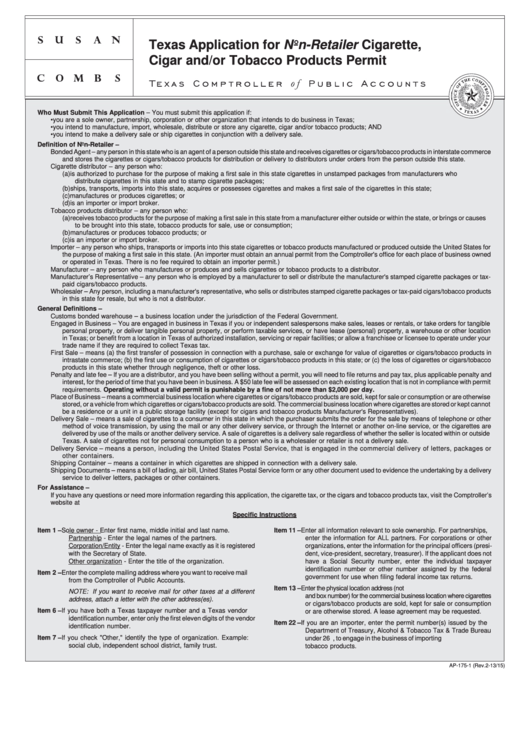

Texas Application for Non-Retailer Cigarette,

Cigar and/or Tobacco Products Permit

Who Must Submit This Application – You must submit this application if:

• you are a sole owner, partnership, corporation or other organization that intends to do business in Texas;

• you intend to manufacture, import, wholesale, distribute or store any cigarette, cigar and/or tobacco products; AND

• you intend to make a delivery sale or ship cigarettes in conjunction with a delivery sale.

Definition of Non-Retailer –

Bonded Agent – any person in this state who is an agent of a person outside this state and receives cigarettes or cigars/tobacco products in interstate commerce

and stores the cigarettes or cigars/tobacco products for distribution or delivery to distributors under orders from the person outside this state.

Cigarette distributor – any person who:

(a) is authorized to purchase for the purpose of making a first sale in this state cigarettes in unstamped packages from manufacturers who

distribute cigarettes in this state and to stamp cigarette packages;

(b) ships, transports, imports into this state, acquires or possesses cigarettes and makes a first sale of the cigarettes in this state;

(c) manufactures or produces cigarettes; or

(d) is an importer or import broker.

Tobacco products distributor – any person who:

(a) receives tobacco products for the purpose of making a first sale in this state from a manufacturer either outside or within the state, or brings or causes

to be brought into this state, tobacco products for sale, use or consumption;

(b) manufactures or produces tobacco products; or

(c) is an importer or import broker.

Importer – any person who ships, transports or imports into this state cigarettes or tobacco products manufactured or produced outside the United States for

the purpose of making a first sale in this state. (An importer must obtain an annual permit from the Comptroller's office for each place of business owned

or operated in Texas. There is no fee required to obtain an importer permit.)

Manufacturer – any person who manufactures or produces and sells cigarettes or tobacco products to a distributor.

Manufacturer’s Representative – any person who is employed by a manufacturer to sell or distribute the manufacturer's stamped cigarette packages or tax-

paid cigars/tobacco products.

Wholesaler – Any person, including a manufacturer's representative, who sells or distributes stamped cigarette packages or tax-paid cigars/tobacco products

in this state for resale, but who is not a distributor.

General Definitions –

Customs bonded warehouse – a business location under the jurisdiction of the Federal Government.

Engaged in Business – You are engaged in business in Texas if you or independent salespersons make sales, leases or rentals, or take orders for tangible

personal property, or deliver tangible personal property, or perform taxable services, or have lease (personal) property, a warehouse or other location

in Texas; or benefit from a location in Texas of authorized installation, servicing or repair facilities; or allow a franchisee or licensee to operate under your

trade name if they are required to collect Texas tax.

First Sale – means (a) the first transfer of possession in connection with a purchase, sale or exchange for value of cigarettes or cigars/tobacco products in

intrastate commerce; (b) the first use or consumption of cigarettes or cigars/tobacco products in this state; or (c) the loss of cigarettes or cigars/tobacco

products in this state whether through negligence, theft or other loss.

Penalty and late fee – If you are a distributor, and you have been selling without a permit, you will need to file returns and pay tax, plus applicable penalty and

interest, for the period of time that you have been in business. A $50 late fee will be assessed on each existing location that is not in compliance with permit

requirements. Operating without a valid permit is punishable by a fine of not more than $2,000 per day.

Place of Business – means a commercial business location where cigarettes or cigars/tobacco products are sold, kept for sale or consumption or are otherwise

stored, or a vehicle from which cigarettes or cigars/tobacco products are sold. The commercial business location where cigarettes are stored or kept cannot

be a residence or a unit in a public storage facility (except for cigars and tobacco products Manufacturer's Representatives).

Delivery Sale – means a sale of cigarettes to a consumer in this state in which the purchaser submits the order for the sale by means of telephone or other

method of voice transmission, by using the mail or any other delivery service, or through the Internet or another on-line service, or the cigarettes are

delivered by use of the mails or another delivery service. A sale of cigarettes is a delivery sale regardless of whether the seller is located within or outside

Texas. A sale of cigarettes not for personal consumption to a person who is a wholesaler or retailer is not a delivery sale.

Delivery Service – means a person, including the United States Postal Service, that is engaged in the commercial delivery of letters, packages or

other containers.

Shipping Container – means a container in which cigarettes are shipped in connection with a delivery sale.

Shipping Documents – means a bill of lading, air bill, United States Postal Service form or any other document used to evidence the undertaking by a delivery

service to deliver letters, packages or other containers.

For Assistance –

If you have any questions or need more information regarding this application, the cigarette tax, or the cigars and tobacco products tax, visit the Comptroller’s

website at or call 1-800-862-2260 or 512-463-3731.

Specific Instructions

Item 1 –

Sole owner - Enter first name, middle initial and last name.

Item 11 – Enter all information relevant to sole ownership. For partnerships,

Partnership - Enter the legal names of the partners.

enter the information for ALL partners. For corporations or other

Corporation/Entity - Enter the legal name exactly as it is registered

organizations, enter the information for the principal officers (presi-

with the Secretary of State.

dent, vice-president, secretary, treasurer). If the applicant does not

Other organization - Enter the title of the organization.

have a Social Security number, enter the individual taxpayer

identification number or other number assigned by the federal

Item 2 –

Enter the complete mailing address where you want to receive mail

government for use when filing federal income tax returns.

from the Comptroller of Public Accounts.

Item 13 – Enter the physical location address (not P.O. Box number or rural route

NOTE: If you want to receive mail for other taxes at a different

and box number) for the commercial business location where cigarettes

address, attach a letter with the other address(es).

or cigars/tobacco products are sold, kept for sale or consumption

Item 6 –

If you have both a Texas taxpayer number and a Texas vendor

or are otherwise stored. A lease agreement may be requested.

identification number, enter only the first eleven digits of the vendor

Item 22 – If you are an importer, enter the permit number(s) issued by the

identification number.

Department of Treasury, Alcohol & Tobacco Tax & Trade Bureau

Item 7 –

If you check "Other," identify the type of organization. Example:

under 26 U.S.C. Chapter 52, to engage in the business of importing

social club, independent school district, family trust.

tobacco products.

AP-175-1 (Rev.2-13/15)

1

1 2

2 3

3 4

4