AB CD

Be sure to print and sign your report.

PRINT FORM

CLEAR FIELDS

*5610100W121609*

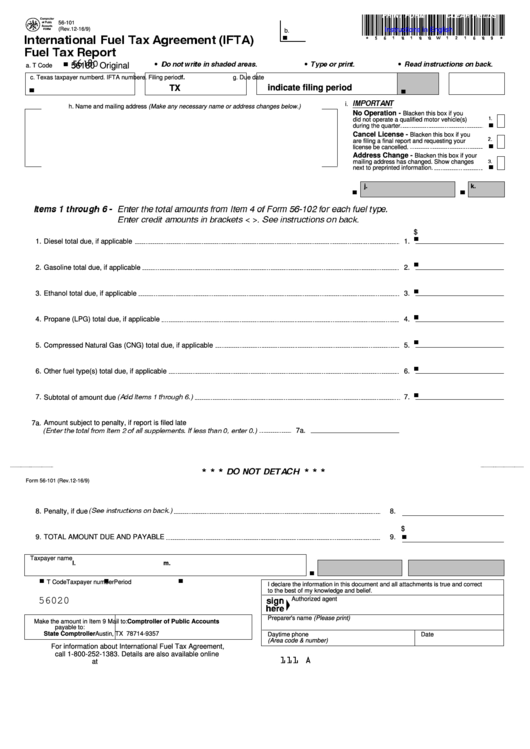

56-101

Instructions in English

International Fuel Tax Agreement (IFTA)

(Rev.12-16/9)

b.

b

Fuel Tax Report

56180

Do not write in shaded areas.

Type or print.

Read instructions on back.

56180 Original

a. T Code

b

I

I

I

c. Texas taxpayer number

d. IFTA number

e. Filing period

f.

g. Due date

TX

indicate filing period

b

b

IMPORTANT

i.

h. Name and mailing address (Make any necessary name or address changes below.)

No Operation -

Blacken this box if you

did not operate a qualified motor vehicle(s)

1.

during the quarter.

b

Cancel License -

Blacken this box if you

are filing a final report and requesting your

2.

license be cancelled.

b

Address Change -

Blacken this box if your

mailing address has changed. Show changes

3.

next to preprinted information.

b

j.

k.

b

b

Items 1 through 6 -

Enter the total amounts from Item 4 of Form 56-102 for each fuel type.

Enter credit amounts in brackets < >. See instructions on back.

$

1.

Diesel total due, if applicable

1.

b

2.

Gasoline total due, if applicable

2.

b

3.

Ethanol total due, if applicable

3.

b

4.

Propane (LPG) total due, if applicable

4.

b

5.

Compressed Natural Gas (CNG) total due, if applicable

5.

b

6.

Other fuel type(s) total due, if applicable

6.

b

(Add Items 1 through 6.)

7.

Subtotal of amount due

7.

b

7

a.

Amount subject to penalty, if report is filed late

(Enter the total from Item 2 of all supplements. If less than 0, enter 0.)

7a.

* * * DO NOT DETACH * * *

Form 56-101 (Rev.12-16/9)

(See instructions on back.)

8.

Penalty, if due

8.

$

9.

TOTAL AMOUNT DUE AND PAYABLE

9.

b

Taxpayer name

AB

l.

m.

b

T Code

Taxpayer number

Period

b

b

b

I declare the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

56020

Authorized agent

Preparer's name (Please print)

Make the amount in Item 9

Mail to: Comptroller of Public Accounts

payable to:

P.O. Box 149357

State Comptroller

Austin, TX 78714-9357

Daytime phone

Date

(Area code & number)

For information about International Fuel Tax Agreement,

call 1-800-252-1383. Details are also available online

111 A

at

1

1 2

2