Form Uc-27 - General Instructions Sheet

ADVERTISEMENT

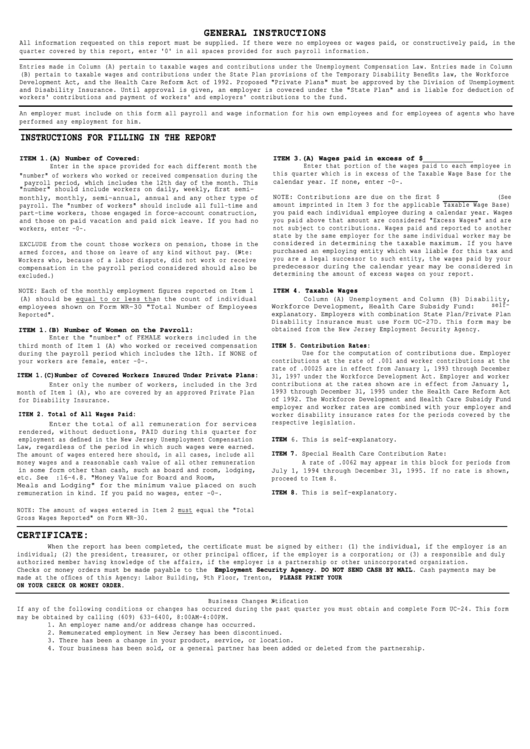

GENERAL INSTRUCTIONS

All information requested on this report must be supplied. If there were no employees or wages paid, or constructively paid, in the

quarter covered by this report, enter '0' in all spaces provided for such payroll information.

Entries made in Column (A) pertain to taxable wages and contributions under the Unemployment Compensation Law. Entries made in Column

(B) pertain to taxable wages and contributions under the State Plan provisions of the Temporary Disability Benefits law, the Workforce

Development Act, and the Health Care Reform Act of 1992. Proposed "Private Plans" must be approved by the Division of Unemployment

and Disability Insurance. Until approval is given, an employer is covered under the "State Plan" and is liable for deduction of

workers' contributions and payment of workers' and employers' contributions to the fund.

An employer must include on this form all payroll and wage information for his own employees and for employees of agents who have

performed any employment for him.

INSTRUCTIONS FOR FILLING IN THE REPORT

ITEM 1.(A) Number of Covered:

ITEM 3.(A) Wages paid in excess of $

Enter that portion of the wages paid to each employee in

workers:

Enter in the space provided for each different month the

this quarter which is in excess of the Taxable Wage Base for the

"number" of workers who worked or received compensation during the

calendar year. If none, enter -0-.

payroll period, which includes the 12th day of the month. This

"number" should include workers on daily, weekly, first semi-

(See

NOTE: Contributions are due on the first $

monthly, monthly, semi-annual, annual and any other type of

amount imprinted in Item 3 for the applicable Taxable Wage Base)

payroll. The "number of workers" should include all full-time and

you paid each individual employee during a calendar year. Wages

part-time workers, those engaged in force-account construction,

you paid above that amount are considered "Excess Wages" and are

and those on paid vacation and paid sick leave. If you had no

not subject to contributions. Wages paid and reported to another

workers, enter -0-.

state by the same employer for the same individual worker may be

considered in determining the taxable maximum. If you have

EXCLUDE from the count those workers on pension, those in the

purchased an employing entity which was liable for this tax and

armed forces, and those on leave of any kind without pay. (Note:

you are a legal successor to such entity, the wages paid by your

Workers who, because of a labor dispute, did not work or receive

predecessor during the calendar year may be considered in

compensation in the payroll period considered should also be

determining the amount of excess wages on your report.

excluded.)

NOTE: Each of the monthly employment figures reported on Item 1

ITEM 4. Taxable Wages

(A) should be equal to or less than the count of individual

Column (A) Unemployment and Column (B) Disability,

self-

Workforce Development, Health Care Subsidy Fund:

employees shown on Form WR-30 "Total Number of Employees

explanatory. Employers with combination State Plan/Private Plan

Reported".

Disability Insurance must use Form UC-27D. This form may be

obtained from the New Jersey Employment Security Agency.

ITEM 1.(B) Number of Women on the Payroll:

Enter the "number" of FEMALE workers included in the

ITEM 5. Contribution Rates:

third month of Item 1 (A) who worked or received compensation

Use for the computation of contributions due. Employer

during the payroll period which includes the 12th. If NONE of

contributions at the rate of .001 and worker contributions at the

your workers are female, enter -0-.

rate of .00025 are in effect from January 1, 1993 through December

ITEM 1.(C)Number of Covered Workers Insured Under Private Plans:

31, 1997 under the Workforce Development Act. Employer and worker

contributions at the rates shown are in effect from January 1,

Enter only the number of workers, included in the 3rd

1993 through December 31, 1995 under the Health Care Reform Act

month of Item 1 (A), who are covered by an approved Private Plan

of 1992. The Workforce Development and Health Care Subsidy Fund

for Disability Insurance.

employer and worker rates are combined with your employer and

ITEM 2. Total of All Wages Paid:

worker disability insurance rates for the periods covered by the

respective legislation.

Enter the total of all remuneration for services

rendered, without deductions, PAID during this quarter for

employment as defined in the New Jersey Unemployment Compensation

ITEM 6. This is self-explanatory.

Law, regardless of the period in which such wages were earned.

ITEM 7. Special Health Care Contribution Rate:

The amount of wages entered here should, in all cases, include all

money wages and a reasonable cash value of all other remuneration

A rate of .0062 may appear in this block for periods from

in some form other than cash, such as board and room, lodging,

July 1, 1994 through December 31, 1995. If no rate is shown,

etc. See N.J.A.C. 12:16-4.8. "Money Value for Board and Room,

proceed to Item 8.

Meals and Lodging" for the minimum value placed on such

ITEM 8. This is self-explanatory.

remuneration in kind. If you paid no wages, enter -0-.

NOTE: The amount of wages entered in Item 2 must equal the "Total

Gross Wages Reported" on Form WR-30.

CERTIFICATE:

When the report has been completed, the certificate must be signed by either: (1) the individual, if the employer is an

individual; (2) the president, treasurer, or other principal officer, if the employer is a corporation; or (3) a responsible and duly

authorized member having knowledge of the affairs, if the employer is a partnership or other unincorporated organization.

Checks or money orders must be made payable to the N.J. Employment Security Agency. DO NOT SEND CASH BY MAIL. Cash payments may be

made at the offices of this Agency: Labor Building, 9th Floor, Trenton, N.J. 08625. PLEASE PRINT YOUR N.J. EMPLOYER REGISTRATION NUMBER

ON YOUR CHECK OR MONEY ORDER .

Business Changes Notification

If any of the following conditions or changes has occurred during the past quarter you must obtain and complete Form UC-24. This form

may be obtained by calling (609) 633-6400, 8:00AM-4:00PM.

1. An employer name and/or address change has occurred.

2. Remunerated employment in New Jersey has been discontinued.

3. There has been a change in your product, service, or location.

4. Your business has been sold, or a general partner has been added or deleted from the partnership.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1