Important Note For Form 433-Oic Page 3

ADVERTISEMENT

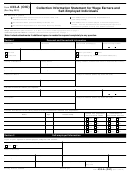

11. Add amounts in Boxes G through M to obtain your total equity and assets

N

0.00

0.00

12. Enter amount from Item 28

$

If Box O is “0” or less, STOP. Enter

0.00

Enter amount from Item 39 and subtract

– $

amount from Box N on line 7 of

Form 656-P. This is your offer

amount and should represent your

O

Net Difference

=

0.00

maximum ability to pay.

This amount would be available

to pay monthly on your tax liability.

b.

13. a.

If you will pay the offer amount in more

If you will pay the offer amount

than 90 days but less than 2 years:

in 90 days or less:

Enter amount

Enter amount

0.00

0.00

$

$

from Box O

from Box O

x 60

x 48

Multiply by

Multiply by

=

=

P

S

0.00

0.00

Enter amount

Enter amount

+

Q

+

T

0.00

0.00

from Box N

from Box N

=

Add amounts

Add amounts

R

=

U

0.00

0.00

in Box P and

in Box S and

Box Q

Box T

Enter the amount

Enter the amount

from Box R in Item 7

from Box U in Item 7

of Form 656-P.

of Form 656-P.

Note: Your offer

Note: Your offer

amount must equal

amount must equal

or exceed the amount

or exceed the amount

shown in Box U.

shown in Box R.

Form

Please attach a statement to the Form 433-OIC explaining where

433-

you will get the funds to make this offer.

OIC

Statement

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3