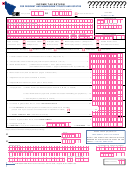

Form 1041me - Income Tax Return For Resident And Nonresident Trusts And Estates - 2001 Page 2

ADVERTISEMENT

???????????

FORM 1041ME, page 2

010910100

SCHEDULE 1 - FIDUCIARY ADJUSTMENT

1

ADDITIONS — Income exempt from federal income tax, but taxable by Maine law:

,

.

a Income from municipal and state bonds, other than Maine .....................................................................................

1a

,

.

b Net Operating Loss Recovery Adjustment (attach schedule) .................................................................................

1b

,

.

c Maine State Retirement Contributions .................................................................................................................

1c

,

.

d Fiduciary Adjustment .......................................................................................................................................

1d

,

.

e Other .............................................................................................................................................................

1e

,

.

f

Total additions (add lines 1a through 1e) ..............................................................................................................

1f

2

DEDUCTIONS — Income exempt from Maine income tax, but taxable by federal law:

,

.

a U.S. Government Bond interest included in federal taxable income .........................................................................

2a

,

.

b Social security and Railroad Retirement Benefits included in federal taxable income (see instructions) ........................

2b

,

.

c Interest from Maine Municipal General Obligation Bonds included in federal taxable income ........................................

2c

,

.

d Premiums for Long-Term Care Insurance (do not include health insurance premiums on this line) ................................

2d

e Maine State Retirement System Pick-Up Contributions paid during 2001

,

.

which have been previously taxed by the state ...................................................................................................

2e

,

.

f

Federal Work Opportunity Credit ........................................................................................................................

2f

,

.

g Other. List ______________________________________________ (See instructions) .............................................

2g

,

.

h Total Deductions (add lines 2a through 2g) ...........................................................................................................

2h

,

.

3

Net Fiduciary Adjustment (subtract line 2h from line 1f — see instructions [may be a negative amount]) ........................ 3

Resident trusts or estates: If the trust/estate’s share of distributable net income is less than 100%, multiply net fiduciary

adjustment by Schedule 2, Column 3, line f. Enter result here and on page 1, line 2. Nonresident trusts or estates: Enter gross fiduciary adjustment here and on

Schedule NR, line 3. Do not apply the allocation rate from Schedule 2 at this time; the rate will be applied when completing Schedule 2, column 6.

SCHEDULE 2 — ALLOCATION OF MAINE-SOURCE INCOME

1. Name

2. Share of income

3. Percent

4. State

5. Social Security

6. Maine-source income

B = beneficiary

(copy from federal return)

of

number/EIN of

of nonresident beneficiaries

TE = trust or estate

domicile

beneficiaries

and nonresident estate or trust

(a) B-

$

%

$

(b) B-

$

%

$

(c) B-

$

%

$

(d) B-

$

%

$

(e) B-

$

%

$

(f) TE-

$

%

$

(g) Total

$

100%

$

Nonresident:

Line g, column 6: Enter the amount from Schedule NR, line 4, column B. Enter amount from line f, column 6 on page 1, line 3.

SCHEDULE 3 - CREDIT FOR INCOME TAX PAID TO ANOTHER JURISDICTION

,

1

Maine taxable income from page 1, line 3 ....................................................................................................................... 1

.

,

2

Income taxed by ( ____________________________________ other jurisdiction) included in line 1 ........................................ 2

.

3

Percentage of income taxed by other jurisdiction (divide line 2 by line 1) ............................................................................. 3 __________________________ %

4

Limitation of credit:

,

.

a Page 1, line 4 $ ______________________ multiplied by _____________________ % on line 3 above .............................. 4a

,

.

b Income taxes paid to other jurisdiction net of tax credits ............................................................................................. 4b

,

.

5

Allowable credit: line 4a or 4b, whichever is less. Enter here and on Maine Schedule A, line 4 ................................................ 5

Special instructions for taxpayers who claim credit for income tax paid to more than one other jurisdiction: Credit for each jurisdiction must be computed

separately. Use a separate Schedule 3 for each one. Add the results together and enter on Schedule A, line 4.

Printed under Approp. 010 18F 0002.07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2