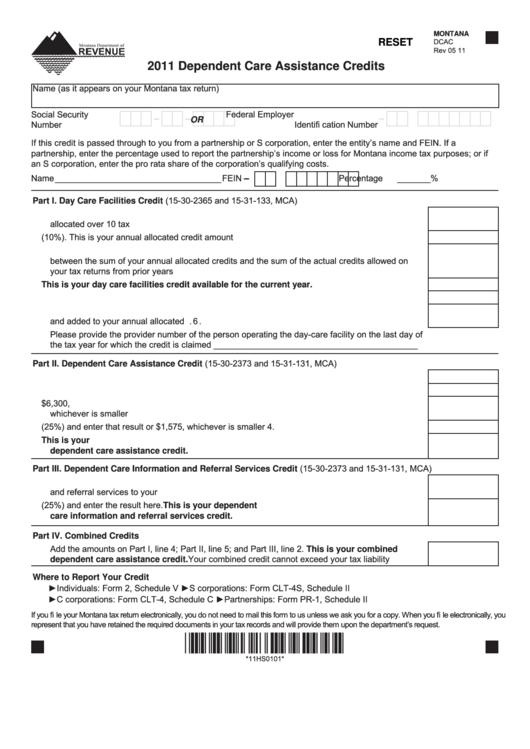

MONTANA

RESET

DCAC

Rev 05 11

2011 Dependent Care Assistance Credits

Name (as it appears on your Montana tax return)

Social Security

Federal Employer

-

-

-

OR

Number

Identifi cation Number

If this credit is passed through to you from a partnership or S corporation, enter the entity’s name and FEIN. If a

partnership, enter the percentage used to report the partnership’s income or loss for Montana income tax purposes; or if

an S corporation, enter the pro rata share of the corporation’s qualifying costs.

Name ___________________________________ FEIN

Percentage _______ %

-

Part I. Day Care Facilities Credit (15-30-2365 and 15-31-133, MCA)

1. Enter original amount of day care facility credit calculated. This is your total credit that is

allocated over 10 tax years.............................................................................................................. 1.

2. Multiply line 1 by 0.10 (10%). This is your annual allocated credit amount ..................................... 2.

3. Enter the amount available to be carried forward from prior tax years. This is the difference

between the sum of your annual allocated credits and the sum of the actual credits allowed on

your tax returns from prior years ..................................................................................................... 3.

4. Add lines 2 and 3. This is your day care facilities credit available for the current year. .......... 4.

5. Enter the amount of credit claimed in the current tax year .............................................................. 5.

6. Subtract line 5 from line 4. This is your credit available to be carried forward to the next tax year

and added to your annual allocated credit....................................................................................... 6.

Please provide the provider number of the person operating the day-care facility on the last day of

the tax year for which the credit is claimed ___________________________________________

Part II. Dependent Care Assistance Credit (15-30-2373 and 15-31-131, MCA)

1. Enter here the total amount of dependent care assistance that you furnished your employees ..... 1.

2. Enter here the total number of employees who were provided this service .................................... 2.

3. Divide the amount on line 1 by the number on line 2 and enter that result or $6,300,

whichever is smaller ........................................................................................................................ 3.

4. Multiply the amount on line 3 by 0.25 (25%) and enter that result or $1,575, whichever is smaller 4.

5. Multiply the amount on line 4 by the amount on line 2 and enter the result here. This is your

dependent care assistance credit. ............................................................................................... 5.

Part III. Dependent Care Information and Referral Services Credit (15-30-2373 and 15-31-131, MCA)

1. Enter here the total amount that you paid or incurred during the year for providing information

and referral services to your employees.......................................................................................... 1.

2. Multiply the amount on line 1 by 0.25 (25%) and enter the result here. This is your dependent

care information and referral services credit. ............................................................................ 2.

Part IV. Combined Credits

Add the amounts on Part I, line 4; Part II, line 5; and Part III, line 2. This is your combined

dependent care assistance credit. Your combined credit cannot exceed your tax liability .............

Where to Report Your Credit

►Individuals: Form 2, Schedule V

►S corporations: Form CLT-4S, Schedule II

►C corporations: Form CLT-4, Schedule C

►Partnerships: Form PR-1, Schedule II

If you fi le your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you fi le electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*11HS0101*

*11HS0101*

1

1