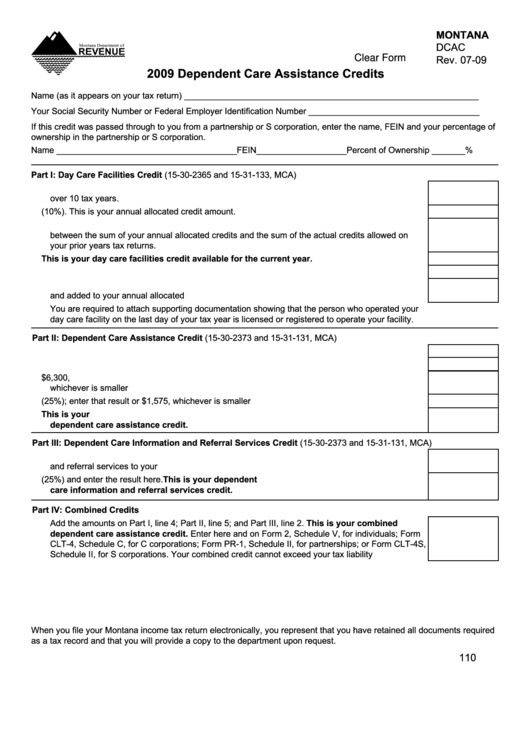

MonTAnA

DCAC

Clear Form

Rev. 07-09

2009 Dependent Care Assistance Credits

Name (as it appears on your tax return) ______________________________________________________________

Your Social Security Number or Federal Employer Identification Number ____________________________________

If this credit was passed through to you from a partnership or S corporation, enter the name, FEIN and your percentage of

ownership in the partnership or S corporation.

Name ______________________________________ FEIN___________________ Percent of Ownership _______ %

Part I: Day Care Facilities Credit (15-30-2365 and 15-31-133, MCA)

1. Enter original amount of day care facility credit calculated. This is your total credit that is allocated

over 10 tax years. ............................................................................................................................ 1.

2. Multiply line 1 by 0.10 (10%). This is your annual allocated credit amount. .................................... 2.

3. Enter the amount available to be carried forward from prior tax years. This is the difference

between the sum of your annual allocated credits and the sum of the actual credits allowed on

your prior years tax returns. ............................................................................................................ 3.

4. Add lines 2 and 3. This is your day care facilities credit available for the current year. .......... 4.

5. Enter the amount of credit claimed in the current tax year. ............................................................. 5.

6. Subtract line 5 from line 4. This is your credit available to be carried forward to the next tax year

and added to your annual allocated credit....................................................................................... 6.

You are required to attach supporting documentation showing that the person who operated your

day care facility on the last day of your tax year is licensed or registered to operate your facility.

Part II: Dependent Care Assistance Credit (15-30-2373 and 15-31-131, MCA)

1. Enter here the total amount of dependent care assistance that you furnished your employees ..... 1.

2. Enter here the total number of employees who were provided this service .................................... 2.

3. Divide the amount on line 1 by the number on line 2 and enter that result or $6,300,

whichever is smaller ........................................................................................................................ 3.

4. Multiply the amount on line 3 by 0.25 (25%); enter that result or $1,575, whichever is smaller ...... 4.

5. Multiply the amount on line 4 by the amount on line 2 and enter the result here. This is your

dependent care assistance credit. ............................................................................................... 5.

Part III: Dependent Care Information and Referral Services Credit (15-30-2373 and 15-31-131, MCA)

1. Enter here the total amount that you paid or incurred during the year for providing information

and referral services to your employees.......................................................................................... 1.

2. Multiply the amount on line 1 by 0.25 (25%) and enter the result here. This is your dependent

care information and referral services credit. ............................................................................ 2.

Part IV: Combined Credits

Add the amounts on Part I, line 4; Part II, line 5; and Part III, line 2. This is your combined

dependent care assistance credit. Enter here and on Form 2, Schedule V, for individuals; Form

CLT-4, Schedule C, for C corporations; Form PR-1, Schedule II, for partnerships; or Form CLT-4S,

Schedule II, for S corporations. Your combined credit cannot exceed your tax liability .....................

When you file your Montana income tax return electronically, you represent that you have retained all documents required

as a tax record and that you will provide a copy to the department upon request.

110

1

1