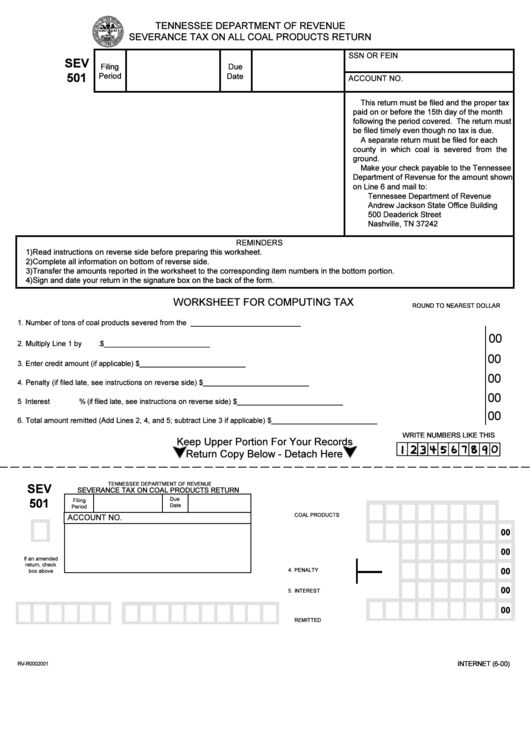

Form Sev 501 - Severance Tax On All Coal Products Return - 2000

ADVERTISEMENT

TENNESSEE DEPARTMENT OF REVENUE

SEVERANCE TAX ON ALL COAL PRODUCTS RETURN

SEV

501

WORKSHEET FOR COMPUTING TAX

ROUND TO NEAREST DOLLAR

1. Number of tons of coal products severed from the ground ......................................................................................

___________________________

00

2. Multiply Line 1 by

. ............................................................................................................................................. $ __________________________

00

3. Enter credit amount (if applicable) ............................................................................................................................. $ __________________________

00

4. Penalty (if filed late, see instructions on reverse side) .............................................................................................. $ __________________________

00

5 Interest

% (if filed late, see instructions on reverse side) ............................................................................. $ __________________________

00

6. Total amount remitted (Add Lines 2, 4, and 5; subtract Line 3 if applicable) ............................................................... $ __________________________

Keep Upper Portion For Your Records

Return Copy Below - Detach Here

TENNESSEE DEPARTMENT OF REVENUE

SEV

Due

501

Filing

Date

Period

1. NUMBER OF TONS OF

COAL PRODUCTS

00

2.TOTAL TONS X

00

3. CREDIT AMOUNT

If an amended

return, check

00

4. PENALTY

box above

00

5. INTEREST

00

6. TOTAL AMOUNT

REMITTED

RV-R0002001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2