Form Dp-200 - Request For Department Identification Number (Din) - New Hampshire Department Of Revenue Administration

ADVERTISEMENT

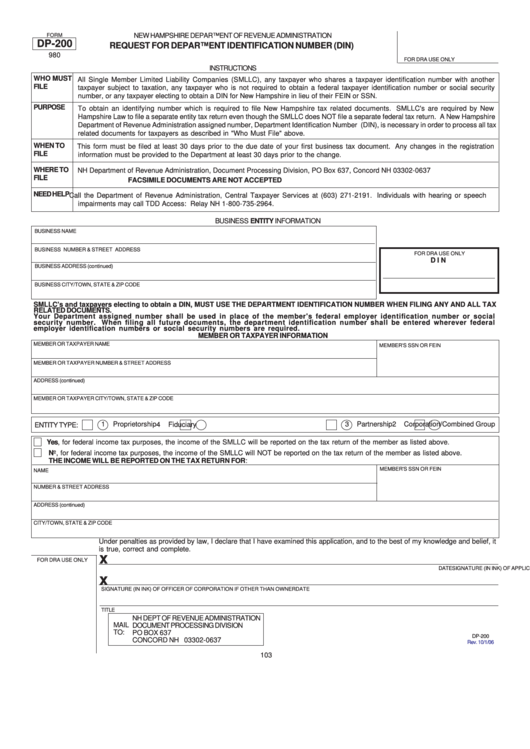

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-200

REQUEST FOR DEPARTMENT IDENTIFICATION NUMBER (DIN)

980

FOR DRA USE ONLY

INSTRUCTIONS

WHO MUST

All Single Member Limited Liability Companies (SMLLC), any taxpayer who shares a taxpayer identification number with another

FILE

taxpayer subject to taxation, any taxpayer who is not required to obtain a federal taxpayer identification number or social security

number, or any taxpayer electing to obtain a DIN for New Hampshire in lieu of their FEIN or SSN.

PURPOSE

To obtain an identifying number which is required to file New Hampshire tax related documents. SMLLC's are required by New

Hampshire Law to file a separate entity tax return even though the SMLLC does NOT file a separate federal tax return. A New Hampshire

Department of Revenue Administration assigned number, Department Identification Number (DIN), is necessary in order to process all tax

related documents for taxpayers as described in "Who Must File" above.

WHEN TO

This form must be filed at least 30 days prior to the due date of your first business tax document. Any changes in the registration

FILE

information must be provided to the Department at least 30 days prior to the change.

WHERE TO

NH Department of Revenue Administration, Document Processing Division, PO Box 637, Concord NH 03302-0637

FILE

FACSIMILE DOCUMENTS ARE NOT ACCEPTED

NEED HELP

Call the Department of Revenue Administration, Central Taxpayer Services at (603) 271-2191. Individuals with hearing or speech

impairments may call TDD Access: Relay NH 1-800-735-2964.

BUSINESS ENTITY INFORMATION

BUSINESS NAME

BUSINESS NUMBER & STREET ADDRESS

FOR DRA USE ONLY

D I N

BUSINESS ADDRESS (continued)

BUSINESS CITY/TOWN, STATE & ZIP CODE

SMLLC's and taxpayers electing to obtain a DIN, MUST USE THE DEPARTMENT IDENTIFICATION NUMBER WHEN FILING ANY AND ALL TAX

RELATED DOCUMENTS.

Your Department assigned number shall be used in place of the member's federal employer identification number or social

security number. When filing all future documents, the department identification number shall be entered wherever federal

employer identification numbers or social security numbers are required.

MEMBER OR TAXPAYER INFORMATION

MEMBER OR TAXPAYER NAME

MEMBER'S SSN OR FEIN

MEMBER OR TAXPAYER NUMBER & STREET ADDRESS

ADDRESS (continued)

MEMBER OR TAXPAYER CITY/TOWN, STATE & ZIP CODE

1

Proprietorship

2

Corporation/Combined Group

3

Partnership

4

Fiduciary

ENTITY TYPE:

Yes, for federal income tax purposes, the income of the SMLLC will be reported on the tax return of the member as listed above.

No, for federal income tax purposes, the income of the SMLLC will NOT be reported on the tax return of the member as listed above.

THE INCOME WILL BE REPORTED ON THE TAX RETURN FOR:

MEMBER'S SSN OR FEIN

NAME

NUMBER & STREET ADDRESS

ADDRESS (continued)

CITY/TOWN, STATE & ZIP CODE

Under penalties as provided by law, I declare that I have examined this application, and to the best of my knowledge and belief, it

is true, correct and complete.

x

FOR DRA USE ONLY

SIGNATURE (IN INK) OF APPLICANT

DATE

x

SIGNATURE (IN INK) OF OFFICER OF CORPORATION IF OTHER THAN OWNER

DATE

TITLE

NH DEPT OF REVENUE ADMINISTRATION

MAIL

DOCUMENT PROCESSING DIVISION

TO:

PO BOX 637

DP-200

CONCORD NH 03302-0637

Rev. 10/1/06

103

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1