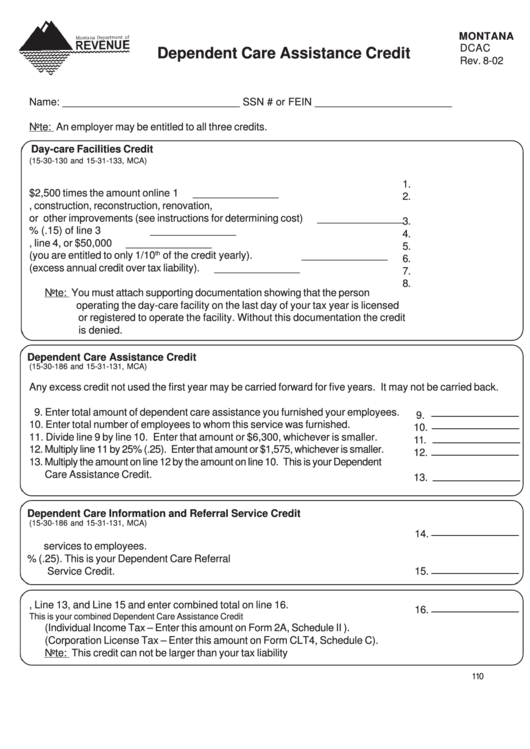

Montana Form Dcac - Dependent Care Assistance Credit

ADVERTISEMENT

MONTANA

DCAC

Dependent Care Assistance Credit

Rev. 8-02

Name: _______________________________ SSN # or FEIN ________________________

Note: An employer may be entitled to all three credits.

Day-care Facilities Credit

(15-30-130 and 15-31-133, MCA)

1. Number of dependents facility is designed to accommodate

_______________

1.

2. Take $2,500 times the amount on line 1

_______________

2.

3. Cost of acquisition, construction, reconstruction, renovation,

or other improvements (see instructions for determining cost)

_______________

3.

4. Enter 15% (.15) of line 3

_______________

4.

5. Enter the lesser of line 2, line 4, or $50,000

_______________

5.

th

6. Line 5 divided by ten (you are entitled to only 1/10

of the credit yearly).

_______________

6.

7. Enter carryforward amounts (excess annual credit over tax liability).

_______________

7.

8. Add line 6 and line 7

_______________

8.

Note: You must attach supporting documentation showing that the person

operating the day-care facility on the last day of your tax year is licensed

or registered to operate the facility. Without this documentation the credit

is denied.

Dependent Care Assistance Credit

(15-30-186 and 15-31-131, MCA)

Any excess credit not used the first year may be carried forward for five years. It may not be carried back.

9. Enter total amount of dependent care assistance you furnished your employees.

9.

10. Enter total number of employees to whom this service was furnished.

10.

11. Divide line 9 by line 10. Enter that amount or $6,300, whichever is smaller.

11.

12. Multiply line 11 by 25% (.25). Enter that amount or $1,575, whichever is smaller.

12.

13. Multiply the amount on line 12 by the amount on line 10. This is your Dependent

Care Assistance Credit.

13.

Dependent Care Information and Referral Service Credit

(15-30-186 and 15-31-131, MCA)

14. Amount paid or incurred during the year for providing information and referral

14.

services to employees.

15. Multiply line 14 by 25% (.25). This is your Dependent Care Referral

Service Credit.

15.

16. Add Line 8, Line 13, and Line 15 and enter combined total on line 16.

16.

This is your combined Dependent Care Assistance Credit

(Individual Income Tax – Enter this amount on Form 2A, Schedule II ).

(Corporation License Tax – Enter this amount on Form CLT4, Schedule C).

Note: This credit can not be larger than your tax liability

110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1