Form Rpd-41285 - Annual Statement Of Withholding Of Oil And Gas Proceeds Instructions Page 2

ADVERTISEMENT

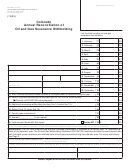

RPD-41285

New Mexico Taxation and Revenue Department

Rev. 09/02/2014

Annual Statement of Withholding of Oil and Gas Proceeds

Instructions

page 2 of 2

How to Complete RPD-41285

For More Information. See the instructions for RPD-41374,

Column 1

2013 Annual Report of Non-Resident Remittees Holding an

Agreement to Pay Tax on Oil and Gas Proceeds, and FYI-330,

Year and Contact Information

Income and Withholding Returns and Electronic Filing.

1. Enter the tax year.

2. Enter your name, address, and phone number. If the

address is outside the U.S., mark the box.

For Help. To get help with this form and corporate

income taxes, in Santa Fe call (505) 827-0825, call toll

3. Enter the remittee’s name and address. If the address is

free (866) 809-2335 and select option 4, or send email to

outside the U.S., mark the box.

cit.taxreturnhelp@state.nm.us.

Column 2

INSTRUCTIONS FOR REMITTEES

Identification Numbers, Proceeds, and State Tax Withheld

This section is for remittees. If you are a remitter, see page 1,

1. Enter your federal indentification number using hyphens.

Instructions for Remitters.

If the number is a federal employer identification number

(FEIN), enter it in XX-XXXXXXX format and mark the FEIN

How to File. Attach RPD-41285, Form 1099-MISC, or pro

box. If the number is a social security number, enter it in

forma Form 1099-MISC to your New Mexico income tax return

XXX-XX-XXXX format and mark the SSN box.

to claim the amount of tax withheld against your personal or

corporate income tax due.

2. Enter your Combined Reporting System (CRS) identifica-

tion number using hyphens in XX-XXXXXX-XXX format.

Due Date to File with the State. You are required to file

If you are not required to have a CRS number, leave this

the RPD -41285, Form 1099-MISC, or pro forma Form

field blank.

1099-MISC that you received from the remitter with your

New Mexico income tax return. The due date is the same

3. Enter the remittee’s federal identification number using

date your New Mexico income tax return is due.

hyphens. If the number is an FEIN, enter it in XX-XXXXXXX

format and mark the FEIN box. If the number is a social

IMPORTANT: Unless you are listed as the remittee or the

security number, enter it in XXX-XX-XXXX format and

recipient of the income, do not attach these forms to your

mark the SSN box.

income tax return. When filing your return, you cannot use an

4. Enter the remittee’s gross oil and gas proceeds from wells

income and withholding statement that is issued to someone

located in New Mexico.

else.

5. Enter the New Mexico state tax withheld.

Send Each Remittee a Copy. After completing RPD-41285

(or Form 1099-MISC or pro forma Form 1099-MISC) for all

remittees, send each remittee a copy of the form by February

15 or the next business day, if February 15 falls on a Saturday,

Sunday, or a state or national legal holiday.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2