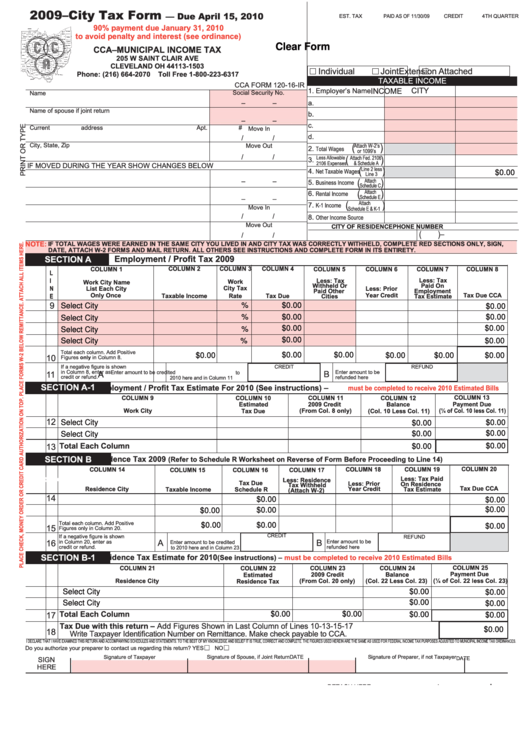

2009–City Tax Form

— Due April 15, 2010

EST. TAX

PAID AS OF 11/30/09

CREDIT

4TH QUARTER

90% payment due January 31, 2010

to avoid penalty and interest (see ordinance)

Clear Form

CCA–MUNICIPAL INCOME TAX

205 W SAINT CLAIR AVE

CLEVELAND OH 44113-1503

Individual

Joint

Extension Attached

Phone: (216) 664-2070

Toll Free 1-800-223-6317

TAXABLE INCOME

CCA FORM 120-16-IR

CITY

1. Employer’s Name

INCOME

Social Security No.

Name

–

–

a.

Name of spouse if joint return

b.

–

–

c.

Current address

Apt. #

Move In

d.

/

/

City, State, Zip

Move Out

(

)

Attach W-2’s

2.

Total Wages

or 1099’s

/

/

Less Allowable

(

)

Attach Fed. 2106

3.

2106 Expenses

& Schedule A

IF MOVED DURING THE YEAR SHOW CHANGES BELOW

(

)

Line 2 less

4.

Net Taxable Wages

$0.00

Line 3

–

–

Attach

(

)

5.

Business Income

Schedule C

(

)

Attach

6.

Rental Income

Schedule E

–

–

(

Attach

)

7.

K-1 Income

Move In

Schedule E & K-1

/

/

8.

Other Income Source

Move Out

CITY OF RESIDENCE

PHONE NUMBER

(

)

–

/

/

NOTE:

IF TOTAL WAGES WERE EARNED IN THE SAME CITY YOU LIVED IN AND CITY TAX WAS CORRECTLY WITHHELD, COMPLETE RED SECTIONS ONLY, SIGN,

DATE, ATTACH W-2 FORMS AND MAIL RETURN. ALL OTHERS SEE INSTRUCTIONS AND COMPLETE FORM IN ITS ENTIRETY.

SECTION A

Employment / Profit Tax 2009

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 1

COLUMN 5

COLUMN 6

COLUMN 7

COLUMN 8

L

I

Less: Tax

Less: Tax

Work

Work City Name

Withheld Or

Paid On

N

City Tax

List Each City

Less: Prior

Paid Other

Employment

E

Only Once

Year Credit

Tax Due CCA

Taxable Income

Rate

Tax Due

Cities

Tax Estimate

%

9

Select City

$0.00

$0.00

%

$0.00

$0.00

Select City

$0.00

$0.00

%

Select City

$0.00

$0.00

Select City

%

Total each column. Add Positive

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

10

Figures only in Column 8.

If a negative figure is shown

CREDIT

REFUND

in Column 8, enter as

Enter amount to be

Enter amount to be credited to

B

11

A

credit or refund.

2010 here and in Column 11

refunded here

SECTION A-1

Employment / Profit Tax Estimate For 2010 (See instructions) –

must be completed to receive 2010 Estimated Bills

COLUMN 9

COLUMN 10

COLUMN 11

COLUMN 12

COLUMN 13

Payment Due

Estimated

2009 Credit

Balance

Work City

(From Col. 8 only)

(¼ of Col. 10 less Col. 11)

Tax Due

(Col. 10 Less Col. 11)

12

Select City

$0.00

$0.00

$0.00

$0.00

Select City

Total Each Column

$0.00

$0.00

13

SECTION B

Residence Tax 2009

(Refer to Schedule R Worksheet on Reverse of Form Before Proceeding to Line 14)

COLUMN 18

COLUMN 19

COLUMN 20

COLUMN 14

COLUMN 15

COLUMN 16

COLUMN 17

Click here to go to calculation area

Less: Tax Paid

Less: Residence

Tax Due

Less: Prior

On Residence

Tax Withheld

Year Credit

Tax Due CCA

Residence City

Tax Estimate

Taxable Income

Schedule R

(Attach W-2)

14

$0.00

$0.00

$0.00

$0.00

$0.00

Total each column. Add Positive

$0.00

$0.00

$0.00

15

Figures only in Column 20.

CREDIT

If a negative figure is shown

REFUND

in Column 20, enter as

A

B

Enter amount to be

16

Enter amount to be credited

credit or refund.

refunded here

to 2010 here and in Column 23

SECTION B-1

Residence Tax Estimate for 2010

(See instructions) –

must be completed to receive 2010 Estimated Bills

COLUMN 23

COLUMN 25

COLUMN 21

COLUMN 22

COLUMN 24

2009 Credit

Balance

Payment Due

Estimated

(¼ of Col. 22 less Col. 23)

Residence City

(From Col. 20 only)

(Col. 22 Less Col. 23)

Residence Tax

$0.00

Select City

$0.00

$0.00

Select City

$0.00

$0.00

$0.00

$0.00

$0.00

Total Each Column

17

Tax Due with this return – Add Figures Shown in Last Column of Lines 10-13-15-17

$0.00

18

Write Taxpayer Identification Number on Remittance. Make check payable to CCA.

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS. TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

@

@

Do you authorize your preparer to contact us regarding this return? YES

NO

Signature of Taxpayer

Signature of Spouse, if Joint Return

DATE

Signature of Preparer, if not Taxpayer

DATE

SIGN

HERE

1

1 2

2 3

3