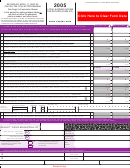

Form 531 - Local Earned Income Tax Return - 2014 Page 2

ADVERTISEMENT

MULTIPLE W2 WORKSHEET

TAXPAYER

SPOUSE

LOCAL GROSS

LOCAL TAXES

LOCAL GROSS

LOCAL TAX

EMPLOYER'S NAME

WAGES

WITHHELD

WAGES

WITHHELD

1

2

3

4

5

6

00

00

00

00

TOTAL

(ENTER ON LINE 1)

Round to the nearest whole dollar

Total Taxpayer

Total Spouse

ENCLOSE A W-2 FORM FOR EACH EMPLOYER

NET EFFECT WORKSHEET

PROFITS & LOSSES FROM BUSINESS, PROFESSION, FARM

DESCRIPTION

TAXPAYER

SPOUSE

SCHEDULE C

SCHEDULE C

SCHEDULE C

SCHEDULE E (Royalties Taxable, Rental Income Non-taxable)

SCHEDULE E (Royalties Taxable, Rental Income Non-taxable)

SCHEDULE F

SCHEDULE F

SCHEDULE K-1 (PA S Corp are Non-taxable, please provide a copy for informational purposes only.)

SCHEDULE K-1 (PA S Corp are Non-taxable, please provide a copy for informational purposes only.)

Taxpayer's Total Schedule Income cannot be netted against Spouse's Total Schedule Income.

Taxpayers must provide verification of earned income/expense items as indicated with this return.

00

00

Total (ENTER ON LINE 4a, IF NEGATIVE ENTER ZERO, ENCLOSE ALL SCHEDULES & DOCUMENTATION)

Totals cannot be combined

Total Taxpayer

Total Spouse

OTHER TAXABLE INCOME WORKSHEET

DESCRIPTION

TAXPAYER

SPOUSE

FORM 1099 (Do not report Interest and Dividend Income, Non-taxable)

FORM 1099 (Do not report Interest and Dividend Income, Non-taxable)

MISC EARNED INCOME (PATENTS, FEES, HONORARIA, ETC)

00

00

Total (ENTER ON LINE 4b)

Totals cannot be combined

Total Taxpayer

Total Spouse

DISTRESSED/COMMUTER TAX WORKSHEET

Taxpayer

(1)

(2)

(3) Home Location (4) Work Location

(5)

(6) Disallowed

(7) Credit Allowed

Local Wages

Tax Withheld

Resident Rate

Non-Resident Rate Col 4 minus Col 3 Withholding Credit For Tax Allowed

(W2 box 16 or 18)

(W2 box 19)

(Rate from line 6)

(See Instructions)

(if less than 0 enter 0)

(Col 1 x Col5)

(Col 2 - Col 6)

Example:

10,000

130

1.25%

1.30%

0.05%

5

125

1.

2.

3.

00

TOTAL

- Enter this amount on Line 6a

DISTRESSED/COMMUTER TAX WORKSHEET

Spouse

(1)

(2)

(3) Home Location (4) Work Location

(5)

(6) Disallowed

(7) Credit Allowed

Local Wages

Tax Withheld

Resident Rate

Non-Resident Rate

Col 4 minus Col 3 Withholding Credit For Tax Allowed

(W2 box 16 or 18)

(W2 box 19)

(Rate from line 6)

(See Instructions)

(if less than 0 enter 0)

(Col 1 x Col5)

(Col 2 - Col 6)

Example:

10,000

130

1.25%

1.30%

0.05%

5

125

1.

2.

3.

00

TOTAL

- Enter this amount on Line 6a

SUBMIT A COPY OF THIS PAGE WITH YOUR RETURN AND NECESSARY SUPPORTING DOCUMENTS TO:

CTCB PO BOX 60547 HARRISBURG PA 17106-0547

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3