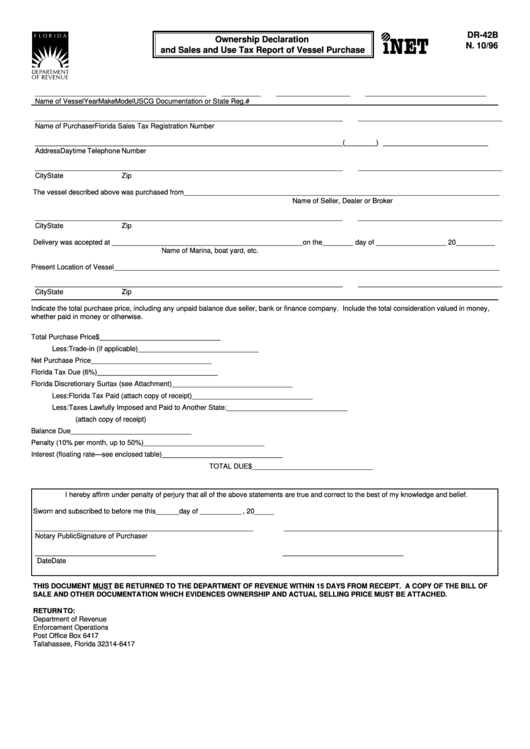

Form Dr-42b - Ownership Declaration And Sales And Use Tax Report Of Vessel Purchase

ADVERTISEMENT

DR-42B

Ownership Declaration

N. 10/96

and Sales and Use Tax Report of Vessel Purchase

____________________________________________

__________

_________

__________

_______________________________

Name of Vessel

Year

Make

Model

USCG Documentation or State Reg.#

_______________________________________________________________________________

_____________________________________

Name of Purchaser

Florida Sales Tax Registration Number

_______________________________________________________________________________

(________) ___________________________

Address

Daytime Telephone Number

_______________________________________________________________________________

_____________________________________

City

State

Zip

The vessel described above was purchased from _________________________________________________________________________________

Name of Seller, Dealer or Broker

_______________________________________________________________________________

_____________________________________

City

State

Zip

Delivery was accepted at _________________________________________________ on the________ day of __________________ 20 __________

Name of Marina, boat yard, etc.

Present Location of Vessel ___________________________________________________________________________________________________

_______________________________________________________________________________

_____________________________________

City

State

Zip

Indicate the total purchase price, including any unpaid balance due seller, bank or finance company. Include the total consideration valued in money,

whether paid in money or otherwise.

Total Purchase Price

$

_______________________________

Less: Trade-in (if applicable)

_______________________________

Net Purchase Price

_______________________________

Florida Tax Due (6%)

_______________________________

Florida Discretionary Surtax (see Attachment)

_______________________________

Less: Florida Tax Paid (attach copy of receipt)

_______________________________

Less: Taxes Lawfully Imposed and Paid to Another State:

_______________________________

(attach copy of receipt)

Balance Due

_______________________________

Penalty (10% per month, up to 50%)

_______________________________

Interest (floating rate—see enclosed table)

_______________________________

TOTAL DUE

$

_______________________________

I hereby affirm under penalty of perjury that all of the above statements are true and correct to the best of my knowledge and belief.

Sworn and subscribed to before me this ______day of

, 20_____

________________________________________________________

________________________________________________________

Notary Public

Signature of Purchaser

_______________________________

_______________________________

Date

Date

THIS DOCUMENT MUST BE RETURNED TO THE DEPARTMENT OF REVENUE WITHIN 15 DAYS FROM RECEIPT. A COPY OF THE BILL OF

SALE AND OTHER DOCUMENTATION WHICH EVIDENCES OWNERSHIP AND ACTUAL SELLING PRICE MUST BE ATTACHED.

RETURN TO:

Department of Revenue

Enforcement Operations

Post Office Box 6417

Tallahassee, Florida 32314-6417

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1