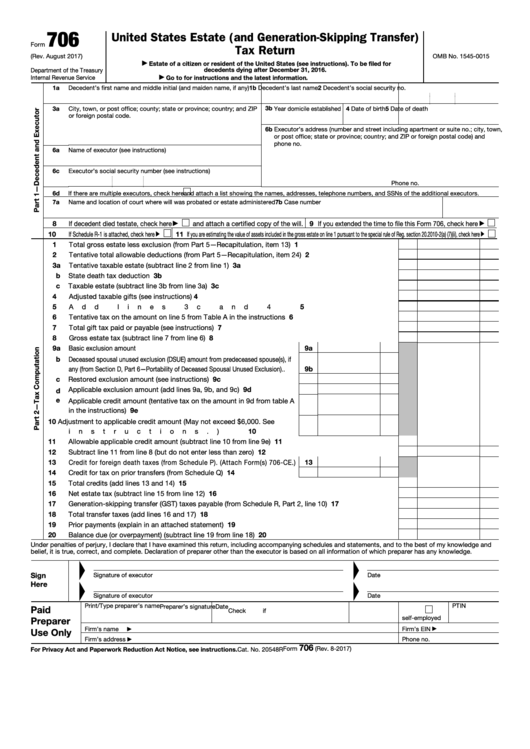

706

United States Estate (and Generation-Skipping Transfer)

Form

Tax Return

(Rev. August 2017)

OMB No. 1545-0015

Estate of a citizen or resident of the United States (see instructions). To be filed for

▶

Department of the Treasury

decedents dying after December 31, 2016.

Internal Revenue Service

Go to for instructions and the latest information.

▶

1a

Decedent’s first name and middle initial (and maiden name, if any)

1b Decedent’s last name

2 Decedent’s social security no.

3a

3b Year domicile established 4 Date of birth

5 Date of death

City, town, or post office; county; state or province; country; and ZIP

or foreign postal code.

6b Executor’s address (number and street including apartment or suite no.; city, town,

or post office; state or province; country; and ZIP or foreign postal code) and

phone no.

6a

Name of executor (see instructions)

6c

Executor’s social security number (see instructions)

Phone no.

6d

If there are multiple executors, check here

and attach a list showing the names, addresses, telephone numbers, and SSNs of the additional executors.

7a

Name and location of court where will was probated or estate administered

7b Case number

8

9 If you extended the time to file this Form 706, check here

If decedent died testate, check here

and attach a certified copy of the will.

▶

▶

10

If Schedule R-1 is attached, check here

11 If you are estimating the value of assets included in the gross estate on line 1 pursuant to the special rule of Reg. section 20.2010-2(a) (7)(ii), check here

▶

▶

1

Total gross estate less exclusion (from Part 5—Recapitulation, item 13) .

.

.

.

.

.

.

.

.

.

1

2

Tentative total allowable deductions (from Part 5—Recapitulation, item 24) .

.

.

.

.

.

.

.

.

2

3a

3a

Tentative taxable estate (subtract line 2 from line 1) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

b

State death tax deduction .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3b

c

Taxable estate (subtract line 3b from line 3a) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3c

4

4

Adjusted taxable gifts (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Add lines 3c and 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Tentative tax on the amount on line 5 from Table A in the instructions

.

.

.

.

.

.

.

.

.

.

6

7

7

Total gift tax paid or payable (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

Gross estate tax (subtract line 7 from line 6) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9a

Basic exclusion amount

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9a

b

Deceased spousal unused exclusion (DSUE) amount from predeceased spouse(s), if

9b

any (from Section D, Part 6—Portability of Deceased Spousal Unused Exclusion).

.

c

Restored exclusion amount (see instructions)

.

.

.

.

.

.

.

.

9c

Applicable exclusion amount (add lines 9a, 9b, and 9c)

.

.

.

.

.

9d

d

e

Applicable credit amount (tentative tax on the amount in 9d from table A

in the instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9e

10

Adjustment to applicable credit amount (May not exceed $6,000. See

10

instructions.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Allowable applicable credit amount (subtract line 10 from line 9e)

.

.

.

.

.

.

.

.

.

.

.

11

12

Subtract line 11 from line 8 (but do not enter less than zero)

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

13

Credit for foreign death taxes (from Schedule P). (Attach Form(s) 706-CE.)

14

Credit for tax on prior transfers (from Schedule Q) .

.

.

.

.

.

.

14

15

Total credits (add lines 13 and 14) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

Net estate tax (subtract line 15 from line 12) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17

17

Generation-skipping transfer (GST) taxes payable (from Schedule R, Part 2, line 10)

.

.

.

.

.

.

18

Total transfer taxes (add lines 16 and 17) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

19

Prior payments (explain in an attached statement) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

20

20

Balance due (or overpayment) (subtract line 19 from line 18) .

.

.

.

.

.

.

.

.

.

.

.

.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete. Declaration of preparer other than the executor is based on all information of which preparer has any knowledge.

Sign

Signature of executor

Date

Here

Signature of executor

Date

Print/Type preparer’s name

PTIN

Preparer’s signature

Date

Paid

Check

if

self-employed

Preparer

Firm’s name

Firm’s EIN

▶

Use Only

▶

Firm’s address

Phone no.

▶

706

Form

(Rev. 8-2017)

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 20548R

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31