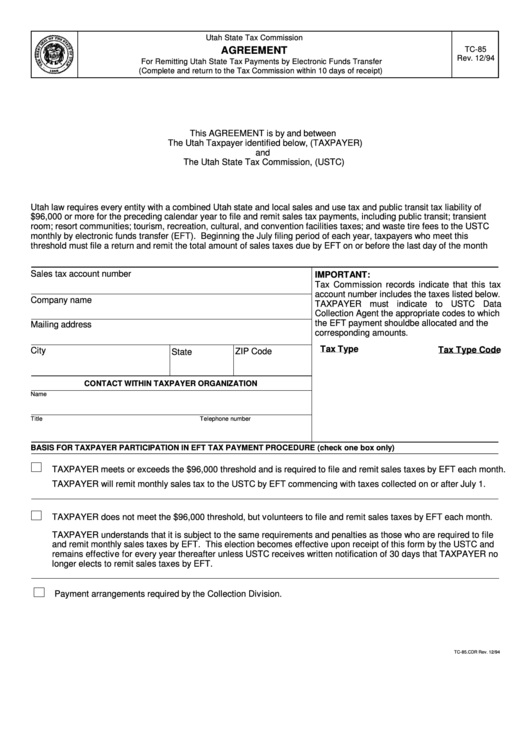

Utah State Tax Commission

AGREEMENT

TC-85

Rev. 12/94

For Remitting Utah State Tax Payments by Electronic Funds Transfer

(Complete and return to the Tax Commission within 10 days of receipt)

This AGREEMENT is by and between

The Utah Taxpayer identified below, (TAXPAYER)

and

The Utah State Tax Commission, (USTC)

Utah law requires every entity with a combined Utah state and local sales and use tax and public transit tax liability of

$96,000 or more for the preceding calendar year to file and remit sales tax payments, including public transit; transient

room; resort communities; tourism, recreation, cultural, and convention facilities taxes; and waste tire fees to the USTC

monthly by electronic funds transfer (EFT). Beginning the July filing period of each year, taxpayers who meet this

threshold must file a return and remit the total amount of sales taxes due by EFT on or before the last day of the month

Sales tax account number

IMPORTANT:

Tax Commission records indicate that this tax

account number includes the taxes listed below.

Company name

TAXPAYER must indicate to USTC Data

Collection Agent the appropriate codes to which

the EFT payment should be allocated and the

Mailing address

corresponding amounts.

Tax Type

Tax Type Code

City

ZIP Code

State

CONTACT WITHIN TAXPAYER ORGANIZATION

Name

Telephone number

Title

BASIS FOR TAXPAYER PARTICIPATION IN EFT TAX PAYMENT PROCEDURE (check one box only)

TAXPAYER meets or exceeds the $96,000 threshold and is required to file and remit sales taxes by EFT each month.

TAXPAYER will remit monthly sales tax to the USTC by EFT commencing with taxes collected on or after July 1.

TAXPAYER does not meet the $96,000 threshold, but volunteers to file and remit sales taxes by EFT each month.

TAXPAYER understands that it is subject to the same requirements and penalties as those who are required to file

and remit monthly sales taxes by EFT. This election becomes effective upon receipt of this form by the USTC and

remains effective for every year thereafter unless USTC receives written notification of 30 days that TAXPAYER no

longer elects to remit sales taxes by EFT.

Payment arrangements required by the Collection Division.

TC-85.CDR Rev. 12/94

1

1 2

2