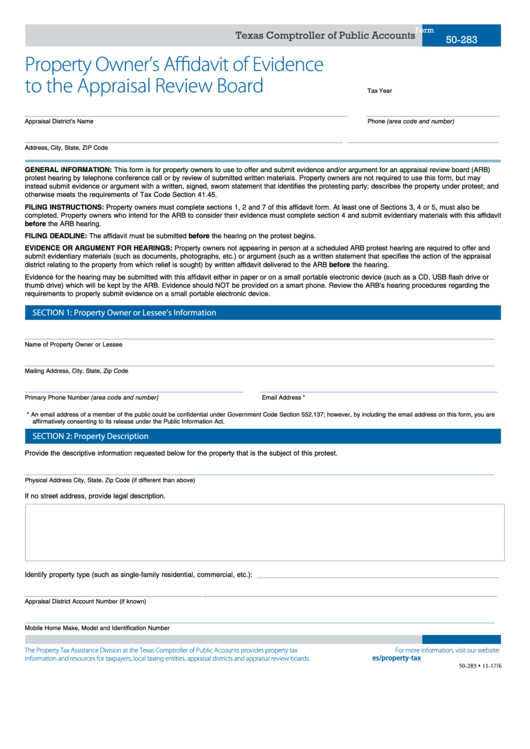

Form

Texas Comptroller of Public Accounts

50-283

Property Owner’s Affidavit of Evidence

to the Appraisal Review Board

____________________________

Tax Year

____________________________________________________________________

____________________________

Appraisal District’s Name

Phone (area code and number)

___________________________________________________________________

________________________________

Address, City, State, ZIP Code

GENERAL INFORMATION: This form is for property owners to use to offer and submit evidence and/or argument for an appraisal review board (ARB)

protest hearing by telephone conference call or by review of submitted written materials. Property owners are not required to use this form, but may

instead submit evidence or argument with a written, signed, sworn statement that identifies the protesting party; describes the property under protest; and

otherwise meets the requirements of Tax Code Section 41.45.

FILING INSTRUCTIONS: Property owners must complete sections 1, 2 and 7 of this affidavit form. At least one of Sections 3, 4 or 5, must also be

completed. Property owners who intend for the ARB to consider their evidence must complete section 4 and submit evidentiary materials with this affidavit

before the ARB hearing.

FILING DEADLINE: The affidavit must be submitted before the hearing on the protest begins.

EVIDENCE OR ARGUMENT FOR HEARINGS: Property owners not appearing in person at a scheduled ARB protest hearing are required to offer and

submit evidentiary materials (such as documents, photographs, etc.) or argument (such as a written statement that specifies the action of the appraisal

district relating to the property from which relief is sought) by written affidavit delivered to the ARB before the hearing.

Evidence for the hearing may be submitted with this affidavit either in paper or on a small portable electronic device (such as a CD, USB flash drive or

thumb drive) which will be kept by the ARB. Evidence should NOT be provided on a smart phone. Review the ARB’s hearing procedures regarding the

requirements to properly submit evidence on a small portable electronic device.

SECTION 1: Property Owner or Lessee’s Information

___________________________________________________________________________________________________

Name of Property Owner or Lessee

___________________________________________________________________________________________________

Mailing Address, City, State, Zip Code

______________________________________________

__________________________________________________

Primary Phone Number (area code and number)

Email Address *

* An email address of a member of the public could be confidential under Government Code Section 552.137; however, by including the email address on this form, you are

affirmatively consenting to its release under the Public Information Act.

SECTION 2: Property Description

Provide the descriptive information requested below for the property that is the subject of this protest.

___________________________________________________________________________________________________

Physical Address City, State, Zip Code (if different than above)

If no street address, provide legal description.

___________________________________________________

Identify property type (such as single-family residential, commercial, etc.):

____

__

_

__________

____________________

______________________________________________________________

Apprai

sal D

ist

rict Account Nu

mber (if known)

___________________________________________________________________________________________________

Mobile Home Make, Model and Identification Number

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-283 • 11-17/6

1

1 2

2 3

3