Instructions For Form 706 - United States Estate (And Generation-Skipping Transfer) Tax Return - 2005

ADVERTISEMENT

Department of the Treasury

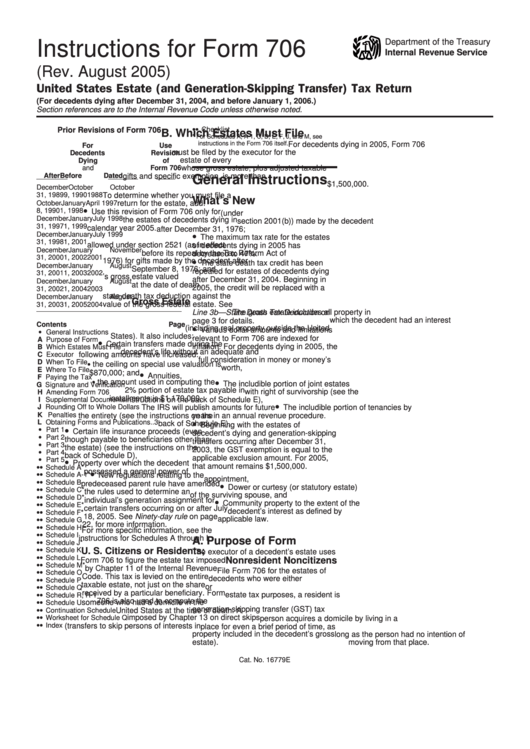

Instructions for Form 706

Internal Revenue Service

(Rev. August 2005)

United States Estate (and Generation-Skipping Transfer) Tax Return

(For decedents dying after December 31, 2004, and before January 1, 2006.)

Section references are to the Internal Revenue Code unless otherwise noted.

•• Checklist . . . . . . . . . . . . . . . . . . .

Prior Revisions of Form 706

30

B. Which Estates Must File

* For Schedules A, A-1, C, D, E, F, J, and M, see

instructions in the Form 706 itself.

For decedents dying in 2005, Form 706

For

Use

must be filed by the executor for the

Decedents

Revision

estate of every U.S. citizen or resident

Dying

of

and

Form 706

whose gross estate, plus adjusted taxable

After

Before

Dated

gifts and specific exemption, is more than

General Instructions

$1,500,000.

December

October

October

31, 1989

9, 1990

1988

To determine whether you must file a

What’s New

October

January

April 1997

return for the estate, add:

•

8, 1990

1, 1998

Use this revision of Form 706 only for

1. The adjusted taxable gifts (under

December

January

July 1998

the estates of decedents dying in

section 2001(b)) made by the decedent

31, 1997

1, 1999

calendar year 2005.

after December 31, 1976;

•

December

January

July 1999

2. The total specific exemption

The maximum tax rate for the estates

31, 1998

1, 2001

allowed under section 2521 (as in effect

of decedents dying in 2005 has

December

January

November

before its repeal by the Tax Reform Act of

decreased to 47%.

31, 2000

1, 2002

2001

•

1976) for gifts made by the decedent after

The state death tax credit has been

December

January

August

September 8, 1976; and

repealed for estates of decedents dying

31, 2001

1, 2003

2002

3. The decedent’s gross estate valued

after December 31, 2004. Beginning in

December

January

August

at the date of death.

2005, the credit will be replaced with a

31, 2002

1, 2004

2003

state death tax deduction against the

December

January

August

Gross Estate

value of the gross federal estate. See

31, 2003

1, 2005

2004

Line 3b — State Death Tax Deduction on

The gross estate includes all property in

which the decedent had an interest

page 3 for details.

Contents

Page

•

(including real property outside the United

Various dollar amounts and limitations

• General Instructions . . . . . . . . . . . .

1

States). It also includes:

relevant to Form 706 are indexed for

A Purpose of Form . . . . . . . . . . . . . .

1

•

Certain transfers made during the

inflation. For decedents dying in 2005, the

B Which Estates Must File . . . . . . . . .

1

decedent’s life without an adequate and

following amounts have increased:

C Executor . . . . . . . . . . . . . . . . . . .

2

full consideration in money or money’s

D When To File . . . . . . . . . . . . . . . .

2

•

the ceiling on special use valuation is

worth,

E Where To File . . . . . . . . . . . . . . . .

2

•

$870,000; and

Annuities,

F Paying the Tax . . . . . . . . . . . . . . .

2

•

•

the amount used in computing the

The includible portion of joint estates

G Signature and Verification . . . . . . . .

2

2% portion of estate tax payable in

with right of survivorship (see the

H Amending Form 706 . . . . . . . . . . .

2

installments is $1,170,000.

instructions on the back of Schedule E),

I Supplemental Documents . . . . . . . .

2

•

J Rounding Off to Whole Dollars . . . . .

2

The IRS will publish amounts for future

The includible portion of tenancies by

K Penalties . . . . . . . . . . . . . . . . . . .

2

the entirety (see the instructions on the

years in an annual revenue procedure.

•

L Obtaining Forms and Publications . .

3

back of Schedule E),

Beginning with the estates of

•

• Part 1 . . . . . . . . . . . . . . . . . . . . .

3

Certain life insurance proceeds (even

decedent’s dying and generation-skipping

• Part 2 . . . . . . . . . . . . . . . . . . . . .

3

though payable to beneficiaries other than

transfers occurring after December 31,

• Part 3 . . . . . . . . . . . . . . . . . . . . .

6

the estate) (see the instructions on the

2003, the GST exemption is equal to the

• Part 4 . . . . . . . . . . . . . . . . . . . . .

10

back of Schedule D),

applicable exclusion amount. For 2005,

• Part 5 . . . . . . . . . . . . . . . . . . . . .

•

11

Property over which the decedent

•• Schedule A* . . . . . . . . . . . . . . . . .

that amount remains $1,500,000.

11

•

possessed a general power of

•• Schedule A-1* . . . . . . . . . . . . . . . .

11

New regulations relating to the

appointment,

•• Schedule B . . . . . . . . . . . . . . . . . .

11

predeceased parent rule have amended

•

Dower or curtesy (or statutory estate)

•• Schedule C* . . . . . . . . . . . . . . . . .

13

the rules used to determine an

of the surviving spouse, and

•• Schedule D* . . . . . . . . . . . . . . . . .

13

•

individual’s generation assignment for

•• Schedule E* . . . . . . . . . . . . . . . . .

Community property to the extent of the

13

certain transfers occurring on or after July

•• Schedule F* . . . . . . . . . . . . . . . . .

decedent’s interest as defined by

13

18, 2005. See Ninety-day rule on page

•• Schedule G . . . . . . . . . . . . . . . . .

applicable law.

13

22, for more information.

•• Schedule H . . . . . . . . . . . . . . . . .

14

For more specific information, see the

•• Schedule I . . . . . . . . . . . . . . . . . .

15

instructions for Schedules A through I.

A. Purpose of Form

•• Schedule J* . . . . . . . . . . . . . . . . .

17

•• Schedule K . . . . . . . . . . . . . . . . . .

17

U. S. Citizens or Residents;

The executor of a decedent’s estate uses

•• Schedule L . . . . . . . . . . . . . . . . . .

18

Nonresident Noncitizens

Form 706 to figure the estate tax imposed

•• Schedule M* . . . . . . . . . . . . . . . . .

18

by Chapter 11 of the Internal Revenue

File Form 706 for the estates of

•• Schedule O . . . . . . . . . . . . . . . . .

18

Code. This tax is levied on the entire

•• Schedule P . . . . . . . . . . . . . . . . . .

decedents who were either U.S. citizens

19

taxable estate, not just on the share

•• Schedule Q . . . . . . . . . . . . . . . . .

or U.S. residents at the time of death. For

20

received by a particular beneficiary. Form

•• Schedule R, R-1 . . . . . . . . . . . . . .

estate tax purposes, a resident is

21

•• Schedule U . . . . . . . . . . . . . . . . .

706 is also used to compute the

someone who had a domicile in the

24

•• Continuation Schedule . . . . . . . . . .

generation-skipping transfer (GST) tax

26

United States at the time of death. A

•• Worksheet for Schedule Q . . . . . . .

imposed by Chapter 13 on direct skips

28

person acquires a domicile by living in a

•• Index . . . . . . . . . . . . . . . . . . . . . .

29

(transfers to skip persons of interests in

place for even a brief period of time, as

property included in the decedent’s gross

long as the person had no intention of

estate).

moving from that place.

Cat. No. 16779E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30