Form It-2210 - Interest Penalty On Underpayment Of Ohio Estimated Tax - 2000

ADVERTISEMENT

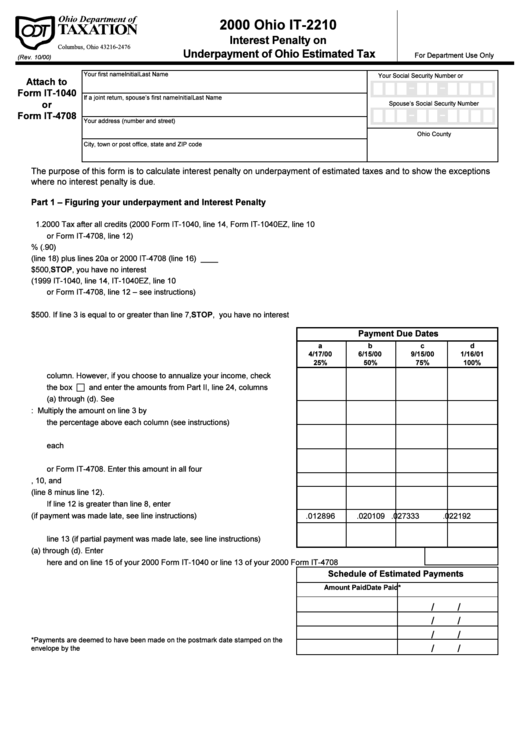

2000 Ohio IT-2210

Interest Penalty on

P.O. Box 2476

Columbus, Ohio 43216-2476

Underpayment of Ohio Estimated Tax

For Department Use Only

(Rev. 10/00)

Your first name

Initial

Last Name

Your Social Security Number or F.E.I.N.

Attach to

–

–

Form IT-1040

If a joint return, spouse’s first name

Initial

Last Name

or

Spouse’s Social Security Number

–

–

Form IT-4708

Your address (number and street)

Ohio County

City, town or post office, state and ZIP code

The purpose of this form is to calculate interest penalty on underpayment of estimated taxes and to show the exceptions

where no interest penalty is due.

Part 1 – Figuring your underpayment and Interest Penalty

STOP

STOP

Payment Due Dates

a

b

c

d

4/17/00

6/15/00

9/15/00

1/16/01

25%

50%

75%

100%

c

Schedule of Estimated Payments

Amount Paid

Date Paid*

/

/

/

/

/

/

*Payments are deemed to have been made on the postmark date stamped on the

/

/

envelope by the U.S. Postal Service.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1