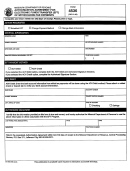

EFT METHOD - TAXPAYER WILL INITIATE TAX PAYMENTS EACH MONTH USING THE EFT

PROCEDURE INDICATED BELOW (check one box only)

TAXPAYER elects to initiate ACH-DEBIT transactions to withdraw funds from TAXPAYER's bank account, identified

previously, pursuant to instructions TAXPAYER gives to the USTC Data Collection Agent each month. A voided

check or deposit slip for this bank account is attached.

The USTC and Data Collection Agent warrants to transfer only those debit transactions and to withdraw only those

funds from TAXPAYER's bank account that TAXPAYER explicitly authorizes.

TAXPAYER BANK INFORMATION (For ACH-DEBIT Option Only)

Taxpayer bank's name

Bank's ABA number (9 digit number)

Bank's address

Taxpayer's bank account number

Bank's City

Bank's State

Bank's ZIP Code

Account type (checking, savings, etc.)

ACH-CREDIT

TAXPAYER will initiate tax payments to the USTC each month through ACH-CREDIT transactions. TAXPAYER

agrees to contact its bank authorizing it to transfer payments through NACHA system's CCD+ application and Tax

Payment Convention (TXP) addendum.

TAXPAYER understands that, in order for its EFT payment to be considered timely made, the payment must be initiated

with the USTC Data Collection Agent or TAXPAYER's bank, as appropriate, prior to 3:00pm Salt Lake City time on the

due date. If the due date falls on a weekend or holiday, the payment must be initiated by 3:00pm Salt Lake City time on

the next business day.

TAXPAYER may at any time and with 10 days written notice to the USTC, change banks or bank accounts, and change

from the ACH-CREDIT to the ACH-DEBIT method of EFT remittance. A change from the ACH-DEBIT to the ACH-CREDIT

method shall be made only with prior written approval of the USTC.

This agreement shall continue in full force and effect until USTC receives written notice of a modification permitted by this

AGREEMENT, or TAXPAYER's termination of an election to remit sales taxes by EFT, or until TAXPAYER no longer meets

the requirements for mandatory EFT remittance of sales taxes.

TAXPAYER CERTIFIES THAT ALL INFORMATION PROVIDED IN THIS AGREEMENT IS TRUE,

COMPLETE, AND CORRECT.

Title

TAXPAYER Authorized Signature

Date

Utah State Tax Commission

210 North 1950 West

Salt Lake City, Utah 84134

Telephone (801) 297-2200

For questions regarding this agreement form, call (801) 297-3817.

1

1 2

2