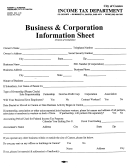

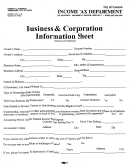

Business Information Sheet - City Of Munroe Falls

ADVERTISEMENT

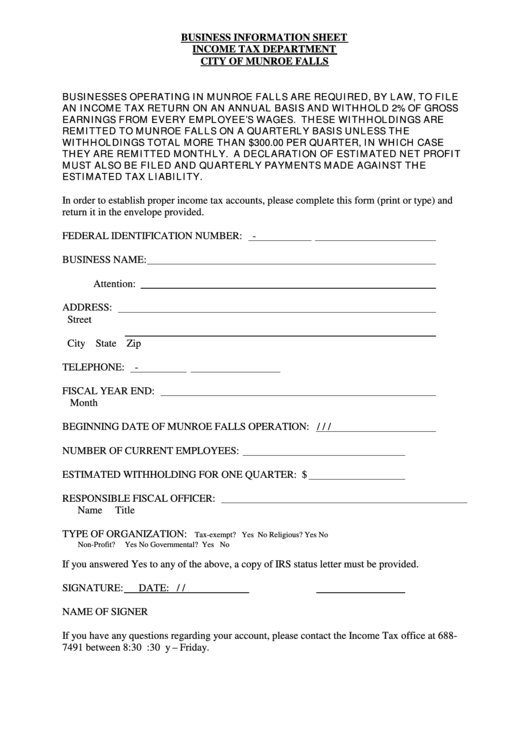

BUSINESS INFORMATION SHEET

INCOME TAX DEPARTMENT

CITY OF MUNROE FALLS

BUSINESSES OPERATING IN MUNROE FALLS ARE REQUIRED, BY LAW, TO FILE

AN INCOME TAX RETURN ON AN ANNUAL BASIS AND WITHHOLD 2% OF GROSS

EARNINGS FROM EVERY EMPLOYEE’S WAGES. THESE WITHHOLDINGS ARE

REMITTED TO MUNROE FALLS ON A QUARTERLY BASIS UNLESS THE

WITHHOLDINGS TOTAL MORE THAN $300.00 PER QUARTER, IN WHICH CASE

THEY ARE REMITTED MONTHLY. A DECLARATION OF ESTIMATED NET PROFIT

MUST ALSO BE FILED AND QUARTERLY PAYMENTS MADE AGAINST THE

ESTIMATED TAX LIABILITY.

In order to establish proper income tax accounts, please complete this form (print or type) and

return it in the envelope provided.

FEDERAL IDENTIFICATION NUMBER:

-

BUSINESS NAME:

Attention:

ADDRESS:

Street

City

State

Zip

TELEPHONE:

-

FISCAL YEAR END:

Month

BEGINNING DATE OF MUNROE FALLS OPERATION:

/

/

/

NUMBER OF CURRENT EMPLOYEES:

ESTIMATED WITHHOLDING FOR ONE QUARTER: $

RESPONSIBLE FISCAL OFFICER:

Name

Title

TYPE OF ORGANIZATION:

Tax-exempt? Yes No

Religious?

Yes

No

Non-Profit?

Yes No

Governmental? Yes

No

If you answered Yes to any of the above, a copy of IRS status letter must be provided.

SIGNATURE:

DATE:

/

/

NAME OF SIGNER

If you have any questions regarding your account, please contact the Income Tax office at 688-

7491 between 8:30 a.m. and 4:30 p.m. Monday – Friday.

ADVERTISEMENT

0 votes

Related Articles

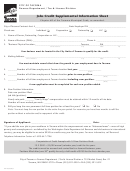

Related forms

Related Categories

Parent category: Financial

1

1