Form Sev-400t - Severance Tax Estimate - Timber - 2005

ADVERTISEMENT

SIGNATURE O F TAXPAYER O R PREPARER

WVISEV400T

REV 7/05

WEST VIRGINIA SEVERANCE TAX ESTIMATE

-

TIMBER

DATE

I

I

GENERAL

INFORMATION

1

,

'

i..

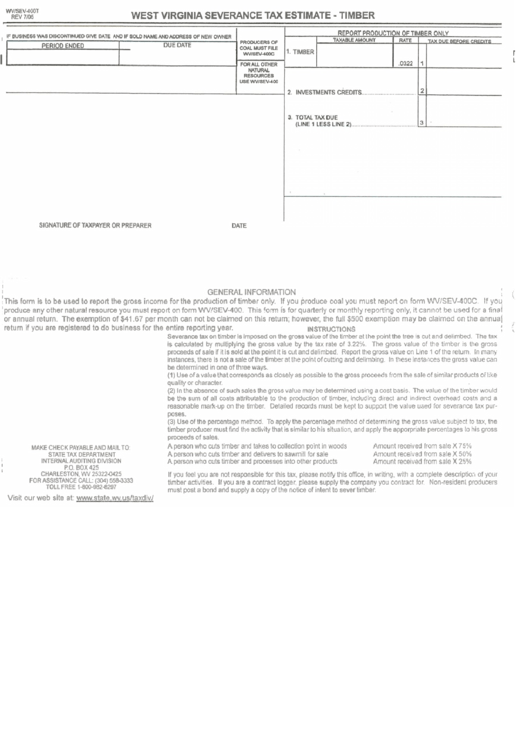

i ~ h i s form

is

to

be

used to report the gross income for the production o f timber only.

If

you produce coal you must report o n form

WV/SEV-400C.

If

yoy

'produce any other natura! resource you must report o n form WV!SEV-400.

This

form

is

for quarterly

or

monthly reporting only,

i !

cannot

be used for

a

f i n d

or annual return. The exemption of

$41.67 per

month

can

not b e claimed on this return; however, the full

$500

exemption m ay

be

claimed o n the annual

return

if

you are registered

to

d o business for the entire reporting year.

INSTRIJCTIONS

1

'

I

MAKE

CHECK PAYABLE

AND

MAILTO:

STATE

TAX

DEPARTMENT

PROWCERS OF

COMMUST FILE

WVIs01-raoc

FOR A U OTHER

NATURAL

RESOURCES

USE WISEV4W

REPORT PRODUCTION O F TIMBER ONLY

I

IF BUSINESS WAS DISCONTINUED

G I V E

M T E AND IF SOLO NAME AND ADORESS

OF

N E W

OWNER

Severanca tax on timber is imposed on the gross value of the timber et the point the tree is cut and delimbed. The tax

is calculated by multiplying the gross value bj the tax rate of

3.22%.

The

gross value of the timber is the grgss

proceeds of saie if it Is sold at the point it is cut and delimbed. Report the gross value on Line

1

of the retum. In many

instances, there Is not a sale of the timber at the point of cutting and delimbing. In these instatices the gross value can

be determined in one of three ways.

(1) Use of a value that corresponds as closely as possible to the gross proceeds from the sale of similar products of like

quality or character.

(2) In the absence of such sales the gross value may be determined using a cost basis. The value of the timber would

be the sum of all costs attributable to the production of timber, including direct and indirect overhead costs and a

reasonable mark-up on the timber. Detailed records must be kept to support the value used for severance tax pur-

poses.

(3)

Use of the percentage

method.

To apply the percentage method of determining the gross value subject to tax, the

timber producer must find the activity that is similar to his situation, and apply the apporpriate percentages to his gross

proceeds of sales.

,,

TIMBER

I

A person who cuts timber and takes to wlleciion point in woods

A person who cuts timber and delivers to sawmill for sale

Amount received from sale X

75%

Amount received from saie X

50%

TAXABLE AMOUNT

PERIOD ENDED

I

INTERNAL AUDITING DIVISION

A

person who cuts timber and processes into other products

Amount rece~ved from sale X

25%

I

I

PO. BO X

425

CHARLESTON,

WV

253226425

If you feel you are not responsible for this tax, please notify this office, in writing, with a complete description of yoclr

FOR ASSISTANCE CALL: (304) 558-3333

timber acDwties If you are a contract logger, please supply the company you contract for Non-resident producers

TOLL FREE 1-8W-982-8297

must post a bond and supply a copy of the notice of intent to sever timber.

Visit our web site at:

2.

INVESTMENTS CREDITS

............ .

.

...........

DUE DATE

2

.

RATE

,0322

~

F

O

1

I

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1