Security Number

Spouse’s Social Security Number

Name: ____________________________________

(Complete only if filing a joint return)

Total Taxable Amount

B

Loans, Notes, and Accounts Receivable

Schedule

January 1, 2002

Accounts Receivable (see Instructions, Page 7)

Notes Receivable

Loans and Advances Receivable

Other Receivables

12.

Total of Schedule B (Enter on Schedule A, Line 1.)

12.

FEIN of Trust

C

Beneficial Interest in any Trust

(Individual Receiving Income from Trust Property)

Schedule

Beneficial Interest in Stocks, Mutuals, Money Market Funds, and Limited Partnership Interests

Class

Just Value

Name of Company Issuing Stocks

Number

Total Just Value

C = Common

January 1, 2002

Per Share

(List Alphabetically — Do Not Abbreviate)

of Shares

P = Preferred

(A)

(D)

(C)

C x D = (E)

(B)

a.

Total Value of Stocks in Trust

a.

Beneficial Interest in Bonds

Name of Issuer, Series

Face Value

Interest

Maturity

Number

Per $100

Total Taxable Amount

January 1, 2002

(List Alphabetically — One Bond Per Line)

Per Bond

Rate

Date

Owned

Value

(A)

(B)

(C)

(D)

(E)

(F)

(G)

b.

Total Value of Bonds in Trust

b.

Beneficial Interest in Other Intangible Assets

Total Taxable Amount

Type of Property

January 1, 2002

c.

Total Value of Other Intangible Assets in Trust

c.

13.

Total of Schedule C; Lines a + b + c (Enter on Schedule A, Line 2.)

13.

D

Bonds

Schedule

Name of Issuer, Series

Face Value

Interest

Maturity

Number

Per $100

Total Taxable Amount

January 1, 2002

(List Alphabetically — One Bond Per Line)

Per Bond

Rate

Date

Owned

Value

(A)

(B)

(C)

(D)

(E)

(F)

(G)

Example:

X,Y,Z Corporation

X,Y,Z Corporation

X,Y,Z Corporation

X,Y,Z Corporation

X,Y,Z Corporation

50 50 50 50 50

7% 7% 7% 7% 7%

2020

2020

2020

2020

2020

50 50 50 50 50

1 1 1 1 1 00

00

00

00

00. . . . . 1 1 1 1 1 420

420

420

420

420

÷

(B) X (E)

(B) X (E)

1 0 0 X (F)

1 0 0 X (F)

1 0 0 X (F) = = = = = $2,503.55

$2,503.55

$2,503.55

(B) X (E)

(B) X (E)

(B) X (E)

1 0 0 X (F)

1 0 0 X (F)

$2,503.55

$2,503.55

14.

Total of Schedule D (Enter on Schedule A, Line 3.)

14.

Include additional schedules if necessary. Photocopies of all schedules are acceptable. You may use your broker's

statement if all required information is listed and the totals are transferred to the appropriate schedule(s).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4