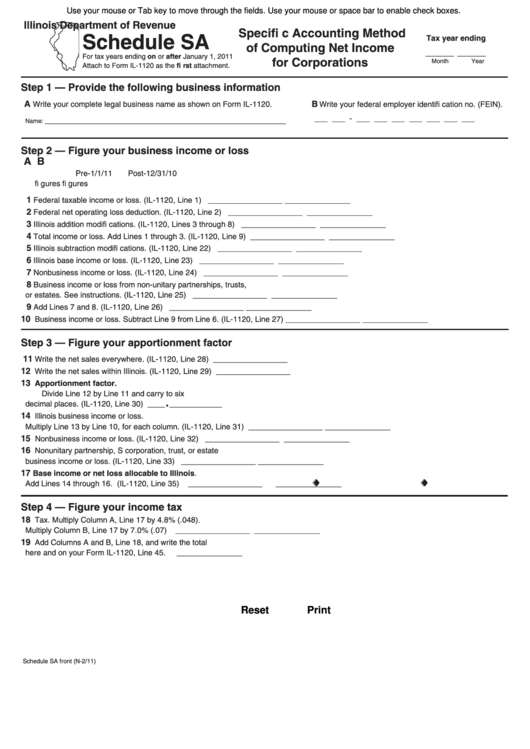

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Specifi c Accounting Method

Schedule SA

Tax year ending

of Computing Net Income

______ ______

For tax years ending on or after January 1, 2011

for Corporations

Month

Year

Attach to Form IL-1120 as the fi rst attachment.

Step 1 — Provide the following business information

A

Write your complete legal business name as shown on Form IL-1120.

B

Write your federal employer identifi cation no. (FEIN).

___ ___ - ___ ___ ___ ___ ___ ___ ___

_______________________________________________________

Name:

Step 2 — Figure your business income or loss

A

B

Pre-1/1/11

Post-12/31/10

fi gures

fi gures

1

Federal taxable income or loss. (IL-1120, Line 1)

_________________

_______________

2

Federal net operating loss deduction. (IL-1120, Line 2)

_________________

_______________

3

Illinois addition modifi cations. (IL-1120, Lines 3 through 8)

_________________

_______________

4

Total income or loss. Add Lines 1 through 3. (IL-1120, Line 9)

_________________

_______________

5

Illinois subtraction modifi cations. (IL-1120, Line 22)

_________________

_______________

6

Illinois base income or loss. (IL-1120, Line 23)

_________________

_______________

7

Nonbusiness income or loss. (IL-1120, Line 24)

_________________

_______________

8

Business income or loss from non-unitary partnerships, trusts,

or estates. See instructions. (IL-1120, Line 25)

_________________

_______________

9

Add Lines 7 and 8. (IL-1120, Line 26)

_________________

_______________

10

Business income or loss. Subtract Line 9 from Line 6. (IL-1120, Line 27)

_________________

_______________

Step 3 — Figure your apportionment factor

11

Write the net sales everywhere. (IL-1120, Line 28)

_________________

12

Write the net sales within Illinois. (IL-1120, Line 29)

_________________

13

Apportionment factor.

Divide Line 12 by Line 11 and carry to six

.

decimal places. (IL-1120, Line 30)

____

____________

14

Illinois business income or loss.

Multiply Line 13 by Line 10, for each column. (IL-1120, Line 31)

_________________

_______________

15

Nonbusiness income or loss. (IL-1120, Line 32)

_________________

_______________

16

Nonunitary partnership, S corporation, trust, or estate

business income or loss. (IL-1120, Line 33)

_________________

_______________

17

Base income or net loss allocable to Illinois.

Add Lines 14 through 16. (IL-1120, Line 35)

_________________

_______________

Step 4 — Figure your income tax

18

Tax. Multiply Column A, Line 17 by 4.8% (.048).

Multiply Column B, Line 17 by 7.0% (.07)

_________________

_______________

19

Add Columns A and B, Line 18, and write the total

here and on your Form IL-1120, Line 45.

_______________

Reset

Print

Schedule SA front (N-2/11)

1

1