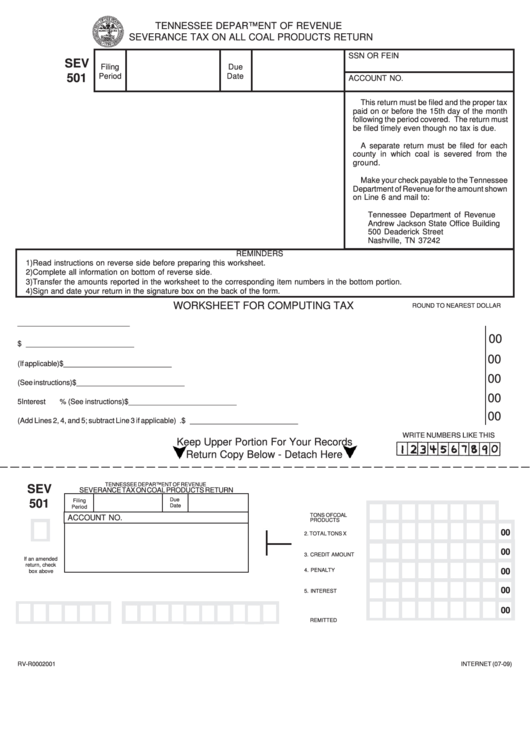

TENNESSEE DEPARTMENT OF REVENUE

SEVERANCE TAX ON ALL COAL PRODUCTS RETURN

SSN OR FEIN

SEV

Filing

Due

501

Period

Date

ACCOUNT NO.

This return must be filed and the proper tax

paid on or before the 15th day of the month

following the period covered. The return must

be filed timely even though no tax is due.

A separate return must be filed for each

county in which coal is severed from the

ground.

Make your check payable to the Tennessee

Department of Revenue for the amount shown

on Line 6 and mail to:

Tennessee Department of Revenue

Andrew Jackson State Office Building

500 Deaderick Street

Nashville, TN 37242

REMINDERS

1) Read instructions on reverse side before preparing this worksheet.

2) Complete all information on bottom of reverse side.

3) Transfer the amounts reported in the worksheet to the corresponding item numbers in the bottom portion.

4) Sign and date your return in the signature box on the back of the form.

WORKSHEET FOR COMPUTING TAX

ROUND TO NEAREST DOLLAR

1. Number of tons of coal products severed from the ground ......................................................................................

___________________________

00

2. Multiply Line 1 by

. .............................................................................................................................................. $ __________________________

00

3. Enter credit amount (If applicable) ............................................................................................................................. $ __________________________

00

4. Penalty (See instructions) ......................................................................................................................................... $ __________________________

00

5 Interest

% (See instructions) ........................................................................................................................... $ __________________________

00

6. Total amount due (Add Lines 2, 4, and 5; subtract Line 3 if applicable) ...................................................................... $ __________________________

WRITE NUMBERS LIKE THIS

Keep Upper Portion For Your Records

Return Copy Below - Detach Here

TENNESSEE DEPARTMENT OF REVENUE

SEV

SEVERANCE TAX ON COAL PRODUCTS RETURN

Due

Filing

501

Date

Period

1. NUMBER OF

TONS OF COAL

ACCOUNT NO.

PRODUCTS

00

2. TOTAL TONS X

00

3. CREDIT AMOUNT

If an amended

return, check

4. PENALTY

00

box above

00

5. INTEREST

00

6. TOTAL AMOUNT

REMITTED

RV-R0002001

INTERNET (07-09)

1

1 2

2