Instructions For Amended Tax Return Form 132 April 2011

ADVERTISEMENT

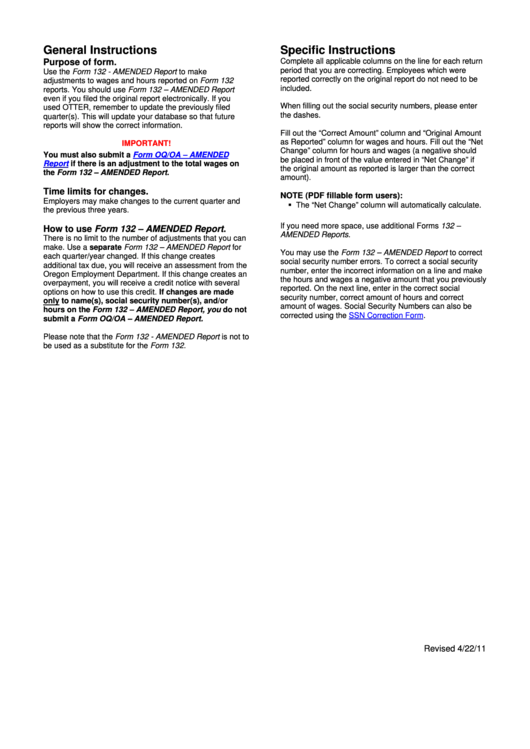

General Instructions

Specific Instructions

Purpose of form.

Complete all applicable columns on the line for each return

period that you are correcting. Employees which were

Use the Form 132 - AMENDED Report to make

reported correctly on the original report do not need to be

adjustments to wages and hours reported on Form 132

included.

reports. You should use Form 132 – AMENDED Report

even if you filed the original report electronically. If you

When filling out the social security numbers, please enter

used OTTER, remember to update the previously filed

the dashes.

quarter(s). This will update your database so that future

reports will show the correct information.

Fill out the “Correct Amount” column and “Original Amount

as Reported” column for wages and hours. Fill out the “Net

IMPORTANT!

Change” column for hours and wages (a negative should

You must also submit a

Form OQ/OA – AMENDED

be placed in front of the value entered in “Net Change” if

Report

if there is an adjustment to the total wages on

the original amount as reported is larger than the correct

the Form 132 – AMENDED Report.

amount).

Time limits for changes.

NOTE (PDF fillable form users):

Employers may make changes to the current quarter and

The “Net Change” column will automatically calculate.

the previous three years.

If you need more space, use additional Forms 132 –

How to use Form 132 – AMENDED Report.

AMENDED Reports.

There is no limit to the number of adjustments that you can

make. Use a separate Form 132 – AMENDED Report for

You may use the Form 132 – AMENDED Report to correct

each quarter/year changed. If this change creates

social security number errors. To correct a social security

additional tax due, you will receive an assessment from the

number, enter the incorrect information on a line and make

Oregon Employment Department. If this change creates an

the hours and wages a negative amount that you previously

overpayment, you will receive a credit notice with several

reported. On the next line, enter in the correct social

options on how to use this credit. If changes are made

security number, correct amount of hours and correct

only to name(s), social security number(s), and/or

amount of wages. Social Security Numbers can also be

hours on the Form 132 – AMENDED Report, you do not

corrected using the

SSN Correction

Form.

submit a Form OQ/OA – AMENDED Report.

Please note that the Form 132 - AMENDED Report is not to

be used as a substitute for the Form 132.

Revised 4/22/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1