Distributors Gasoline And Ethanol Blended Fuel Tax Report Form - State Of New Mexico

ADVERTISEMENT

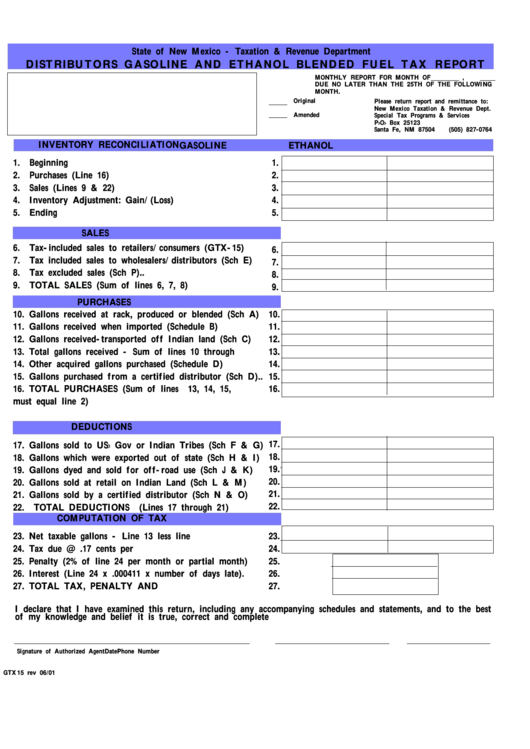

State of New Mexico - Taxation & Revenue Department

DISTRIBUTORS GASOLINE AND ETHANOL BLENDED FUEL TAX REPORT

MONTHLY REPORT FOR MONTH OF

,

DUE NO LATER THAN THE 25TH OF THE FOLLOWING

MONTH.

Original

Please return report and remittance to:

New Mexico Taxation & Revenue Dept.

Amended

Special Tax Programs & Services

P>O> Box 25123

Santa Fe, NM 87504

(505) 827-0764

INVENTORY RECONCILIATION

GASOLINE

ETHANOL

1. Beginning Inventory.............................................................

1.

2. Purchases (Line 16).............................................................

2.

3. Sales (Lines 9 & 22)............................................................

3.

4. Inventory Adjustment: Gain/(Loss)....................................

4.

5. Ending Inventory.................................................................

5.

SALES

6. Tax-included sales to retailers/consumers (GTX-15).......

6.

7. Tax included sales to wholesalers/distributors (Sch E)

7.

8. Tax excluded sales (Sch P)..

8.

9. TOTAL SALES (Sum of lines 6, 7, 8)

......................

9.

PURCHASES

10. Gallons received at rack, produced or blended (Sch A)

10.

11. Gallons received when imported (Schedule B)...................

11.

12. Gallons received-transported off Indian land (Sch C)

12.

13. Total gallons received - Sum of lines 10 through 12......

13.

14. Other acquired gallons purchased (Schedule D)................

14.

15. Gallons purchased from a certified distributor (Sch D)..

15.

16. TOTAL PURCHASES (Sum of lines 13, 14, 15,

16.

must equal line 2)...................

DEDUCTIONS

17.

17. Gallons sold to US> Gov or Indian Tribes (Sch F & G)

18.

18. Gallons which were exported out of state (Sch H & I)

19.

19. Gallons dyed and sold for off-road use (Sch J & K)

20.

20. Gallons sold at retail on Indian Land (Sch L & M)

21.

21. Gallons sold by a certified distributor (Sch N & O)

22.

22. TOTAL DEDUCTIONS (Lines 17 through 21)...................

COMPUTATION OF TAX

23. Net taxable gallons - Line 13 less line 22........................

23.

24. Tax due @ .17 cents per gallon.........................................

24.

25. Penalty (2% of line 24 per month or partial month).......

25.

26. Interest (Line 24 x .000411 x number of days late).

26.

27. TOTAL TAX, PENALTY AND INTEREST.......................

27.

I declare that I have examined this return, including any accompanying schedules and statements, and to the best

of my knowledge and belief it is true, correct and complete

Signature of Authorized Agent

Date

Phone Number

GTX15 rev 06/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2