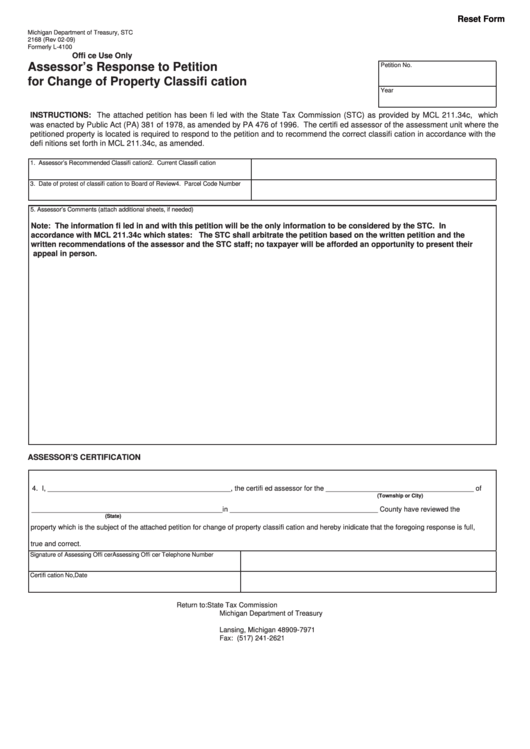

Reset Form

Michigan Department of Treasury, STC

2168 (Rev 02-09)

Formerly L-4100

Offi ce Use Only

Assessor’s Response to Petition

Petition No.

for Change of Property Classifi cation

Year

INSTRUCTIONS: The attached petition has been fi led with the State Tax Commission (STC) as provided by MCL 211.34c, which

was enacted by Public Act (PA) 381 of 1978, as amended by PA 476 of 1996. The certifi ed assessor of the assessment unit where the

petitioned property is located is required to respond to the petition and to recommend the correct classifi cation in accordance with the

defi nitions set forth in MCL 211.34c, as amended.

1. Assessor’s Recommended Classifi cation

2. Current Classifi cation

3. Date of protest of classifi cation to Board of Review

4. Parcel Code Number

5. Assessor’s Comments (attach additional sheets, if needed)

Note: The information fi led in and with this petition will be the only information to be considered by the STC. In

accordance with MCL 211.34c which states: The STC shall arbitrate the petition based on the written petition and the

written recommendations of the assessor and the STC staff; no taxpayer will be afforded an opportunity to present their

appeal in person.

ASSESSOR’S CERTIFICATION

4. I, _______________________________________________, the certifi ed assessor for the ______________________________________ of

(Township or City)

_________________________________________________in ______________________________________ County have reviewed the

(State)

property which is the subject of the attached petition for change of property classifi cation and hereby inidicate that the foregoing response is full,

true and correct.

Signature of Assessing Offi cer

Assessing Offi cer Telephone Number

Certifi cation No,

Date

Return to:

State Tax Commission

Michigan Department of Treasury

P.O. Box 30471

Lansing, Michigan 48909-7971

Fax: (517) 241-2621

1

1