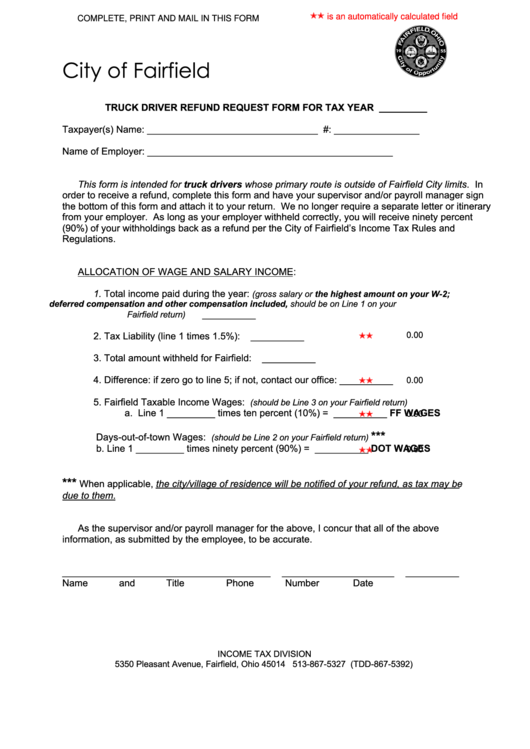

is an automatically calculated field

COMPLETE, PRINT AND MAIL IN THIS FORM

City of Fairfield

TRUCK DRIVER REFUND REQUEST FORM FOR TAX YEAR _________

Taxpayer(s) Name: ________________________________

S.S. #: ________________

Name of Employer: ______________________________________________

This form is intended for truck drivers whose primary route is outside of Fairfield City limits. In

order to receive a refund, complete this form and have your supervisor and/or payroll manager sign

the bottom of this form and attach it to your return. We no longer require a separate letter or itinerary

from your employer. As long as your employer withheld correctly, you will receive ninety percent

(90%) of your withholdings back as a refund per the City of Fairfield’s Income Tax Rules and

Regulations.

ALLOCATION OF WAGE AND SALARY INCOME:

1.

Total income paid during the year:

(gross salary or the highest amount on your W-2;

deferred compensation and other compensation included, should be on Line 1 on your

__________

Fairfield return)

2.

Tax Liability (line 1 times 1.5%):

__________

0.00

3.

Total amount withheld for Fairfield:

__________

4.

Difference: if zero go to line 5; if not, contact our office:

__________

0.00

5.

Fairfield Taxable Income Wages:

(should be Line 3 on your Fairfield return)

a.

Line 1 _________ times ten percent (10%) =

__________ FF WAGES

0.00

***

Days-out-of-town Wages:

(should be Line 2 on your Fairfield return)

b.

Line 1 _________ times ninety percent (90%) =

__________ DOT WAGES

0.00

***

When applicable, the city/village of residence will be notified of your refund, as tax may be

due to them.

As the supervisor and/or payroll manager for the above, I concur that all of the above

information, as submitted by the employee, to be accurate.

_______________________________________

_____________________

__________

Name and Title

Phone Number

Date

INCOME TAX DIVISION

5350 Pleasant Avenue, Fairfield, Ohio 45014 513-867-5327 (TDD-867-5392)

1

1