Form Db020w-Nr - Payment Of Indiana Withholding Tax For Nonresident Shareholders, Partners, Or Benefi Ciaries Of Trusts And Estates

ADVERTISEMENT

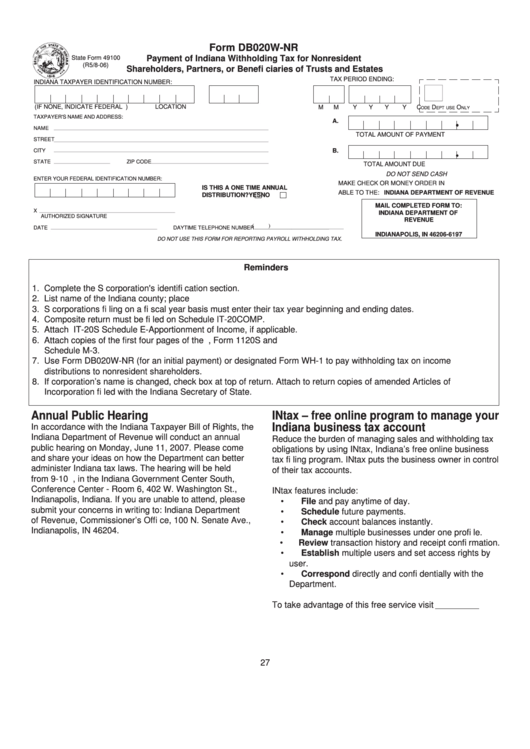

Form DB020W-NR

Payment of Indiana Withholding Tax for Nonresident

State Form 49100

(R5/8-06)

Shareholders, Partners, or Benefi ciaries of Trusts and Estates

TAX PERIOD ENDING:

INDIANA TAXPAYER IDENTIFICATION NUMBER:

(IF NONE, INDICATE FEDERAL I.D. NUMBER BELOW)

LOCATION

M

M

Y

Y

Y

Y

C

D

O

ODE

EPT USE

NLY

.

.

TAXPAYER'S NAME AND ADDRESS:

A.

NAME

TOTAL AMOUNT OF PAYMENT

STREET

.

B.

CITY

STATE

ZIP CODE

TOTAL AMOUNT DUE

DO NOT SEND CASH

ENTER YOUR FEDERAL IDENTIFICATION NUMBER:

MAKE CHECK OR MONEY ORDER IN U.S. FUNDS PAY-

IS THIS A ONE TIME ANNUAL

ABLE TO THE: INDIANA DEPARTMENT OF REVENUE

DISTRIBUTION?

YES

NO

MAIL COMPLETED FORM TO:

X

INDIANA DEPARTMENT OF

AUTHORIZED SIGNATURE

REVENUE

DAYTIME TELEPHONE NUMBER (

)

P.O. BOX 6197

DATE

INDIANAPOLIS, IN 46206-6197

DO NOT USE THIS FORM FOR REPORTING PAYROLL WITHHOLDING TAX.

Reminders

1. Complete the S corporation's identifi cation section.

2. List name of the Indiana county; place O.O.S. in the county box to indicate an out-of-state business operation.

3. S corporations fi ling on a fi scal year basis must enter their tax year beginning and ending dates.

4. Composite return must be fi led on Schedule IT-20COMP.

5. Attach IT-20S Schedule E-Apportionment of Income, if applicable.

6. Attach copies of the fi rst four pages of the U.S. Income Tax Return for an S Corporation, Form 1120S and

Schedule M-3.

7. Use Form DB020W-NR (for an initial payment) or designated Form WH-1 to pay withholding tax on income

distributions to nonresident shareholders.

8. If corporation’s name is changed, check box at top of return. Attach to return copies of amended Articles of

Incorporation fi led with the Indiana Secretary of State.

Annual Public Hearing

INtax – free online program to manage your

Indiana business tax account

In accordance with the Indiana Taxpayer Bill of Rights, the

Indiana Department of Revenue will conduct an annual

Reduce the burden of managing sales and withholding tax

public hearing on Monday, June 11, 2007. Please come

obligations by using INtax, Indiana’s free online business

and share your ideas on how the Department can better

tax fi ling program. INtax puts the business owner in control

administer Indiana tax laws. The hearing will be held

of their tax accounts.

from 9-10 a.m., in the Indiana Government Center South,

Conference Center - Room 6, 402 W. Washington St.,

INtax features include:

Indianapolis, Indiana. If you are unable to attend, please

• File and pay anytime of day.

submit your concerns in writing to: Indiana Department

• Schedule future payments.

of Revenue, Commissioner’s Offi ce, 100 N. Senate Ave.,

• Check account balances instantly.

Indianapolis, IN 46204.

• Manage multiple businesses under one profi le.

• Review transaction history and receipt confi rmation.

• Establish multiple users and set access rights by

user.

• Correspond directly and confi dentially with the

Department.

To take advantage of this free service visit intax.in.gov

27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1