Form 531 - Local Earned Income Tax Return - 2014 Page 3

ADVERTISEMENT

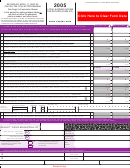

2014

CAPITAL TAX COLLECTION BUREAU

LOCAL EARNED INCOME TAX RETURN

Return this form with supporting

documentation attached to the back of

PO BOX 60547 HARRISBURG PA 17106-0547

Phone: (717) 234-3217

TH

the return by APRIL 15

, 2015

Physical address: 2301 N 3RD ST HARRISBURG PA 17110

WEBSITE:

(Enclose payments, do not attach)

Hours: 8 am - 4 pm MONDAY - THURSDAY 8:30 am - 4 pm FRIDAY

CHECK HERE IF YOU MOVED

Dates

Physical Address [No PO Box, RR or RD] include temporary addresses

DURING THIS TAX YEAR. PROVIDE

___/___/___ to ___/___/___

EACH PHYSICAL ADDRESS FOR TAX

YEAR 2014.

___/___/___ to ___/___/___

***

FIRST COMPLETE THE PART-YEAR

___/___/___ to ___/___/___

RESIDENT WORKSHEET IF YOU LIVED

WITHIN MORE THAN ONE

Taxpayer

MUNICIPALITY.

Current Name and Address

Electronic PIN:

Social Security #:

Account #:

School District:

Municipality:

PSD:

Extension

Amended Return

Non- Resident Return

Extension and Non-Resident Return, see instructions

VISIT

Taxpayer

FOR ADDITIONAL FORMS OR INFORMATION

Disabled

Unemployed

Homemaker

Active Duty Military

Retired

Deceased

This year each individual taxpayer must file on their own form. Column 1 and 2 will record the

earnings and specified tax credits for the first half (Jan 1st thru June 30th) and the second

If you had NO EARNED

DATE:___________________

half (July 1st thru Dec. 31st) respectively. Use the provided worksheets on the back of the

INCOME circle the reason

Column 1: From Jan. 1

Column 2: From July 1

Bureau's Copy to help determine the proper prorated amounts. Taxpayers must provide

why:

Total

verification of earned income/expense items as indicated below with this return.

thru June 30

thru Dec. 31

Round to the whole dollar

Round to the whole dollar

Round to the whole dollar

00

00

00

Earned Income/Compensation

1.

(From W-2 form or amount from income proration worksheet)

(Attach W-2)

1

Less Allowable Business Expenses

00

00

00

2.

(Attach PA UE Forms)

2

TOTAL Earned Income & Compensation

00

00

00

3.

(Line 1 minus Line 2)

3

4. a. Net Effect of Profits & Losses From Business, Profession, & Farm

(Attach Documentation & Complete Net Effect Worksheet) Loss = 0

00

00

00

4a

b. Other Taxable Income

00

00

00

(Attach documentation if available and complete Other Taxable Income Worksheet)

4b

TOTAL Taxable Earned Income/Compensation & Net Profits

00

00

00

5.

(Add Line 3, Line 4a, & Line 4b.)

5

Calculation of Tax:

1.75 %

1.70 %

6.

Tax Rate:

00

00

00

a. Multiply Line 5 by proper tax rate provided for the correct portion of the year.

6a

. Tax Credits:

00

00

00

a. Tax Withheld by Employer

)

7

(Total from W2 Proration Worksheet or Partial Year Resident Worksheet

7a

00

b.

Quarterly Tax Payments

7b

00

Prior Year Overpayment

c.

7c

(unless refunded)

d

Credit for tax paid to other states

00

00

00

.

(Attach Sch G & required copies )

7d

00

e. TOTAL

(Add Lines a, b, c & d)

7e

Overpayment

00

8.

(If Line 7e is greater than Line 6a. AMOUNTS $2.00 OR LESS WILL NOT BE REFUNDED)

8

Credit to Next Year

00

a.

8a

NO CREDIT OR REFUND WILL BE PROCESSED

WITHOUT COMPLETE DOCUMENTATION.

Refund

b.

00

Paper Check

Direct Deposit

8b

Direct Deposit Information

Checking or

Taxpayer

ROUTING NO.

ACCOUNT NUMBER

Name of Bank

Savings Acct

00

Tax Balance Due

9.

(If Line 7e is less than Line 6a enter the difference as the balance due.)

9

Interest and Penalty

10. a.

1% per month of Line 9 if taxes are paid after April 15. (Please note individuals who have

00

failed to make quarterly self-payments sufficient to meet their tax obligations are subject to additional charges.)

10a

b. Collection Fee

(Returns filed after the due date may be subject to additional cost of collection.)

10b

00

TOTAL Payment Due

11.

(Line 9 plus Line 10a & 10b.)

NO PAYMENTS OF $2.00 OR LESS ARE REQUIRED

11

nter amount enclosed

12. E

.

12

SIGN YOUR RETURN. Under penalties of perjury I have examined this return, and to the best of my belief it is true, correct and complete.

Taxpayer Signature

Date

Phone Number

Preparer's Name

Date

Phone Number

Signature of Preparer

MAKE TWO COPIES OF THE COMPETED RETURN. ONE

TO SUBMIT TO CTCB AND ONE TO KEEP FOR YOUR

FORM 531

RECORDS.

*Filing this tax return does not constitute an appeal.

MAKE CHECKS PAYABLE TO - CTCB

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3