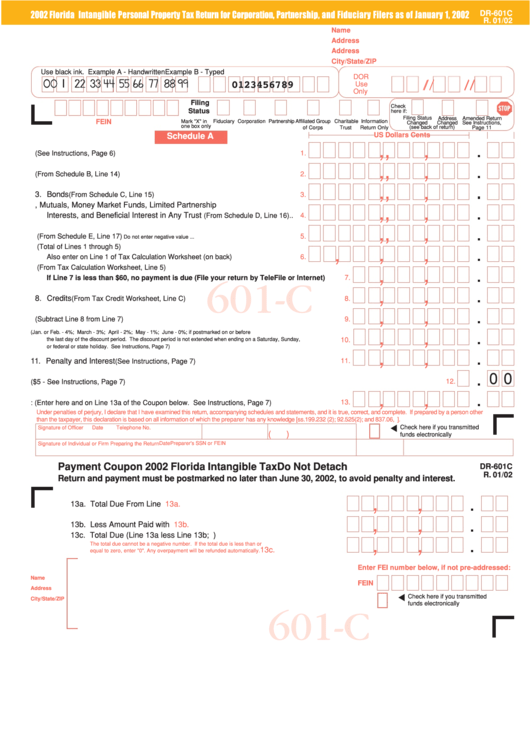

Form Dr-601c - Florida Intangible Personal Property Tax Return For Corporation, Partnership, And Fiduciary Filers - 2002

ADVERTISEMENT

DR-601C

2002 Florida Intangible Personal Property Tax Return for Corporation, Partnership, and Fiduciary Filers as of January 1, 2002

R. 01/02

Name

Address

Address

City/State/ZIP

Use black ink. Example A - Handwritten

Example B - Typed

DOR

0 0 0 0 0 1 1 1 1 1 2 2 2 2 2 3 3 3 3 3 4 4 4 4 4 5 5 5 5 5 6 6 6 6 6 7 7 7 7 7 8 8 8 8 8 9 9 9 9 9

/ / / / /

/ / / / /

0123456789

Use

Only

Filing

Check

Status

here if:

Filing Status

Address

Amended Return

FEIN

Mark "X" in

Fiduciary Corporation Partnership

Affiliated Group

Charitable

Information

Changed

Changed

See Instructions,

one box only

(see back of return)

of Corps

Trust

Return Only

Page 11

US Dollars

Cents

Schedule A

,

,

,

1. Accounts Receivable

(See Instructions, Page 6) ...............................................

1.

,

,

,

2. Loans and Notes Receivable

(From Schedule B, Line 14) ...............................

2.

,

,

,

3. Bonds

(From Schedule C, Line 15) .......................................................................

3.

4. Stocks, Mutuals, Money Market Funds, Limited Partnership

,

,

,

Interests, and Beneficial Interest in Any Trust

(From Schedule D, Line 16) ..

4.

,

,

,

5. As Agent for Stockholders

(From Schedule E, Line 17)

5.

Do not enter negative value ...

6. Total Taxable Intangible Assets

(Total of Lines 1 through 5)

,

,

,

Also enter on Line 1 of Tax Calculation Worksheet (on back) .................................

6.

7. Tax Due

(From Tax Calculation Worksheet, Line 5)

,

,

If Line 7 is less than $60, no payment is due (File your return by TeleFile or Internet) ......

7.

601-C

,

,

8. Credits

(From Tax Credit Worksheet, Line C) .............................................................................

8.

,

,

9. Total Tax Due

(Subtract Line 8 from Line 7) ..............................................................................

9.

10. Discount

(Jan. or Feb. - 4%; March - 3%; April - 2%; May - 1%; June - 0%; if postmarked on or before

,

,

the last day of the discount period. The discount period is not extended when ending on a Saturday, Sunday, ...........................

10.

or federal or state holiday. See Instructions, Page 7)

,

,

11. Penalty and Interest

(See Instructions, Page 7) ......................................................................

11.

0 0

12. Voluntary Election Campaign Contribution

12.

($5 - See Instructions, Page 7) ...............................................................................

,

,

13. Total Due

13.

: (Enter here and on Line 13a of the Coupon below. See Instructions, Page 7) ........

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and it is true, correct, and complete. If prepared by a person other

than the taxpayer, this declaration is based on all information of which the preparer has any knowledge [ss.199.232 (2); 92.525(2); and 837.06, F.S.].

Check here if you transmitted

Signature of Officer

Date

Telephone No.

(

)

funds electronically

Date

Preparer's SSN or FEIN

Signature of Individual or Firm Preparing the Return

Payment Coupon 2002 Florida Intangible Tax

Do Not Detach

DR-601C

R. 01/02

Return and payment must be postmarked no later than June 30, 2002, to avoid penalty and interest.

,

,

13a. Total Due From Line 13 ......................................................................

13a.

,

,

13b. Less Amount Paid with Extension ......................................................

13b.

13c. Total Due (Line 13a less Line 13b; U.S. funds only)

,

,

The total due cannot be a negative number. If the total due is less than or

..............................

13c.

equal to zero, enter "0". Any overpayment will be refunded automatically.

Enter FEI number below, if not pre-addressed:

Name

FEIN

Address

Check here if you transmitted

City/State/ZIP

funds electronically

601-C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4