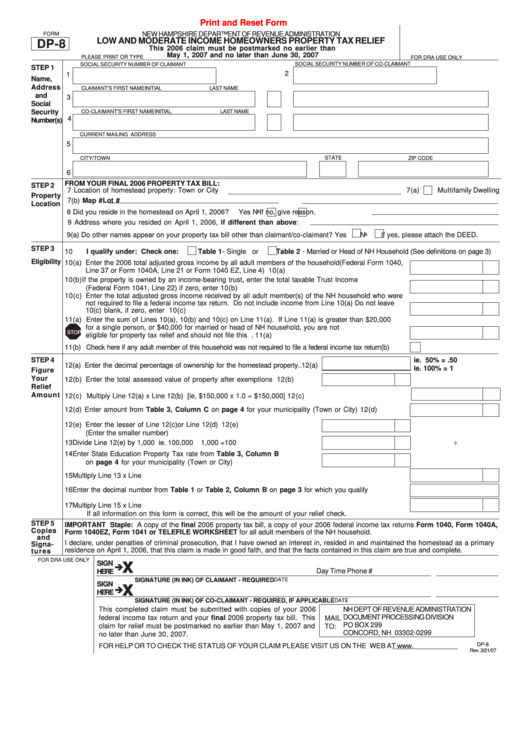

Print and Reset Form

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

LOW AND MODERATE INCOME HOMEOWNERS PROPERTY TAX RELIEF

DP-8

This 2006 claim must be postmarked no earlier than

May 1, 2007 and no later than June 30, 2007

PLEASE PRINT OR TYPE

FOR DRA USE ONLY

SOCIAL SECURITY NUMBER OF CLAIMANT

SOCIAL SECURITY NUMBER OF CO-CLAIMANT

STEP 1

2

1

Name,

Address

CLAIMANT'S FIRST NAME

INITIAL

LAST NAME

and

3

Social

Security

CO-CLAIMANT'S FIRST NAME

INITIAL

LAST NAME

4

Number(s)

CURRENT MAILING ADDRESS

5

STATE

CITY/TOWN

ZIP CODE

6

FROM YOUR FINAL 2006 PROPERTY TAX BILL:

STEP 2

7

Location of homestead property: Town or City

7(a)

Multifamily Dwelling

Property

7(b) Map #

Lot #

Location

8

Did you reside in the homestead on April 1, 2006?

Yes

No

If no, give reason.

9

Address where you resided on April 1, 2006, if different than above:

9(a) Do other names appear on your property tax bill other than claimant/co-claimant? Yes

No

If yes, please attach the DEED.

STEP 3

10

I qualify under: Check one:

Table 1- Single or

Table 2 - Married or Head of NH Household (See definitions on page 3)

Eligibility

10(a) Enter the 2006 total adjusted gross income by all adult members of the household(Federal Form 1040,

Line 37 or Form 1040A, Line 21 or Form 1040 EZ, Line 4) .................................................................. 10(a)

10(b) If the property is owned by an income-bearing trust, enter the total taxable Trust Income

(Federal Form 1041, Line 22) if zero, enter 0 ....................................................................................... 10(b)

10(c) Enter the total adjusted gross income received by all adult member(s) of the NH household who were

not required to file a federal income tax return. Do not include income from Line 10(a) Do not leave

10(c) blank, if zero, enter 0 .................................................................................................................. 10(c)

11(a) Enter the sum of Lines 10(a), 10(b) and 10(c) on Line 11(a). If Line 11(a) is greater than $20,000

for a single person, or $40,000 for married or head of NH household, you are not

STOP

eligible for property tax relief and should not file this claim ................................................................. 11(a)

11(b) Check here if any adult member of this household was not required to file a federal income tax return ..... 11(b)

STEP 4

ie. 50% = .50

12(a) Enter the decimal percentage of ownership for the homestead property .. 12(a)

ie. 100% = 1

Figure

Your

12(b) Enter the total assessed value of property after exemptions ............... 12(b)

Relief

Amount

12(c) Multiply Line 12(a) x Line 12(b) ....... [ie, $150,000 x 1.0 = $150,000] ................................................ 12(c)

12(d) Enter amount from Table 3, Column C on page 4 for your municipality (Town or City) .................. 12(d)

12(e) Enter the lesser of Line 12(c)or Line 12(d) ............................................ 12(e)

(Enter the smaller number)

13

Divide Line 12(e) by 1,000 ...................................................................... 13

ie. 100,000

1,000 =100

÷

14

Enter State Education Property Tax rate from Table 3, Column B

on page 4 for your municipality (Town or City) ..................................... 14

15

Multiply Line 13 x Line 14 ...................................................................................................................... 15

16

Enter the decimal number from Table 1 or Table 2, Column B on page 3 for which you qualify ..... 16

17

Multiply Line 15 x Line 16 ...................................................................................................................... 17

If all information on this form is correct, this will be the amount of your relief check.

STEP 5

IMPORTANT Staple: A copy of the final 2006 property tax bill, a copy of your 2006 federal income tax returns Form 1040, Form 1040A,

Copies

Form 1040EZ, Form 1041 or TELEFILE WORKSHEET for all adult members of the NH household.

and

I declare, under penalties of criminal prosecution, that I have owned an interest in, resided in and maintained the homestead as a primary

Signa-

residence on April 1, 2006, that this claim is made in good faith, and that the facts contained in this claim are true and complete.

tures

FOR DRA USE ONLY

x

SIGN

Day Time Phone #

HERE

SIGNATURE (IN INK) OF CLAIMANT - REQUIRED

DATE

x

SIGN

HERE

SIGNATURE (IN INK) OF CO-CLAIMANT - REQUIRED, IF APPLICABLE

DATE

This completed claim must be submitted with copies of your 2006

NH DEPT OF REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

federal income tax return and your final 2006 property tax bill. This

MAIL

PO BOX 299

claim for relief must be postmarked no earlier than May 1, 2007 and

TO:

CONCORD, NH 03302-0299

no later than June 30, 2007.

DP-8

FOR HELP OR TO CHECK THE STATUS OF YOUR CLAIM PLEASE VISIT US ON THE WEB AT

Rev. 3/21/07

1

1