F

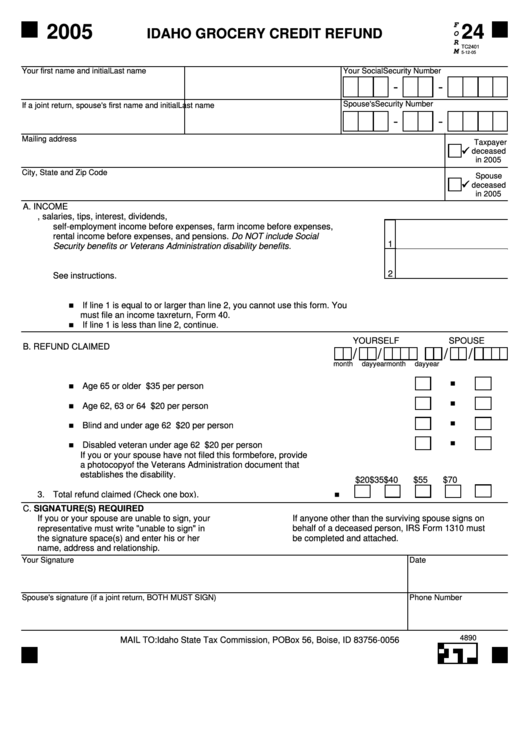

2005

24

IDAHO GROCERY CREDIT REFUND

O

R

TC2401

M

5-12-05

Your first name and initial

Last name

Your Social Security Number

-

-

Spouse's Security Number

If a joint return, spouse's first name and initial Last name

-

-

Mailing address

Taxpayer

deceased

in 2005

City, State and Zip Code

Spouse

deceased

in 2005

A. INCOME

1. Enter your gross income. Include wages, salaries, tips, interest, dividends,

self-employment income before expenses, farm income before expenses,

rental income before expenses, and pensions. Do NOT include Social

1

Security benefits or Veterans Administration disability benefits. .....................................

2. Enter the amount for your filing status from the filing status chart.

2

See instructions. ...............................................................................................................

3. Compare lines 1 and 2.

If line 1 is equal to or larger than line 2, you cannot use this form. You

must file an income tax return, Form 40.

If line 1 is less than line 2, continue.

YOURSELF

SPOUSE

B. REFUND CLAIMED

/

/

/

/

1. Enter the date of birth. ................................................................................

month

day

year

month

day

year

2. Check the boxes that apply.

Age 65 or older ............................................................................... $35 per person

Age 62, 63 or 64 ............................................................................. $20 per person

Blind and under age 62 .................................................................. $20 per person

Disabled veteran under age 62 ...................................................... $20 per person

If you or your spouse have not filed this form before, provide

a photocopy of the Veterans Administration document that

establishes the disability.

$20

$35

$40

$55

$70

3. Total refund claimed (Check one box). ......................................................

C. SIGNATURE(S) REQUIRED

If anyone other than the surviving spouse signs on

If you or your spouse are unable to sign, your

representative must write "unable to sign" in

behalf of a deceased person, IRS Form 1310 must

the signature space(s) and enter his or her

be completed and attached.

name, address and relationship.

Your Signature

Date

Spouse's signature (if a joint return, BOTH MUST SIGN)

Phone Number

4890

MAIL TO: Idaho State Tax Commission, PO Box 56, Boise, ID 83756-0056

1

1