Partner'S Instructions For 2000 Schedule 3k-1 - Wisconsin Department Of Revenue

ADVERTISEMENT

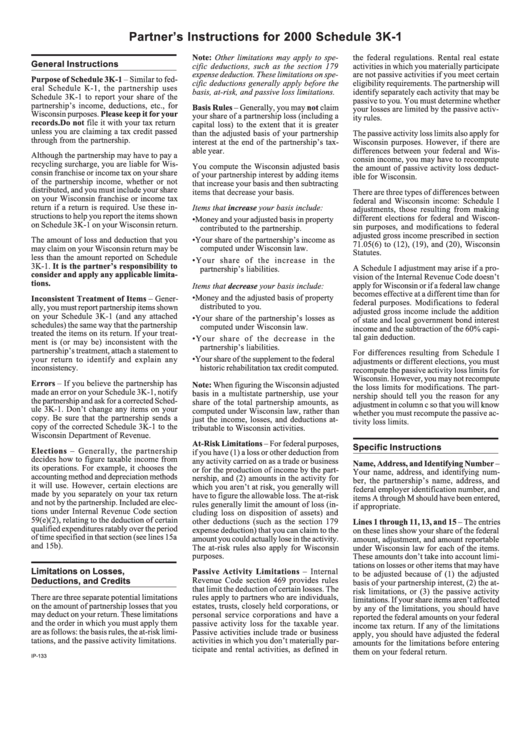

Partner’s Instructions for 2000 Schedule 3K-1

Note: Other limitations may apply to spe-

the federal regulations. Rental real estate

General Instructions

cific deductions, such as the section 179

activities in which you materially participate

expense deduction. These limitations on spe-

are not passive activities if you meet certain

Purpose of Schedule 3K-1 – Similar to fed-

cific deductions generally apply before the

eligibility requirements. The partnership will

eral Schedule K-1, the partnership uses

basis, at-risk, and passive loss limitations.

identify separately each activity that may be

Schedule 3K-1 to report your share of the

passive to you. You must determine whether

partnership’s income, deductions, etc., for

Basis Rules – Generally, you may not claim

your losses are limited by the passive activ-

Wisconsin purposes. Please keep it for your

your share of a partnership loss (including a

ity rules.

records. Do not file it with your tax return

capital loss) to the extent that it is greater

unless you are claiming a tax credit passed

than the adjusted basis of your partnership

The passive activity loss limits also apply for

through from the partnership.

interest at the end of the partnership’s tax-

Wisconsin purposes. However, if there are

able year.

differences between your federal and Wis-

Although the partnership may have to pay a

consin income, you may have to recompute

recycling surcharge, you are liable for Wis-

You compute the Wisconsin adjusted basis

the amount of passive activity loss deduct-

consin franchise or income tax on your share

of your partnership interest by adding items

ible for Wisconsin.

of the partnership income, whether or not

that increase your basis and then subtracting

distributed, and you must include your share

items that decrease your basis.

There are three types of differences between

on your Wisconsin franchise or income tax

federal and Wisconsin income: Schedule I

return if a return is required. Use these in-

Items that increase your basis include:

adjustments, those resulting from making

structions to help you report the items shown

different elections for federal and Wiscon-

• Money and your adjusted basis in property

on Schedule 3K-1 on your Wisconsin return.

sin purposes, and modifications to federal

contributed to the partnership.

adjusted gross income prescribed in section

The amount of loss and deduction that you

• Your share of the partnership’s income as

71.05(6) to (12), (19), and (20), Wisconsin

computed under Wisconsin law.

may claim on your Wisconsin return may be

Statutes.

less than the amount reported on Schedule

• Your share of the increase in the

3K-1. It is the partner’s responsibility to

A Schedule I adjustment may arise if a pro-

partnership’s liabilities.

consider and apply any applicable limita-

vision of the Internal Revenue Code doesn’t

tions.

apply for Wisconsin or if a federal law change

Items that decrease your basis include:

becomes effective at a different time than for

• Money and the adjusted basis of property

Inconsistent Treatment of Items – Gener-

federal purposes. Modifications to federal

distributed to you.

ally, you must report partnership items shown

adjusted gross income include the addition

on your Schedule 3K-1 (and any attached

• Your share of the partnership’s losses as

of state and local government bond interest

schedules) the same way that the partnership

computed under Wisconsin law.

income and the subtraction of the 60% capi-

treated the items on its return. If your treat-

tal gain deduction.

• Your share of the decrease in the

ment is (or may be) inconsistent with the

partnership’s liabilities.

partnership’s treatment, attach a statement to

For differences resulting from Schedule I

your return to identify and explain any

• Your share of the supplement to the federal

adjustments or different elections, you must

inconsistency.

historic rehabilitation tax credit computed.

recompute the passive activity loss limits for

Wisconsin. However, you may not recompute

Errors – If you believe the partnership has

Note: When figuring the Wisconsin adjusted

the loss limits for modifications. The part-

made an error on your Schedule 3K-1, notify

basis in a multistate partnership, use your

nership should tell you the reason for any

the partnership and ask for a corrected Sched-

share of the total partnership amounts, as

adjustment in column c so that you will know

ule 3K-1. Don’t change any items on your

computed under Wisconsin law, rather than

whether you must recompute the passive ac-

copy. Be sure that the partnership sends a

just the income, losses, and deductions at-

tivity loss limits.

copy of the corrected Schedule 3K-1 to the

tributable to Wisconsin activities.

Wisconsin Department of Revenue.

At-Risk Limitations – For federal purposes,

Specific Instructions

Elections – Generally, the partnership

if you have (1) a loss or other deduction from

decides how to figure taxable income from

any activity carried on as a trade or business

Name, Address, and Identifying Number –

its operations. For example, it chooses the

or for the production of income by the part-

Your name, address, and identifying num-

accounting method and depreciation methods

nership, and (2) amounts in the activity for

ber, the partnership’s name, address, and

it will use. However, certain elections are

which you aren’t at risk, you generally will

federal employer identification number, and

made by you separately on your tax return

have to figure the allowable loss. The at-risk

items A through M should have been entered,

and not by the partnership. Included are elec-

rules generally limit the amount of loss (in-

if appropriate.

tions under Internal Revenue Code section

cluding loss on disposition of assets) and

59(e)(2), relating to the deduction of certain

other deductions (such as the section 179

Lines 1 through 11, 13, and 15 – The entries

qualified expenditures ratably over the period

expense deduction) that you can claim to the

on these lines show your share of the federal

of time specified in that section (see lines 15a

amount you could actually lose in the activity.

amount, adjustment, and amount reportable

and 15b).

The at-risk rules also apply for Wisconsin

under Wisconsin law for each of the items.

purposes.

These amounts don’t take into account limi-

tations on losses or other items that may have

Limitations on Losses,

Passive Activity Limitations – Internal

to be adjusted because of (1) the adjusted

Revenue Code section 469 provides rules

Deductions, and Credits

basis of your partnership interest, (2) the at-

that limit the deduction of certain losses. The

risk limitations, or (3) the passive activity

There are three separate potential limitations

rules apply to partners who are individuals,

limitations. If your share items aren’t affected

on the amount of partnership losses that you

estates, trusts, closely held corporations, or

by any of the limitations, you should have

may deduct on your return. These limitations

personal service corporations and have a

reported the federal amounts on your federal

and the order in which you must apply them

passive activity loss for the taxable year.

income tax return. If any of the limitations

are as follows: the basis rules, the at-risk limi-

Passive activities include trade or business

apply, you should have adjusted the federal

tations, and the passive activity limitations.

activities in which you don’t materially par-

amounts for the limitations before entering

ticipate and rental activities, as defined in

them on your federal return.

IP-133

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2