Form Ap-193 - Texas Application For Retailer - Cigarette, Cigar, And/or Tobacco Products Tax Permit

ADVERTISEMENT

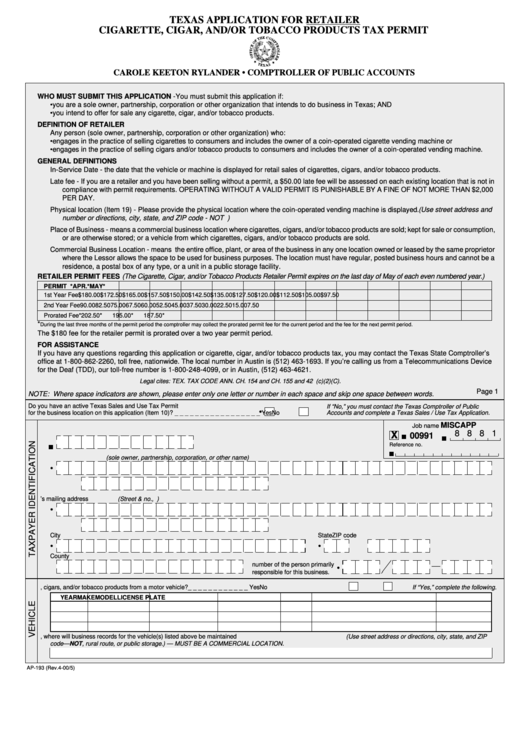

TEXAS APPLICATION FOR RETAILER

CIGARETTE, CIGAR, AND/OR TOBACCO PRODUCTS TAX PERMIT

CAROLE KEETON RYLANDER • COMPTROLLER OF PUBLIC ACCOUNTS

WHO MUST SUBMIT THIS APPLICATION -You must submit this application if:

• you are a sole owner, partnership, corporation or other organization that intends to do business in Texas; AND

• you intend to offer for sale any cigarette, cigar, and/or tobacco products.

DEFINITION OF RETAILER

Any person (sole owner, partnership, corporation or other organization) who:

• engages in the practice of selling cigarettes to consumers and includes the owner of a coin-operated cigarette vending machine or

• engages in the practice of selling cigars and/or tobacco products to consumers and includes the owner of a coin-operated vending machine.

GENERAL DEFINITIONS

In-Service Date - the date that the vehicle or machine is displayed for retail sales of cigarettes, cigars, and/or tobacco products.

Late fee - If you are a retailer and you have been selling without a permit, a $50.00 late fee will be assessed on each existing location that is not in

compliance with permit requirements. OPERATING WITHOUT A VALID PERMIT IS PUNISHABLE BY A FINE OF NOT MORE THAN $2,000

PER DAY.

Physical location (Item 19) - Please provide the physical location where the coin-operated vending machine is displayed. (Use street address and

number or directions, city, state, and ZIP code - NOT P.O. Box or rural route and box number.)

Place of Business - means a commercial business location where cigarettes, cigars, and/or tobacco products are sold; kept for sale or consumption,

or are otherwise stored; or a vehicle from which cigarettes, cigars, and/or tobacco products are sold.

Commercial Business Location - means the entire office, plant, or area of the business in any one location owned or leased by the same proprietor

where the Lessor allows the space to be used for business purposes. The location must have regular, posted business hours and cannot be a

residence, a postal box of any type, or a unit in a public storage facility.

RETAILER PERMIT FEES (The Cigarette, Cigar, and/or Tobacco Products Retailer Permit expires on the last day of May of each even numbered year.)

PERMIT FEE

JUNE

JULY

AUG.

SEPT.

OCT.

NOV.

DEC.

JAN.

FEB.

MAR.*

APR.*

MAY*

1st Year Fee

$180.00

$172.50

$165.00

$157.50

$150.00

$142.50

$135.00

$127.50

$120.00

$112.50

$105.00

$97.50

2nd Year Fee

90.00

82.50

75.00

67.50

60.00

52.50

45.00

37.50

30.00

22.50

15.00

7.50

Prorated Fee*

202.50*

195.00*

187.50*

*

During the last three months of the permit period the comptroller may collect the prorated permit fee for the current period and the fee for the next permit period.

The $180 fee for the retailer permit is prorated over a two year permit period.

FOR ASSISTANCE

If you have any questions regarding this application or cigarette, cigar, and/or tobacco products tax, you may contact the Texas State Comptroller’s

office at 1-800-862-2260, toll free, nationwide. The local number in Austin is (512) 463-1693. If you’re calling us from a Telecommunications Device

for the Deaf (TDD), our toll-free number is 1-800-248-4099, or in Austin, (512) 463-4621.

Legal cites: TEX. TAX CODE ANN. CH. 154 and CH. 155 and 42 U.S.C.A. sec. 405 (c)(2)(C).

Page 1

NOTE: Where space indicators are shown, please enter only one letter or number in each space and skip one space between words.

Do you have an active Texas Sales and Use Tax Permit

If “No,” you must contact the Texas Comptroller of Public

•

Accounts and complete a Texas Sales / Use Tax Application.

for the business location on this application (Item 10)? _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Yes

No

MISCAPP

Job name

1. Enter the 11-digit taxpayer number that you will be using to file your Texas Sales and Use Tax

8 8 8 1

X

00991

Reference no.

2. Legal name of entity (sole owner, partnership, corporation, or other name)

•

3. Owner’s mailing address (Street & no., P.O. box or rural route and box no.)

•

City

State

ZIP code

•

•

•

County

4. Enter the daytime phone

number of the person primarily

•

responsible for this business.

5. Will you be selling cigarettes, cigars, and/or tobacco products from a motor vehicle? _ _ _ _ _ _ _ _ _ _ _ _

Yes

No

If “Yes,” complete the following.

YEAR

MAKE

MODEL

LICENSE PLATE NO.

STATE

MOTOR VEHICLE ID

IN-SERVICE DATE

6. If your place of business is a vehicle, where will business records for the vehicle(s) listed above be maintained (Use street address or directions, city, state, and ZIP

code—NOT P.O. Box, rural route, or public storage.) — MUST BE A COMMERCIAL LOCATION.

AP-193 (Rev.4-00/5)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2