Claim For Refund Form - Income Tax Department - Pickerington - Ohio

ADVERTISEMENT

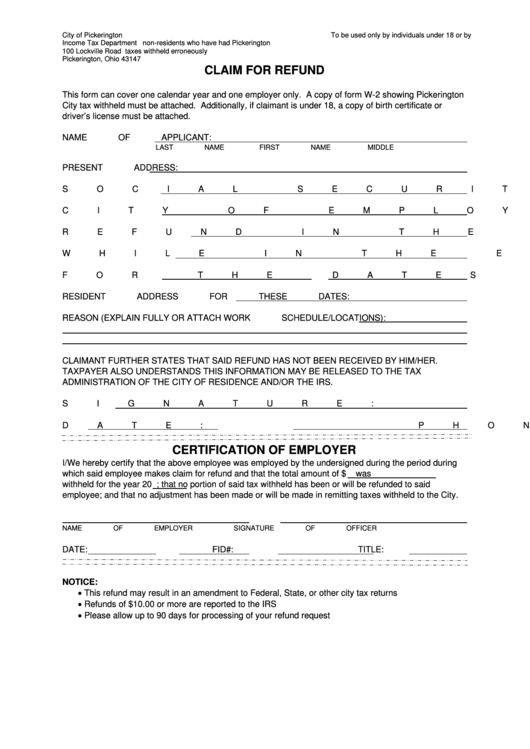

City of Pickerington

To be used only by individuals under 18 or by

Income Tax Department

non-residents who have had Pickerington

100 Lockville Road

taxes withheld erroneously

Pickerington, Ohio 43147

CLAIM FOR REFUND

This form can cover one calendar year and one employer only. A copy of form W-2 showing Pickerington

City tax withheld must be attached. Additionally, if claimant is under 18, a copy of birth certificate or

driver’s license must be attached.

NAME OF APPLICANT:

LAST NAME

FIRST NAME

MIDDLE

PRESENT ADDRESS:

SOCIAL SECURITY NO.:

CITY OF EMPLOYMENT:

REFUND IN THE AMOUNT OF $

WHILE IN THE EMPLOY OF:

FOR THE DATES FROM:

TO:

RESIDENT ADDRESS FOR THESE DATES:

REASON (EXPLAIN FULLY OR ATTACH WORK SCHEDULE/LOCATIONS):

CLAIMANT FURTHER STATES THAT SAID REFUND HAS NOT BEEN RECEIVED BY HIM/HER.

TAXPAYER ALSO UNDERSTANDS THIS INFORMATION MAY BE RELEASED TO THE TAX

ADMINISTRATION OF THE CITY OF RESIDENCE AND/OR THE IRS.

SIGNATURE:

DATE:

PHONE NUMBER:

CERTIFICATION OF EMPLOYER

I/We hereby certify that the above employee was employed by the undersigned during the period during

which said employee makes claim for refund and that the total amount of $

was

withheld for the year 20

; that no portion of said tax withheld has been or will be refunded to said

employee; and that no adjustment has been made or will be made in remitting taxes withheld to the City.

NAME OF EMPLOYER

SIGNATURE OF OFFICER

DATE:

FID#:

TITLE:

PHONE:

NOTICE:

This refund may result in an amendment to Federal, State, or other city tax returns

Refunds of $10.00 or more are reported to the IRS

Please allow up to 90 days for processing of your refund request

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1