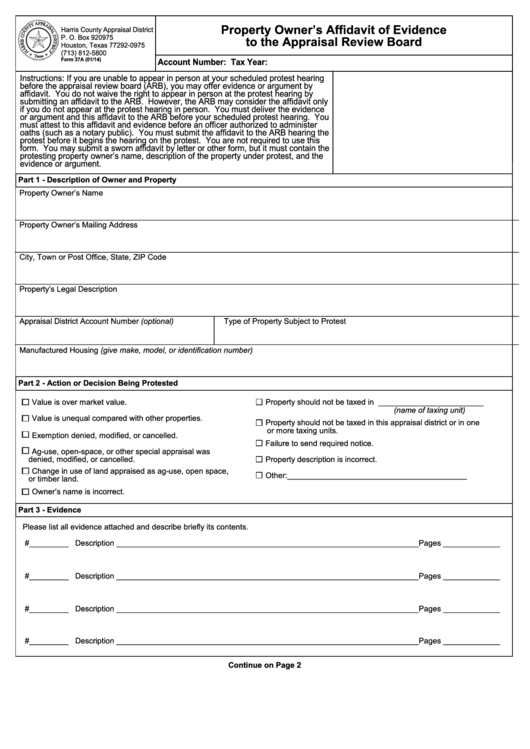

Form 37a - Property Owner'S Affidavit Of Evidence To The Appraisal Review Board

ADVERTISEMENT

Property Owner’s Affidavit of Evidence

Harris County Appraisal District

P. O. Box 920975

to the Appraisal Review Board

Houston, Texas 77292-0975

(713) 812-5800

Form 37A (01/14)

Account Number:

Tax Year:

Instructions: If you are unable to appear in person at your scheduled protest hearing

before the appraisal review board (ARB), you may offer evidence or argument by

affidavit. You do not waive the right to appear in person at the protest hearing by

submitting an affidavit to the ARB. However, the ARB may consider the affidavit only

if you do not appear at the protest hearing in person. You must deliver the evidence

or argument and this affidavit to the ARB before your scheduled protest hearing. You

must attest to this affidavit and evidence before an officer authorized to administer

oaths (such as a notary public). You must submit the affidavit to the ARB hearing the

protest before it begins the hearing on the protest. You are not required to use this

form. You may submit a sworn affidavit by letter or other form, but it must contain the

protesting property owner’s name, description of the property under protest, and the

evidence or argument.

Part 1 - Description of Owner and Property

Property Owner’s Name

___________________________________________________________________________________________________________________

Property Owner’s Mailing Address

___________________________________________________________________________________________________________________

City, Town or Post Office, State, ZIP Code

___________________________________________________________________________________________________________________

Property’s Legal Description

___________________________________________________________________________________________________________________

Appraisal District Account Number (optional)

Type of Property Subject to Protest

___________________________________________________________________________________________________________________

Manufactured Housing (give make, model, or identification number)

Part 2 - Action or Decision Being Protested

Value is over market value.

Property should not be taxed in ________________________

(name of taxing unit)

Value is unequal compared with other properties.

Property should not be taxed in this appraisal district or in one

or more taxing units.

Exemption denied, modified, or cancelled.

Failure to send required notice.

Ag-use, open-space, or other special appraisal was

denied, modified, or cancelled.

Property description is incorrect.

Change in use of land appraised as ag-use, open space,

Other:_________________________________________

or timber land.

Owner’s name is incorrect.

Part 3 - Evidence

Please list all evidence attached and describe briefly its contents.

#_________ Description _____________________________________________________________________Pages _____________

#_________ Description _____________________________________________________________________Pages _____________

#_________ Description _____________________________________________________________________Pages _____________

#_________ Description _____________________________________________________________________Pages _____________

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2