Form Hu-1040-Es - Declaration Of Estimated Income Tax

ADVERTISEMENT

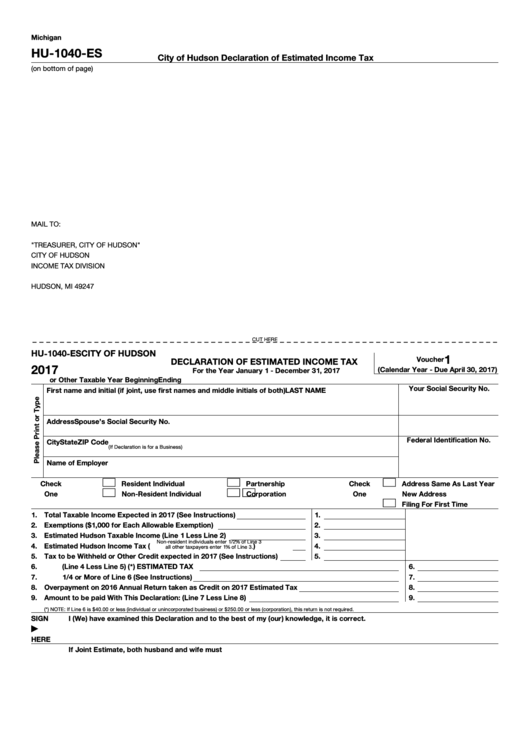

Michigan

HU-1040-ES

City of Hudson Declaration of Estimated Income Tax

(on bottom of page)

MAIL TO:

"TREASURER, CITY OF HUDSON"

CITY OF HUDSON

INCOME TAX DIVISION

P.O. BOX 231

HUDSON, MI 49247

CUT HERE

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

HU-1040-ES

CITY OF HUDSON

1

Voucher

DECLARATION OF ESTIMATED INCOME TAX

2017

(Calendar Year - Due April 30, 2017)

For the Year January 1 - December 31, 2017

or Other Taxable Year Beginning

Ending

Your Social Security No.

First name and initial (if joint, use first names and middle initials of both)

LAST NAME

Address

Spouse's Social Security No.

Federal Identification No.

City

State

ZIP Code

(If Declaration is for a Business)

Name of Employer

Check

Resident Individual

Partnership

Check

Address Same As Last Year

One

Non-Resident Individual

Corporation

One

New Address

Filing For First Time

1.

Total Taxable Income Expected in 2017 (See Instructions)

1.

2.

Exemptions ($1,000 for Each Allowable Exemption)

2.

3.

Estimated Hudson Taxable Income (Line 1 Less Line 2)

3.

Non-resident individuals enter 1/2% of Line 3

4.

Estimated Hudson Income Tax (

)

4.

all other taxpayers enter 1% of Line 3.

5.

Tax to be Withheld or Other Credit expected in 2017 (See Instructions)

5.

6.

(Line 4 Less Line 5) (*) ESTIMATED TAX

6.

7.

1/4 or More of Line 6 (See Instructions)

7.

8.

Overpayment on 2016 Annual Return taken as Credit on 2017 Estimated Tax

8.

9.

Amount to be paid With This Declaration: (Line 7 Less Line 8)

9.

(*) NOTE: If Line 6 is $40.00 or less (individual or unincorporated business) or $250.00 or less (corporation), this return is not required.

SIGN

I (We) have examined this Declaration and to the best of my (our) knowledge, it is correct.

|

HERE

If Joint Estimate, both husband and wife must sign.

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4