Amusement Tax Return - Upper Merion Township - 2015 Page 2

ADVERTISEMENT

IMPORTANT INFORMATION

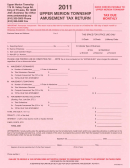

1.

The School District and Township of Upper Merion Amusement Tax Resolution/Ordinance imposes the following

tax upon the admission fee or privilege to attend or engage in any amusement.

2.

The tax is imposed at the rate of Ten (10%) Percentum of the established price charged by any producer for such

privilege.

3.

Permits: Every producer desiring to conduct any amusement within the Upper Merion School District or Township

shall obtain a permit before initiating any business activities. If the applicant has or intends to have more than one

place of amusement, a separate permit must be obtained for each place of amusement.

4.

‘‘Admissions’’ shall have the following meaning ascribed: The established price or regular monetary charge of any

character whatever, including donations, contributions, and dues, or membership fees (periodical or otherwise),

fixed and exacted, or in any manner received by producers, as herein defined from the general public, or a limited

or selected number thereof, directly or indirectly, for the privilege of attending or engaging in any entertainment or

amusement, provided that when such entertainment or amusement is conducted in any roof garden, night club,

cabaret, or other place where the charge for admission is wholly or in part included in the price paid for

refreshments, service, or merchandise, the amount paid for the admission to such amusement may at the option

of the producer be deemed to be Fifty (50%) Percentum of the amount paid for refreshment, service or

merchandise, or the producer may submit a return supported by evidence satisfactory to the collector of the actual

expenditures paid out of the total admissions charged for amusements and pay a tax in accordance with the

Resolution/Ordinance upon the actual expenditures made for such amusements.

5.

‘‘Amusement’’ shall have the following meaning ascribed: All manner and form of entertainment, including among

others, a theatrical performance, operatic performance, carnival, circus, show, concert, lecture, sports event,

vaudeville show, side show, amusement park and all forms of entertainment therein, dancing, golf course, bowling

alley, billiard game, athletic contest, and any other form of diversion, sport, pastime or recreation for which

admission as herein defined is charged or paid by any person for the privilege of attending or engaging therein.

6.

In the case of permanent places of amusement, returns of the amount of tax collected shall be made on or before

the 10th day of the following month.

7.

Producers of temporary, seasonal, or itinerant places of amusement shall file a report promptly after each

performance and the tax collected shall be due and payable on the day such reports are required to be made.

8.

Neglect or refusal to make any report or payment as required will subject the producer to additional penalty Ten

(10%) Percent of the amount of the tax.

9.

Unpaid taxes shall bear interest at the following rate until payment in total is made:

One and One-Quarter Percent (1.25%) of tax due per month or fraction thereof.

10.

Any producer who fails, neglects, or refuses to comply with the Resolution and Ordinance may be fined Three

Hundred Dollars ($300.00) and in default may be imprisoned for a period not exceeding thirty (30) days.

11.

The amusement permit shall at all times be conspicuously displayed at the place for which it was issued.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2