Reset Form

SD 2210-100

Rev. 3/08

10211411

tax.ohio.gov

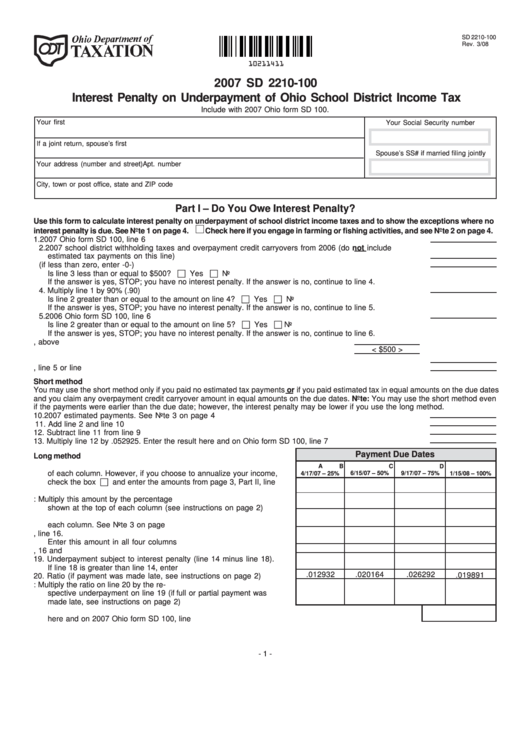

2007 SD 2210-100

Interest Penalty on Underpayment of Ohio School District Income Tax

Include with 2007 Ohio form SD 100.

Your first name

M.I.

Last name

Your Social Security number

If a joint return, spouse’s first name

M.I.

Last name

Spouse’s SS# if married filing jointly

Your address (number and street)

Apt. number

City, town or post office, state and ZIP code

Part I – Do You Owe Interest Penalty?

Use this form to calculate interest penalty on underpayment of school district income taxes and to show the exceptions where no

interest penalty is due. See Note 1 on page 4.

Check here if you engage in farming or fishing activities, and see Note 2 on page 4.

1. 2007 Ohio form SD 100, line 6 ............................................................................................................................ 1.

2. 2007 school district withholding taxes and overpayment credit carryovers from 2006 (do not include

estimated tax payments on this line) ................................................................................................................... 2.

3. Line 1 minus the amount on line 2 (if less than zero, enter -0-) ......................................................................... 3.

Is line 3 less than or equal to $500?

Yes

No

If the answer is yes, STOP; you have no interest penalty. If the answer is no, continue to line 4.

4. Multiply line 1 by 90% (.90) .................................................................................................................................. 4.

Is line 2 greater than or equal to the amount on line 4?

Yes

No

If the answer is yes, STOP; you have no interest penalty. If the answer is no, continue to line 5.

5. 2006 Ohio form SD 100, line 6 ............................................................................................................................ 5.

Is line 2 greater than or equal to the amount on line 5?

Yes

No

If the answer is yes, STOP; you have no interest penalty. If the answer is no, continue to line 6.

6. Amount shown on line 1, above ...................................................................................... 6.

< $500 >

7. Statutory amount .............................................................................................................. 7.

8. Line 6 minus line 7 .............................................................................................................................................. 8.

9. Required annual payment. Enter the smallest of line 4, line 5 or line 8 ............................................................. 9.

Short method

You may use the short method only if you paid no estimated tax payments or if you paid estimated tax in equal amounts on the due dates

and you claim any overpayment credit carryover amount in equal amounts on the due dates. Note: You may use the short method even

if the payments were earlier than the due date; however, the interest penalty may be lower if you use the long method.

10. 2007 estimated payments. See Note 3 on page 4 .......................................................................................... 10.

11. Add line 2 and line 10 ....................................................................................................................................... 11.

12. Subtract line 11 from line 9 ............................................................................................................................... 12.

13. Multiply line 12 by .052925. Enter the result here and on Ohio form SD 100, line 7 ....................................... 13.

Payment Due Dates

Long method

14. Multiply the amount on line 9 by the percentage indicated at the top

A

B

C

D

of each column. However, if you choose to annualize your income,

6/15/07 – 50%

4/17/07 – 25%

9/17/07 – 75%

1/15/08 – 100%

check the box

and enter the amounts from page 3, Part II, line

14 ..................................................................................................... 14.

15. Cumulative tax withheld: Multiply this amount by the percentage

shown at the top of each column (see instructions on page 2) ..... 15.

16. Cumulative estimated tax paid by the dates shown at the top of

each column. See Note 3 on page 4 ................................................. 16.

17. Overpayment credit carryover from 2006 Ohio form SD 100, line 16.

Enter this amount in all four columns ............................................... 17.

18. Add lines 15, 16 and 17 ..................................................................... 18.

19. Underpayment subject to interest penalty (line 14 minus line 18).

If line 18 is greater than line 14, enter -0- .......................................... 19.

.012932

.020164

.026292

.019891

20. Ratio (if payment was made late, see instructions on page 2) ........ 20.

21. Interest penalty for the period: Multiply the ratio on line 20 by the re-

spective underpayment on line 19 (if full or partial payment was

made late, see instructions on page 2) .............................................. 21.

22. Total interest penalty due. Add line 21 columns A through D. Enter

here and on 2007 Ohio form SD 100, line 7 ................................................................................................. 22.

- 1 -

1

1 2

2