Instructions For Form 8027

ADVERTISEMENT

2010

Department of the Treasury

Internal Revenue Service

Instructions for Form 8027

Employer’s Annual Information Return of

Tip Income and Allocated Tips

Section references are to the Internal Revenue Code unless

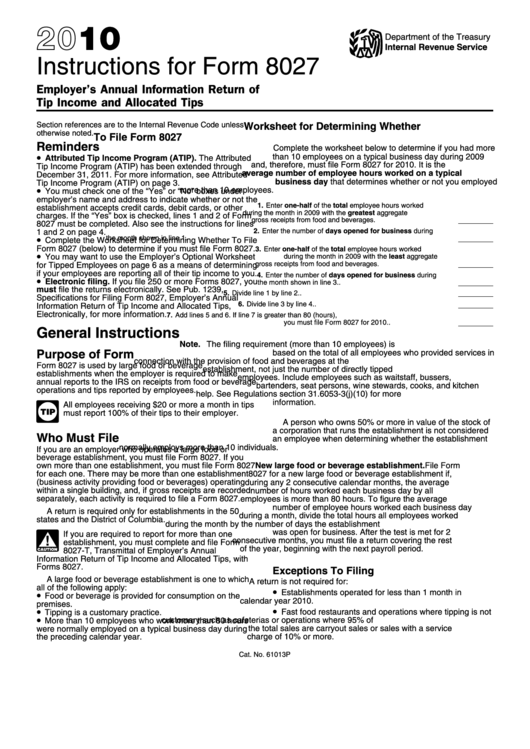

Worksheet for Determining Whether

otherwise noted.

To File Form 8027

Reminders

Complete the worksheet below to determine if you had more

•

than 10 employees on a typical business day during 2009

Attributed Tip Income Program (ATIP). The Attributed

and, therefore, must file Form 8027 for 2010. It is the

Tip Income Program (ATIP) has been extended through

average number of employee hours worked on a typical

December 31, 2011. For more information, see Attributed

business day that determines whether or not you employed

Tip Income Program (ATIP) on page 3.

•

more than 10 employees.

You must check one of the “Yes” or “No” boxes under

employer’s name and address to indicate whether or not the

1. Enter one-half of the total employee hours worked

establishment accepts credit cards, debit cards, or other

during the month in 2009 with the greatest aggregate

charges. If the “Yes” box is checked, lines 1 and 2 of Form

gross receipts from food and beverages . . . . . . . . . .

8027 must be completed. Also see the instructions for lines

2. Enter the number of days opened for business during

1 and 2 on page 4.

•

the month shown in line 1 . . . . . . . . . . . . . . . . . . . .

Complete the Worksheet for Determining Whether To File

Form 8027 (below) to determine if you must file Form 8027.

3. Enter one-half of the total employee hours worked

•

You may want to use the Employer’s Optional Worksheet

during the month in 2009 with the least aggregate

for Tipped Employees on page 6 as a means of determining

gross receipts from food and beverages . . . . . . . . . .

if your employees are reporting all of their tip income to you.

4. Enter the number of days opened for business during

•

Electronic filing. If you file 250 or more Forms 8027, you

the month shown in line 3. . . . . . . . . . . . . . . . . . . .

must file the returns electronically. See Pub. 1239,

5. Divide line 1 by line 2. . . . . . . . . . . . . . . . . . . . . . .

Specifications for Filing Form 8027, Employer’s Annual

6. Divide line 3 by line 4. . . . . . . . . . . . . . . . . . . . . . .

Information Return of Tip Income and Allocated Tips,

Electronically, for more information.

7. Add lines 5 and 6. If line 7 is greater than 80 (hours),

you must file Form 8027 for 2010. . . . . . . . . . . . . . .

General Instructions

Note. The filing requirement (more than 10 employees) is

Purpose of Form

based on the total of all employees who provided services in

connection with the provision of food and beverages at the

Form 8027 is used by large food or beverage

establishment, not just the number of directly tipped

establishments when the employer is required to make

employees. Include employees such as waitstaff, bussers,

annual reports to the IRS on receipts from food or beverage

bartenders, seat persons, wine stewards, cooks, and kitchen

operations and tips reported by employees.

help. See Regulations section 31.6053-3(j)(10) for more

information.

All employees receiving $20 or more a month in tips

must report 100% of their tips to their employer.

TIP

A person who owns 50% or more in value of the stock of

a corporation that runs the establishment is not considered

Who Must File

an employee when determining whether the establishment

normally employs more than 10 individuals.

If you are an employer who operates a large food or

beverage establishment, you must file Form 8027. If you

New large food or beverage establishment. File Form

own more than one establishment, you must file Form 8027

for each one. There may be more than one establishment

8027 for a new large food or beverage establishment if,

(business activity providing food or beverages) operating

during any 2 consecutive calendar months, the average

within a single building, and, if gross receipts are recorded

number of hours worked each business day by all

separately, each activity is required to file a Form 8027.

employees is more than 80 hours. To figure the average

number of employee hours worked each business day

A return is required only for establishments in the 50

during a month, divide the total hours all employees worked

states and the District of Columbia.

during the month by the number of days the establishment

was open for business. After the test is met for 2

If you are required to report for more than one

!

consecutive months, you must file a return covering the rest

establishment, you must complete and file Form

of the year, beginning with the next payroll period.

8027-T, Transmittal of Employer’s Annual

CAUTION

Information Return of Tip Income and Allocated Tips, with

Forms 8027.

Exceptions To Filing

A large food or beverage establishment is one to which

A return is not required for:

all of the following apply:

•

Establishments operated for less than 1 month in

•

Food or beverage is provided for consumption on the

calendar year 2010.

premises.

•

•

Fast food restaurants and operations where tipping is not

Tipping is a customary practice.

•

customary such as cafeterias or operations where 95% of

More than 10 employees who work more than 80 hours

the total sales are carryout sales or sales with a service

were normally employed on a typical business day during

charge of 10% or more.

the preceding calendar year.

Cat. No. 61013P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6