Instructions For Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return - 2011

ADVERTISEMENT

Instructions for Form 706

Department of the Treasury

Internal Revenue Service

(Rev. July 2011)

For decedents dying after December 31, 2009, and before January 1, 2011

United States Estate (and Generation-Skipping Transfer) Tax Return

Contents

Page

Creation Act of 2010 (Act) included

Section references are to the Internal

Revenue Code unless otherwise noted.

several provisions affecting the 2010

Schedule C — Mortgages,

Form 706. They are:

Notes, and Cash . . . . . . . . . . . . . 18

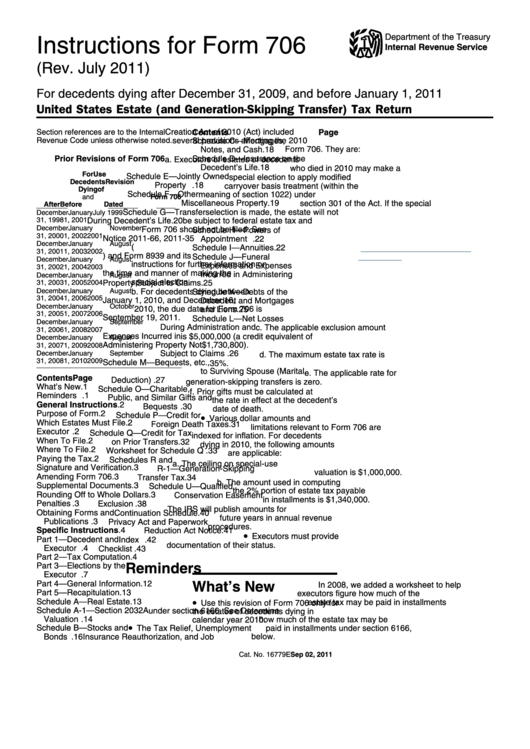

Prior Revisions of Form 706

Schedule D — Insurance on the

a. Executors of estates of decedents

Decedent’s Life . . . . . . . . . . . . . . 18

who died in 2010 may make a

For

Use

Schedule E — Jointly Owned

special election to apply modified

Decedents

Revision

Property . . . . . . . . . . . . . . . . . . . 18

carryover basis treatment (within the

Dying

of

Schedule F — Other

meaning of section 1022) under

Form 706

and

Miscellaneous Property . . . . . . . . 19

section 301 of the Act. If the special

After

Before

Dated

Schedule G — Transfers

election is made, the estate will not

December

January

July 1999

31, 1998

1, 2001

During Decedent’s Life . . . . . . . . . 20

be subject to federal estate tax and

December

January

November

Form 706 should not be filed. See

Schedule H — Powers of

31, 2000

1, 2002

2001

Notice 2011-66, 2011-35 I.R.B. 184

Appointment . . . . . . . . . . . . . . . . 22

December

January

August

(

Schedule I — Annuities . . . . . . . . . . . 22

31, 2001

1, 2003

2002

irb11-35.pdf) and Form 8939 and its

Schedule J — Funeral

December

January

August

instructions for further information on

Expenses and Expenses

31, 2002

1, 2004

2003

the time and manner of making the

Incurred in Administering

December

January

August

special election.

Property Subject to Claims . . . . . . 25

31, 2003

1, 2005

2004

December

January

August

b. For decedents dying between

Schedule K — Debts of the

31, 2004

1, 2006

2005

January 1, 2010, and December 16,

Decedent and Mortgages

December

January

October

2010, the due date for Form 706 is

and Liens . . . . . . . . . . . . . . . . . . . 25

31, 2005

1, 2007

2006

September 19, 2011.

Schedule L — Net Losses

December

January

September

During Administration and

c. The applicable exclusion amount

31, 2006

1, 2008

2007

Expenses Incurred in

is $5,000,000 (a credit equivalent of

December

January

August

Administering Property Not

$1,730,800).

31, 2007

1, 2009

2008

Subject to Claims . . . . . . . . . . . . . 26

December

January

September

d. The maximum estate tax rate is

31, 2008

1, 2010

2009

Schedule M — Bequests, etc.,

35%.

to Surviving Spouse (Marital

e. The applicable rate for

Contents

Page

Deduction) . . . . . . . . . . . . . . . . . . 27

generation-skipping transfers is zero.

What’s New . . . . . . . . . . . . . . . . . . . .1

Schedule O — Charitable,

f. Prior gifts must be calculated at

Reminders . . . . . . . . . . . . . . . . . . . .1

Public, and Similar Gifts and

the rate in effect at the decedent’s

General Instructions . . . . . . . . . . . .2

Bequests . . . . . . . . . . . . . . . . . . . 30

date of death.

Purpose of Form . . . . . . . . . . . . . . . .2

Schedule P — Credit for

•

Various dollar amounts and

Which Estates Must File . . . . . . . . . .2

Foreign Death Taxes . . . . . . . . . . 31

limitations relevant to Form 706 are

Executor . . . . . . . . . . . . . . . . . . . . . .2

Schedule Q — Credit for Tax

indexed for inflation. For decedents

When To File . . . . . . . . . . . . . . . . . .2

on Prior Transfers . . . . . . . . . . . . 32

dying in 2010, the following amounts

Where To File . . . . . . . . . . . . . . . . . .2

Worksheet for Schedule Q . . . . . . . . 33

are applicable:

Paying the Tax . . . . . . . . . . . . . . . . .2

Schedules R and

a. The ceiling on special-use

Signature and Verification . . . . . . . . .3

R-1 — Generation-Skipping

valuation is $1,000,000.

Amending Form 706 . . . . . . . . . . . . .3

Transfer Tax . . . . . . . . . . . . . . . . 34

b. The amount used in computing

Supplemental Documents . . . . . . . . .3

Schedule U — Qualified

the 2% portion of estate tax payable

Rounding Off to Whole Dollars . . . . .3

Conservation Easement

in installments is $1,340,000.

Penalties . . . . . . . . . . . . . . . . . . . . . .3

Exclusion . . . . . . . . . . . . . . . . . . . 38

The IRS will publish amounts for

Obtaining Forms and

Continuation Schedule . . . . . . . . . . . 40

future years in annual revenue

Publications . . . . . . . . . . . . . . . . . .3

Privacy Act and Paperwork

procedures.

Specific Instructions . . . . . . . . . . . .4

Reduction Act Notice . . . . . . . . . . 41

•

Executors must provide

Part 1 — Decedent and

Index . . . . . . . . . . . . . . . . . . . . . . . 42

documentation of their status.

Executor . . . . . . . . . . . . . . . . . . . .4

Checklist . . . . . . . . . . . . . . . . . . . . . 43

Part 2 — Tax Computation . . . . . . . . .4

Reminders

Part 3 — Elections by the

Executor . . . . . . . . . . . . . . . . . . . .7

What’s New

Part 4 — General Information . . . . . . 12

In 2008, we added a worksheet to help

Part 5 — Recapitulation . . . . . . . . . . 13

executors figure how much of the

•

Schedule A — Real Estate . . . . . . . . 13

estate tax may be paid in installments

Use this revision of Form 706 only for

Schedule A-1 — Section 2032A

under section 6166. See Determine

the estates of decedents dying in

Valuation . . . . . . . . . . . . . . . . . . . 14

how much of the estate tax may be

calendar year 2010.

•

Schedule B — Stocks and

paid in installments under section 6166,

The Tax Relief, Unemployment

Bonds . . . . . . . . . . . . . . . . . . . . . 16

Insurance Reauthorization, and Job

below.

Sep 02, 2011

Cat. No. 16779E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43