Form It-370 - New York State Taxpayer Authorization For Electronic Funds Withdrawal For Tax Year 2007

ADVERTISEMENT

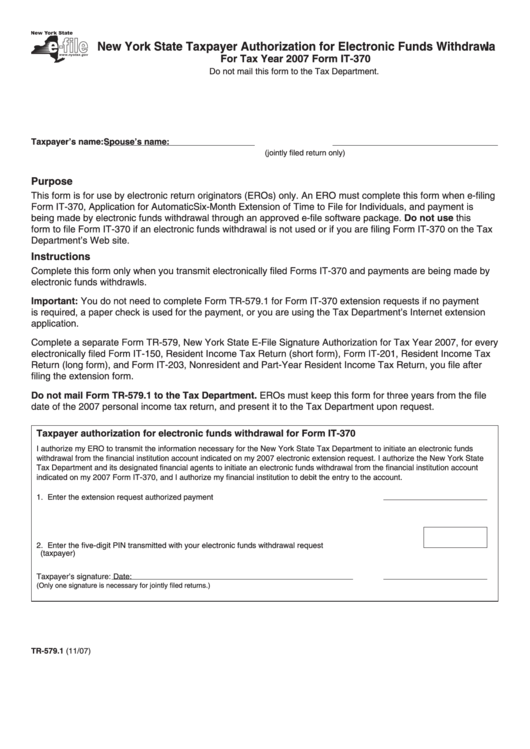

New York State Taxpayer Authorization for Electronic Funds Withdrawal

For Tax Year 2007 Form IT-370

Do not mail this form to the Tax Department.

Taxpayer’s name:

Spouse’s name:

(jointly filed return only)

Purpose

This form is for use by electronic return originators (EROs) only. An ERO must complete this form when e-filing

Form IT-370, Application for Automatic Six-Month Extension of Time to File for Individuals, and payment is

being made by electronic funds withdrawal through an approved e-file software package. Do not use this

form to file Form IT-370 if an electronic funds withdrawal is not used or if you are filing Form IT-370 on the Tax

Department’s Web site.

Instructions

Complete this form only when you transmit electronically filed Forms IT-370 and payments are being made by

electronic funds withdrawls.

Important: You do not need to complete Form TR-579.1 for Form IT-370 extension requests if no payment

is required, a paper check is used for the payment, or you are using the Tax Department’s Internet extension

application.

Complete a separate Form TR-579, New York State E-File Signature Authorization for Tax Year 2007, for every

electronically filed Form IT-150, Resident Income Tax Return (short form), Form IT-201, Resident Income Tax

Return (long form), and Form IT-203, Nonresident and Part-Year Resident Income Tax Return, you file after

filing the extension form.

Do not mail Form TR-579.1 to the Tax Department. EROs must keep this form for three years from the file

date of the 2007 personal income tax return, and present it to the Tax Department upon request.

Taxpayer authorization for electronic funds withdrawal for Form IT-370

I authorize my ERO to transmit the information necessary for the New York State Tax Department to initiate an electronic funds

withdrawal from the financial institution account indicated on my 2007 electronic extension request. I authorize the New York State

Tax Department and its designated financial agents to initiate an electronic funds withdrawal from the financial institution account

indicated on my 2007 Form IT-370, and I authorize my financial institution to debit the entry to the account.

1. Enter the extension request authorized payment ......................................................................... 1.

2. Enter the five-digit PIN transmitted with your electronic funds withdrawal request ......................................... 2.

(taxpayer)

Taxpayer’s signature:

Date:

(Only one signature is necessary for jointly filed returns.)

TR-579.1 (11/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1