Form Rc-25-A - Instructions Sheet

ADVERTISEMENT

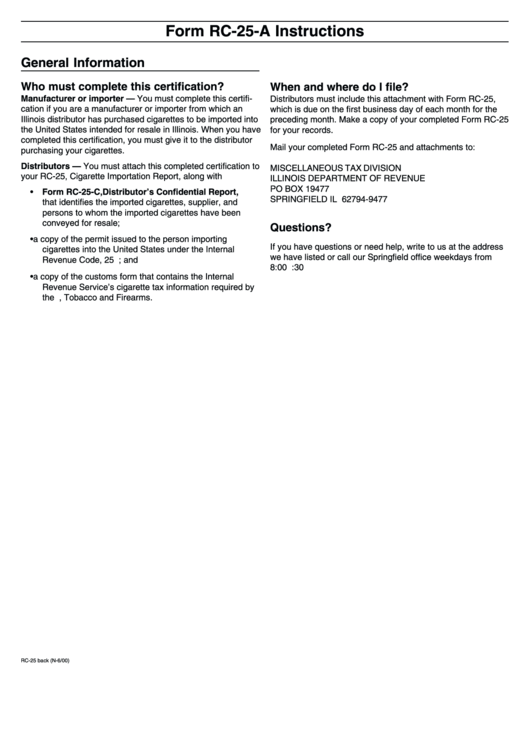

Form RC-25-A Instructions

General Information

Who must complete this certification?

When and where do I file?

Manufacturer or importer — You must complete this certifi-

Distributors must include this attachment with Form RC-25,

cation if you are a manufacturer or importer from which an

which is due on the first business day of each month for the

Illinois distributor has purchased cigarettes to be imported into

preceding month. Make a copy of your completed Form RC-25

the United States intended for resale in Illinois. When you have

for your records.

completed this certification, you must give it to the distributor

Mail your completed Form RC-25 and attachments to:

purchasing your cigarettes.

Distributors — You must attach this completed certification to

MISCELLANEOUS TAX DIVISION

your RC-25, Cigarette Importation Report, along with

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19477

• Form RC-25-C, Distributor’s Confidential Report,

SPRINGFIELD IL 62794-9477

that identifies the imported cigarettes, supplier, and

persons to whom the imported cigarettes have been

conveyed for resale;

Questions?

• a copy of the permit issued to the person importing

If you have questions or need help, write to us at the address

cigarettes into the United States under the Internal

we have listed or call our Springfield office weekdays from

Revenue Code, 25 U.S.C. 5713; and

8:00 a.m. to 4:30 p.m. at 217 785-2622.

• a copy of the customs form that contains the Internal

Revenue Service’s cigarette tax information required by

the U.S. Bureau of Alcohol, Tobacco and Firearms.

RC-25 back (N-6/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1