Form B0-1041 - Resident Beneficiaries

ADVERTISEMENT

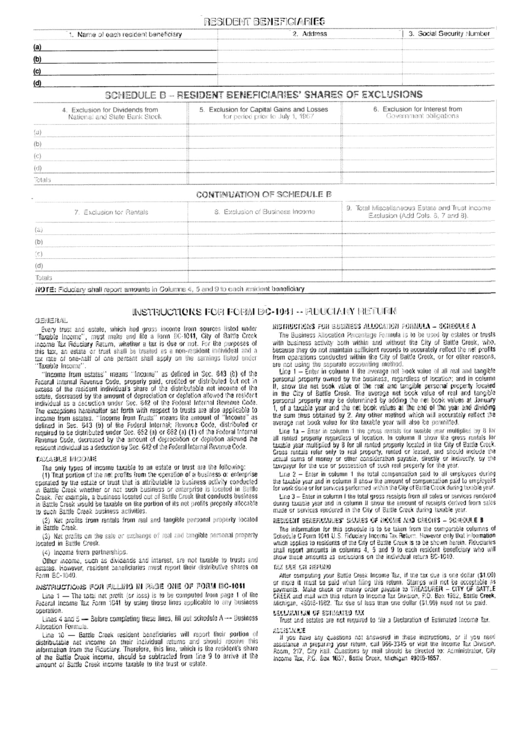

R E S I D E N T B E N E F I C I A R I E S

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

/ 3. E~)cia/securlty N u m b e r

1. Name of each resident beneficiary

2. A d d r e s s

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

+

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,,

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

S C H E D U L E B .... R E S ~ O E N T B E N E F J C I A R | E S ' S H A R E S O F E X C L U S I O N S

National ar'~d S t a t e Bank S t u c k

for' period prior to Ju~y 1, 1967

G o v e r n m e n t obligatio~s

......................................................................................................................................

',4

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4'~

.....................................................................................................................................................................................................

(a)

.................................................................................................................................................

t . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.....................................................................................................

q

(ci

(di

........................................................................................................................ _ _ .......................................................................

l b t a l s

C O N T t N U A T ~ i O N O F S C H E O U L E B

9, Total Miscellaneous E s t a t e and T?ust I n c o m e

7. E{xclusior~ for Rentals

8, Exclusion of B u s i n e s s h c o m e

Exclusion (Add Cols, 6, 7 aod 8},

a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

~

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

t

!!~!:

...........................................................................................................................................................................................................................

Tolals

N O T E :

Fiduciary shall report a m o u n t s in C o l u m n s 4, 5 and 9 to each resident beneficiary

I N S T R U C T I O N S F O R F O R M B 0 - 1 0 4 1 - F I D U C I A R Y R E T U R N

G E N E R A L

INSTRUCTIONS FOR BUSINESS ALLOCATION FORMULA - SCHEDULE A

EverY trust and estate, which had gross income from sources listed under

The Business Allocation Percentage Formula is to be used by estates or trusts

"Taxable Income", must make and file a form BC-1041, City of Battle Creek

with business activity both within and without the City of Battle Creek, who,

Income Tax FiduciarY Return, whether a tax is due or not. For the purposes of

because they do not maintain sufficient records to accurately reflect the net profits

this tax, an estate or trust shall be treated as a non-resident individual and a

from operations conducted within the City of Battle Creek, or for other reasons,

tax rate of one-half of one percent shall apply on the earnings listed under

are not using the separate accounting method.

"Taxable Income".

Line 1 - Enter in column 1 the average net book value of all real and tangible

"Income from estates" means " I n c o m e " as defined in Sec. 643 (b) of the

personal property owned by the business, regardless of location; and in column

Federal Internal Revenue Code, properly paid, credited or distributed but not in

II, show the net book value of the real and tangible personal property located

excess of the resident individual's share of the distributable net income of the

in the City of Battle Creek. The average net book value of real and tangible

estate, decreased by the amount of depreciation or depletion allowed the resident

personal property may be determined by adding the net book values at JanuarY

individual as a deduction under Sec. 642 of the Federa! Internal Revenue Code.

1, of a taxable year and the net book values at the end of the year and dividing

The exceptions hereinafter set forth with respect to trusts are also applicable to

the sum thus obtained by 2. Any other method which will accurately reflect the

income from estates. "Income from Trusts" means the amount of "Income" as

average net book value for the taxable year will also be permitted.

defined in Sec. 643 (b) of the Federal Internal; Revenue Code, distributed or

Line la

Enter in column 1 the gross rentals for taxable year multiplied by 8 for

-

required to be distributed under Sec. 652 (a) or 662 (a) (1) of the Federal Internal

all rented property regardless of location. In column II show the gross rentals for

Revenue Code, decreased by the amount of depreciabon or deplebon allowed the

taxable year multiplied by 8 for all rented property located in the City of Battle Creek.

resident individual as a deduction by Sec. 642 of the Federal Internal Revenue Code.

Gross rentals refer only to real property, rented or leased, and should include the

actual sums of money or other consideration payable, directly or indirectly, by the

T A X A B L E I N C O M E

taxvpayer for the use or possession of such real property for the year.

The only types of income taxable to an estate or trust are the following:

Line 2 - Enter in column 1 the total compensation paid to all employees during

(1) That portion of the net profits from the operation of a business or enterprise

the taxable year and in column II show the amount of compensation paid to employees

operated by the estate or trust that is attributable to business activity conducted

for work done or for services performed within the City of Battle Creek during taxable year.

in Battle Creek whether or not such business or enterprise is located in Battle

Line 3 - Enter in column I the total gross receipts from all sales or services rendered

Creek. For example, a business located out of Battle Creek that conducts business

during taxable year and in column II show the amount of receipts derived from sales

in Battle Creek would be taxable on the portion of its net profits properly allocable

made or services rendered in the City of Battle Creek during taxable year.

to such Battle Creek business activities.

(2) Net profits from rentals from real and tangible personal property located

RESIDENT BENEFICIARIES' SHARES OF INCOME AND CREDITS - SCHEDULE B

in Battle Creek.

The information for this schedule is to be taken from the comparable columns of

(3) Net profits on the sale or exchange of real and tangible personal property

Schedule C Form 1041 U.S. Fiduciary Income Tax Return. However only that information

which applies to residents of the City of Battle Creek is to be shown herein. Fiduciaries

located in Battle Creek.

shall report amounts in columns 4, 5 and 9 to each resident beneficiary who will

(4) Income from partnerships.

show these amounts as exclusions on the individual return BC-1040.

Other income, such as dividends and interest, are not taxable to trusts and

estates. However, resident beneficiaries must report their distributive shares on

TAX DUE OR REFUND

After computing your Battle Creek Income Tax, if the tax due is one dollar ($1.00)

Form BC-1040.

or more it must be paid when filing this return. Stamps will not be acceptable as

BC-1041

I N S T R U C T I O N S FOR FILLING IN PAGE ONE OF FORM

payments. Make check or money order payable to TREASURER - CITY OF BATTLE

Line 1 - - The total net profit (or loss) is to be computed from page 1 of the

CREEK and mail with this return to Income Tax Division, P.O. Box 1982, Battle Creek,

Federal Income Tax Form 1041 by using those lines applicable to any business

Michigan, 49016-1982. Tax due of less than one dollar ($1.00) need not be paid.

operation.

DECLARATION OF ESTIMATED TAX

Lines 4 and

Before completing these lines, fill out schedule A - - Business

5 - -

Trust and estates are not required to file a Declaration of Estimated Income Tax.

Allocation Formula.

ASSISTANCE

Line 10 - - Battle Creek resident beneficiaries will report their portion of

If you have any questions not answered in these instructions, or if you need

distributable net income on their individual returns and should receive this

assistance in prepanng your return, carl 966-3345 or visit the Income Tax Division,

information from the FiduciarY. Therefore, this line, which is the resident's share

Room, 217, City Hall. Questions by mail should be directed to: Administrator, City

of the Battle Creek income, should be subtracted from line 9 to arrive at the

Income Tax, P.O. Box 1657, Battle Creek, Michigan 49016-1657.

amount of Battle Creek income taxable to the trust or estate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1