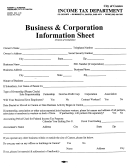

Business Tax Information Sheet - City Of Greeley Page 2

ADVERTISEMENT

Sales Tax Licensing

Sales Tax

All businesses operating in Greeley must apply to

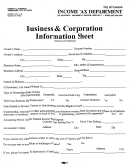

What is the total sales tax rate in Greeley?

the City for one of the following licenses:

The total sales tax rate in the City is currently 6.36%. This

rate is made up of the following components:

General Business/Sales & Use License

Greeley

3.46% *

Required for all in-City commercial establishments.

State of Colorado 2.90%

Total

6.36%

Home Occupation/Sales & Use License

Required for all in-City businesses which are

* Please note that Greeley is located in Weld County and

operated from a residence.

Weld County does not impose a county sales tax. Also,

Weld County is not included in the Regional Transportation

Sales & Use Tax License

District (RTD) and therefore Greeley sales are not subject to

Required for all out-of-City businesses which are

engaged in business in Greeley.

the RTD tax, the Scientific and Cultural Facilities District

(CD), or the Football Stadium District (FD) taxes.

Additional Requirements If The Business or

When do I charge the City sales tax?

Home Occupation Has a Physical Location in

Generally the City sales tax must be collected on all sales,

Greeley

leases or rentals of tangible personal property in the City

To ensure adherence to City Building Codes and

including items delivered into the City. Certain services such

zoning requirements, if the business or home

as cable TV, telephone, gas and electric are also taxable.

occupation has a physical location within the City

Professional services such as legal, advertising and

limits of Greeley, a Sales Tax License/Zoning

accounting services are generally not taxable.

Review/Occupancy Certificate check off list must be

completed and signed by the Community

Some sales are not taxable; they are exempt from the tax.

Development Department along with its Building

Common exemptions include: prescription items, medical

Inspection Division.

supplies for one time use, cigarettes, gasoline, and certain

Also, if the business is a sewer user the

sales to exempt organizations. These City exemptions may

Commercial Sewer User Classification

be different than exemptions allowed by the State of

Questionnaire must be completed.

Colorado.

Do I need a license?

Some items which are taxable in the City, but may be

Even businesses that do not “sell” anything must

taxed differently by other jurisdictions are:

still obtain a City license. The licensing procedure

Cable TV

provides the City with a current listing of all

Natural gas and electricity

businesses and that the area is properly zoned for

Pre-press supplies for printing industries

that particular business activity. Licenses are

Equipment used in manufacturing

perpetual and continue until canceled by the

Food for home consumption

taxpayer. There is no application fee. License

application forms are available from the City Finance

Office by calling (970)350-9733, (970)350-9722 or

All exempt sales must be properly documented and

(970)350-9723.

records must be kept by seller in case of audit. Contact the

Sales Tax Division for more information on how to handle

exempt sales.

Colorado and Other Cities

The City of Greeley is a home-rule city, which

means that Greeley administers and collects only

Greeley tax should not be collected if an item sold is

Greeley sales/use taxes. If you are doing business

delivered outside the City limits. You should contact the

in other cities (i.e. making deliveries into other

City where the item is delivered to determine if you need to

cities), do not report and remit those taxes to

collect that City’s tax. (Be careful not to rely on mailing

Greeley. You will need to contact those towns/cities

addresses or zip codes to decide which tax to collect!!

to determine their requirements. Also, a separate

Mailing addresses do not always correspond to the City

license is necessary to report and remit state

boundaries.)

(Colorado) sales/use tax. Please contact the

Colorado Department of Revenue for their

requirements. Fort Collins office (970)494-9805 or

Denver office (303)232-2416.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4